The Ismuhadi Equation and the Integrated Tax Core Algorithm: Distinct Concepts, Potential Synergies in Indonesian Taxation

- Ekonomi

Friday, 09 May 2025 06:12 WIB

Jakarta, fiskusnews.com:

1. Introduction

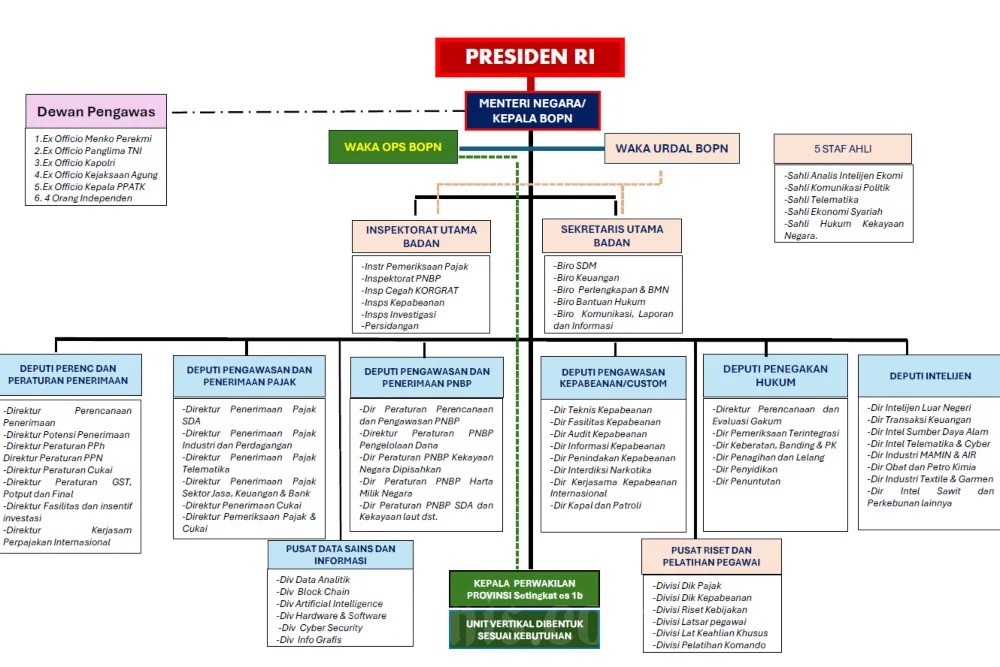

Effective tax administration is crucial for the fiscal health and economic development of any nation, particularly in a large and dynamic economy like Indonesia. A significant challenge in this domain is the detection of financial irregularities, including tax avoidance and the often-concealed activities of the underground economy. To address these issues, innovative tools and comprehensive systems are continuously being explored and implemented. One such tool is the Ismuhadi equation, a novel analytical method developed by an Indonesian tax expert. Separately, the Indonesian government has undertaken a major initiative to modernize its tax infrastructure through the implementation of the Core Tax Administration System (CTAS), an integrated digital platform managed by the Directorate General of Taxes (DJP).

While the Ismuhadi equation represents a specific analytical approach focused on identifying potential tax discrepancies through mathematical relationships in financial statements, the CTAS is a broad technological system designed to streamline and integrate the entire spectrum of tax administration processes. These two concepts, though distinct in their nature and scope, hold the potential for a synergistic relationship that could significantly enhance the Indonesian tax authority’s ability to detect and combat tax evasion, ultimately contributing to a fairer and more robust fiscal environment. This report aims to provide a detailed analysis of both the Ismuhadi equation and the CTAS, exploring their individual characteristics and functionalities, and subsequently examining the potential avenues for their connection and mutual reinforcement within the Indonesian taxation landscape.

The introduction of a specific forensic tool alongside a large-scale system overhaul suggests a comprehensive strategy to strengthen tax compliance in Indonesia. The government’s substantial investment in CTAS to modernize tax administration, coupled with the independent development of an equation focused on fraud detection, indicates a recognition that relying solely on technological advancements might not be sufficient. A multifaceted approach, incorporating both sophisticated analytical techniques and a robust technological infrastructure, is likely deemed necessary to effectively tackle the complex challenges of tax evasion. Furthermore, the user’s inquiry about the relationship between these two concepts points towards an understanding that mathematical principles can be effectively integrated within technological systems. This suggests an anticipation that the CTAS might possess the capability to incorporate or leverage analytical tools like the Ismuhadi equation to enhance its functionalities.

