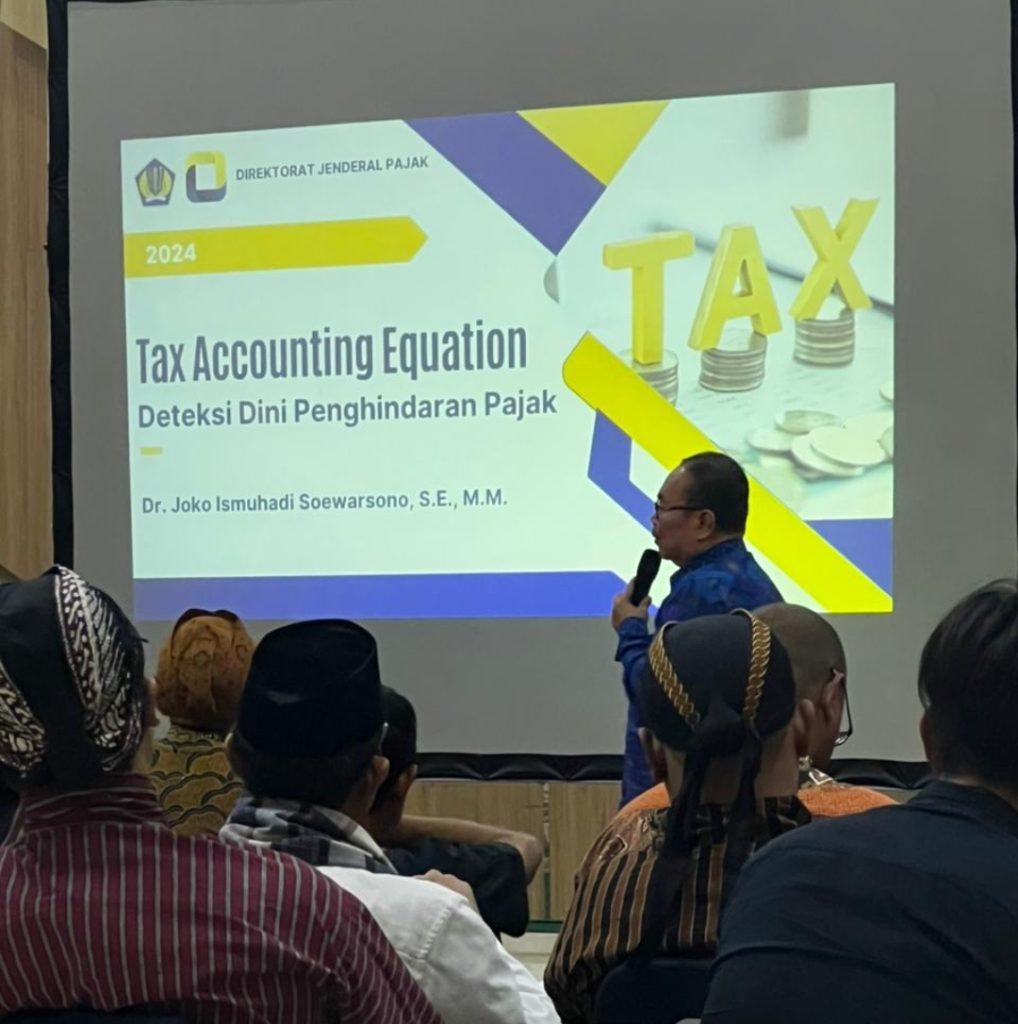

Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) offers a distinct approach to detecting tax irregularities in Indonesia compared to traditional tax audit methods

- Ekonomi

Sunday, 04 May 2025 00:29 WIB

Jakarta, fiskusnews.com:

Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) offers a distinct approach to detecting tax irregularities in Indonesia compared to traditional tax audit methods. Here’s a detailed comparison:

Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE):

- Focus: TAE is a mathematically rigorous forensic accounting tool that analyzes the fundamental relationships between key financial statement components: revenue, expenses, assets, and liabilities. It aims to identify inconsistencies and unusual patterns that may indicate potential tax avoidance, embezzlement, or hidden economic activity.

- Methodology: TAE utilizes specific mathematical formulations derived from the basic accounting equation to establish expected equilibrium between these financial elements. The two primary formulations are:

- Revenue – Expenses = Assets – Liabilities

- Revenue = Expenses + Assets – Liabilities

- Strengths:

- Early Detection: TAE is designed for the early detection of potential tax avoidance schemes by identifying anomalies in the fundamental relationships between financial elements.

- Risk Assessment: It enables tax authorities to prioritize audits and investigations by flagging significant variances from expected financial relationships.

- Uncovering Hidden Activity: TAE can provide insights into the scale and nature of the underground economy by identifying discrepancies between reported financial data and expected tax obligations.

- Targeted Analysis: It offers a focused lens for identifying potential irregularities that might be missed by broader data analysis techniques or traditional audit methods.

- Quantitative Approach: TAE provides a data-driven, quantitative method for analyzing financial statements, moving beyond traditional qualitative assessments.

- Potential Applications: TAE can be used to screen financial data for suspicious patterns, identify unusually high liabilities relative to revenue, assess the sufficiency of reported revenue, and detect potentially misleading accounting transactions like recording revenues as liabilities.

Traditional Tax Audit Methods in Indonesia:

- Focus: Traditional methods aim to verify the accuracy and completeness of tax returns and financial records to ensure compliance with tax laws.

- Methodology: These methods are broadly categorized into:

- Direct Methods: Involve the examination of books, records, and documents related to specific income or expense items.

- Indirect Methods: Utilize various approaches to assess the reasonableness of reported income, such as the cash transaction and bank deposit method, which reconciles reported income with cash inflows and outflows.

- Strengths:

- Detailed Verification: Direct methods allow for a thorough examination of specific financial transactions and supporting documentation.

- Comprehensive Review: Indirect methods can help identify discrepancies by analyzing overall financial activity and comparing it to reported income.

- Limitations:

- Time-Consuming: Traditional audits, especially direct methods, can be resource-intensive and time-consuming.

- May Miss Sophisticated Schemes: They might not always uncover intricate and concealed methods used in sophisticated tax evasion.

- Reactive Approach: Often initiated based on general risk assessments or random selection, rather than specific