2. Understanding the Ismuhadi Equation

Dr. Joko Ismuhadi Soewarsono, an Indonesian tax specialist with extensive experience in forensic tax analysis, is the developer of the Tax Accounting Equation (TAE), commonly referred to as the Ismuhadi equation. His work builds upon the foundational principle of the fundamental accounting equation (Assets = Liabilities + Equity) , adapting it specifically to identify potential tax irregularities in financial reporting.

The Ismuhadi equation is primarily presented in two interrelated formulations :

- Revenue – Expenses = Assets – Liabilities: This formulation establishes a direct link between a company’s profitability, as reflected in its income statement (Revenue minus Expenses), and its net worth, as represented in its balance sheet (Assets minus Liabilities). It suggests that the operational success of a company, aimed at increasing its value, should be reflected in the balance sheet.

- Revenue = Expenses + Assets – Liabilities: This alternative perspective emphasizes that a company’s income should be sufficient to cover its operating costs and contribute to its overall net asset value. This formulation also highlights a potential inverse relationship between Revenue and Liabilities, where an unusual increase in liabilities without a corresponding increase in revenue might warrant further investigation.

The underlying mathematical principle of these equations is to establish an expected equilibrium between key financial reporting components and a company’s tax obligations. By mathematically linking revenue, expenses, assets, and liabilities, the TAE provides a framework for tax authorities to quantitatively assess financial statements. Significant deviations from these anticipated relationships can serve as indicators of potential tax avoidance or even fraudulent activities.

For instance, if a company reports significantly low revenues or inflated expenses while simultaneously showing an unexplained increase in assets, the TAE can flag this discrepancy as a potential indicator of tax evasion. Similarly, the use of clearing accounts to temporarily misrecord revenues as liabilities or expenses as assets is another deceptive practice that the TAE is designed to detect by highlighting unusual inverse relationships between these accounts. Furthermore, the TAE is considered particularly relevant for analyzing the financial statements of integrated group companies, where complex financial engineering activities might be employed to shift profits or inflate costs to minimize overall tax liability.

Dr. Ismuhadi intends for the TAE to be a valuable analytical tool for the DJP in their examination of taxpayer financial statements, with the primary objective of facilitating the early detection of potential tax avoidance and underground economic activity (UEA). He proposes the TAE as a mechanism for the early identification of UEA, which often goes undetected by conventional tax assessment methods. Additionally, for specific scenarios where taxable income might be intentionally reported as zero or negative to minimize tax liabilities, Dr. Ismuhadi has also formulated the Mathematical Accounting Equation (MAE) as: Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan. This indicates a recognition that different tax evasion tactics might require slightly different analytical lenses. The MAE’s inclusion of dividends and a more comprehensive set of accounts suggests it might be particularly useful for analyzing corporate tax evasion strategies where income manipulation directly affects equity and dividend payouts.

The Ismuhadi equation has garnered recognition and discussion in Indonesian news media, highlighting its potential to modernize traditional accounting methodologies and enhance tax enforcement within the country. Its focus on revenue and its relationship with assets and liabilities suggests a specific emphasis on detecting underreporting of income or mischaracterization of financial elements to reduce tax obligations. The development of both TAE and MAE demonstrates a nuanced approach, acknowledging that diverse tax evasion methods may necessitate slightly varied analytical perspectives. The TAE’s specific relevance to the Indonesian context underscores the importance of creating tools tailored to the unique challenges and characteristics of a nation’s economy and tax system, including the informal sector and prevalent evasion tactics.

| Formulation | Primary Focus |

|---|---|

| Revenue – Expenses = Assets – Liabilities | Links the profitability reported in the income statement to the net worth presented in the balance sheet. |

| Revenue = Expenses + Assets – Liabilities | Emphasizes that a company’s income should cover its operational costs and contribute to its net asset value, highlighting a potential inverse relationship between revenue and liabilities. |

| Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan (MAE) | Designed for scenarios where taxable income is reported as zero or negative, focusing on a broader set of financial elements including dividends. |

3. Exploring the Indonesian Core Tax Administration System (CTAS)

The Indonesian Core Tax Administration System (CTAS) represents a significant modernization initiative undertaken by the Directorate General of Taxes (DJP) to fundamentally transform tax administration in the country. This ambitious project aims to create an integrated digital platform that streamlines all core tax administration processes.

The key objectives of CTAS are multifaceted :

- Increasing tax revenue: This is to be achieved by enhancing taxpayer compliance through improved services and by more effectively identifying and addressing non-compliant taxpayers. The system aims to provide a unified view of taxpayers, allowing for better monitoring and enforcement.

- Enhancing operational efficiency: CTAS seeks to automate and digitalize a wide range of tax administration services, including taxpayer registration, tax return processing, payment processing, and compliance monitoring. This automation aims to reduce manual errors and accelerate workflows.

- Improving transparency and data accuracy: By integrating all tax-related data into a single system, CTAS aims to provide real-time data and enhance the accuracy of taxpayer information. This will simplify audits and reduce the risk of fraud and data manipulation.

- Reducing costs: CTAS is intended to lower both the cost of tax compliance for taxpayers through simplified procedures and the administrative costs for the tax authorities by minimizing paperwork and increasing the availability of taxpayer information.

- Strengthening trust and credibility: The implementation of a modern and efficient system is expected to strengthen public trust in the tax administration.

- Creating a knowledge-driven organization: CTAS aims to establish a robust knowledge management system to support better decision-making within the DJP, leveraging data and analytics.

The CTAS incorporates several key features and functionalities :

- Online tax reporting and payment: Taxpayers can file returns and make payments electronically through the system.

- Real-time taxpayer database: CTAS provides a centralized and up-to-date database of all taxpayers.

- Automated compliance checks: The system includes automated checks to ensure compliance with tax regulations.

- Integration with financial institutions: CTAS is designed to integrate with banks and other financial institutions to facilitate data sharing and payment processing.

- Taxpayer account portal: Taxpayers can access their account information and various tax services through an online portal.

- Pre-populated data for tax returns: The system aims to automatically populate tax returns with available data, simplifying the filing process for taxpayers.

- Integration of NIK and NPWP: The system integrates the National Identity Number (NIK) with the Taxpayer Identification Number (NPWP) to create a single identification for individual taxpayers.

- Advanced functionalities for tax officers: CTAS provides tax officers with advanced tools and functionalities to perform their duties more effectively.

- Enhanced data analytics: The system includes robust data analytics capabilities for risk assessment, business intelligence, compliance monitoring, and fraud detection.

The implementation of CTAS has been a multi-year project. Development began in 2018, and the system officially launched on January 1, 2025. The legal framework for CTAS is provided by Presidential Regulation No. 40 of 2018 and Minister of Finance Regulation No. 81 of 2024 (PMK-81). PMK-81 plays a crucial role by streamlining various existing tax regulations to align with the implementation of CTAS, revoking 42 previous regulations.

CTAS is anticipated to bring significant benefits to both taxpayers and the government. Taxpayers can expect improved service quality, reduced compliance costs, and greater convenience in fulfilling their tax obligations. The government, on the other hand, anticipates enhanced revenue collection through better compliance and oversight, improved efficiency in tax administration, and more informed policy-making based on comprehensive and accurate data.

However, the initial implementation of CTAS has not been without challenges. Reports have emerged of technical issues, difficulties in data migration, and the need for extensive training and support for users. Concerns have also been raised regarding data security and the protection of taxpayer privacy within the CTAS framework, given the vast amounts of sensitive information being collected and processed. The decision to adopt a Commercial Off-The-Shelf (COTS) system for CTAS aimed to expedite implementation by leveraging existing technology. However, experts have pointed out that this approach might present challenges in fully customizing the system to the specific nuances of Indonesia’s tax regulations and needs.

The integration of the National Identity Number (NIK) with the Taxpayer Identification Number (NPWP) within CTAS signifies a move towards a more unified and comprehensive taxpayer identification system. This consolidation of citizen data for tax purposes aims to enhance data accuracy and reduce opportunities for tax evasion through the use of multiple identities. The initial challenges encountered during CTAS implementation, despite thorough planning and testing, underscore the inherent complexity of large-scale system overhauls in government administration and highlight the critical importance of robust post-implementation support and continuous refinement.

4. Connecting the Ismuhadi Equation and CTAS

The principles of the Ismuhadi equation hold significant potential for integration into the CTAS framework, which could substantially enhance the system’s tax fraud detection capabilities. The mathematical logic underpinning the TAE could be incorporated into CTAS algorithms to automate risk assessment processes. By embedding these formulations within the system’s analytical engine, CTAS could automatically calculate TAE metrics for a large proportion of taxpayers. Those exhibiting significant deviations from the expected equilibrium defined by the equation could then be flagged for more in-depth scrutiny by tax authorities.

Furthermore, the real-time data access provided by CTAS could facilitate the application of the TAE on a more dynamic basis. Instead of relying solely on periodic financial statement analysis, the system could continuously monitor financial data for potential irregularities as transactions are recorded and reported. This continuous monitoring, informed by the TAE’s logic, could provide an early warning system for potential tax evasion.

The TAE could potentially function as a specific module or an additional analytical tool within the broader CTAS ecosystem. It could complement other fraud detection algorithms and techniques that CTAS is likely to employ, offering a unique perspective rooted in fundamental accounting relationships. This integration could lead to several benefits, including the earlier identification of potential tax evaders, enhanced efficiency of tax audits by directing resources towards cases flagged by the TAE, a more comprehensive and forensic approach to tax analysis, and the potential to uncover hidden economic activity that might otherwise remain undetected.

However, directly integrating a specific equation like the TAE into a complex system such as CTAS presents certain challenges. It would necessitate the development, rigorous testing, and validation of algorithms that accurately reflect the TAE’s logic. Ensuring seamless compatibility with existing CTAS functionalities and data structures would also be crucial. The Ismuhadi equation, with its focus on the relationship between revenue and balance sheet items, could offer a distinct and valuable perspective to CTAS’s risk assessment algorithms. This might enable the identification of tax avoidance patterns that traditional financial ratios or compliance checks may not readily detect. CTAS’s ability to integrate vast amounts of taxpayer data from diverse sources could greatly enhance the applicability and effectiveness of the Ismuhadi equation by providing the necessary data inputs for large-scale analysis and anomaly detection. The potential integration of the Ismuhadi equation into CTAS aligns with the global trend of tax administrations leveraging data analytics and artificial intelligence to improve tax compliance and combat fraud. Incorporating the TAE would represent a step towards adopting more sophisticated, data-driven approaches to tax enforcement in Indonesia.

5. The Role of Algorithms and Data Analytics in Indonesian Tax Fraud Detection

Modern tax administrations increasingly rely on algorithms and data analytics to enhance fraud detection efforts. The DJP has already developed tax analytics systems to support various functions, including compliance monitoring, dispute resolution, and law enforcement. These systems centrally generate data to aid tax administration functions. Research studies indicate the growing use of machine learning algorithms, such as Random Forest, Logistic Regression, and Support Vector Machines (SVM), for detecting financial statement fraud in Indonesia.

A significant challenge in leveraging data analytics for tax fraud detection is ensuring data quality and effectively integrating data from various internal and external sources. Tax officers often face the “last-mile problem,” where the available data is not immediately actionable for their specific tasks. CTAS aims to address these challenges by providing a centralized and integrated platform for tax data and analytics, offering real-time data and validity. The system is designed to streamline essential tax operations, including taxpayer registration, tax return filing, payment processing, compliance tracking, and audits, ensuring a more efficient process for all.

The Ismuhadi equation can be positioned as a specific analytical tool that could be integrated into the broader suite of algorithms and data analytics techniques employed by CTAS. While CTAS aims to utilize data analytics for risk-based compliance approaches , the specific algorithms and their detailed implementation within the system are generally not publicly disclosed. The research suggests a strong trend towards using machine learning algorithms for financial fraud detection in Indonesia. Integrating the Ismuhadi equation into CTAS could be a complementary strategy, combining a rule-based equation with data-driven machine learning models for a more comprehensive fraud detection framework. The “last-mile problem” underscores the need for the output of any analytical tool, including the TAE, to be presented in a clear and actionable format for tax officers. The emphasis on data integration within CTAS is a crucial enabler for advanced analytics, including the application of the Ismuhadi equation, as it provides a more holistic view of a taxpayer’s financial activities.

6. Expert Perspectives and Challenges in Implementation

Expert perspectives on the implementation of CTAS reveal both optimism about its potential and acknowledgment of the challenges encountered during its initial rollout. An economist at Universitas Gadjah Mada highlighted that the system’s implementation appeared rushed and lacked thorough preparation, leading to technical issues such as system failures and difficulties in data migration. Initial complaints from taxpayers also arose concerning accessibility and authorizations within CTAS. Despite these initial hurdles, experts agree that CTAS is a strategic initiative with the potential to significantly strengthen tax administration in Indonesia through digitalization and address the country’s substantial tax gap.

Integrating the Ismuhadi equation within CTAS, while potentially beneficial, would likely present its own set of challenges. The complexity of incorporating a new analytical tool into a large and intricate system like CTAS should not be underestimated. Thorough testing would be essential to ensure the accurate functioning of any algorithms based on the TAE and their compatibility with the existing CTAS infrastructure. Furthermore, tax officers would require adequate training on the principles of the TAE and how to interpret the results generated by CTAS based on this equation to effectively utilize it in their audit processes. Data privacy concerns, already relevant to the extensive data processing within CTAS, would also need careful consideration if new analytical methods like the TAE are introduced. Expert opinions on CTAS implementation suggest that while the initiative is strategically sound, its execution has faced challenges, particularly in ensuring the system is robust and user-friendly from the outset. This underscores the importance of a phased approach to integrating new functionalities, such as the Ismuhadi equation, to avoid overwhelming the system and its users. The concerns raised about data privacy within CTAS are crucial considerations if more advanced analytical tools like the Ismuhadi equation are to be employed. Any integration would need to be mindful of data protection regulations and ensure transparency regarding how taxpayer data is being analyzed. The need for comprehensive training for end-users on CTAS would extend to any new analytical tools integrated into the system.

7. Recommendations and Conclusion

To effectively leverage the Ismuhadi equation within the CTAS framework and enhance tax administration and enforcement in Indonesia, the following recommendations are proposed:

- Pilot Programs: Conduct well-designed pilot programs to rigorously test the practical effectiveness and real-world applicability of integrating the TAE’s logic into CTAS algorithms across various sectors and taxpayer types in Indonesia. This would allow for a thorough evaluation of the TAE’s ability to accurately detect tax avoidance and its impact on audit outcomes.

- Dedicated Modules: Develop specific modules within CTAS that utilize the TAE to generate risk scores or flags for potential tax irregularities based on the mathematical relationships defined by the equation. These modules should present the results in a clear and actionable format for tax auditors.

- Comprehensive Training: Provide thorough training to tax auditors on the fundamental principles of the TAE, its underlying mathematical logic, and practical guidance on how to interpret the results generated by CTAS based on this equation. This training is crucial for ensuring that tax officers can effectively utilize the insights provided by the integrated system in their audit processes.

- Data Privacy and Transparency: Ensure that the integration of the TAE into CTAS aligns fully with all relevant data privacy regulations and that taxpayers are provided with clear information about how their financial data is being analyzed within the system. Transparency is key to maintaining public trust in the tax administration.

- Continuous Monitoring and Refinement: Continuously monitor the performance of the TAE within the CTAS framework based on real-world results and feedback from tax officers. Establish mechanisms for ongoing refinement and optimization of the algorithms to maximize their effectiveness in detecting tax irregularities.

In conclusion, the Ismuhadi equation and the Indonesian Core Tax Administration System (CTAS) represent distinct yet potentially complementary concepts within the realm of Indonesian taxation. The Ismuhadi equation offers a specific, mathematically grounded analytical tool for the early detection of tax avoidance and underground economic activity. CTAS, on the other hand, provides a comprehensive and integrated digital infrastructure designed to modernize and streamline the entire tax administration process. While CTAS offers the technological foundation and data integration necessary for advanced analytics, the Ismuhadi equation provides a targeted analytical approach that could significantly enhance the system’s ability to identify potential tax fraud. By strategically integrating the principles of the Ismuhadi equation into the CTAS framework, the Indonesian tax administration has the potential to move towards a more proactive, data-driven, and ultimately more effective approach to combating tax evasion and enhancing revenue collection, contributing to a fairer and more prosperous Indonesian society.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Dr. Joko Ismuhadi’s Tax Accounting Equation: A Novel Approach to Detecting Financial Irregularities in Indonesia

Jepang dan Inggris Resesi, Bos BI Cemas Ganggu Ekonomi Dunia

KAJIAN DZUHUR RAMADHAN 1445 MASJID SHALAHUDIN SUDIRMAN

INTERNATIONAL WEBINAR – TAX CENTER PKN STAN 2025

Korupsi Korporasi di bidang Perpajakan, Apa Itu?

The Integration of STEM in Law Enforcement: Unpacking the “Ismuhadi Equation” and Charting a Responsible Future

“WOI WONG PAJAK ‘88! WES WEKTUNE KITA KUMPUL MANEH!!”

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION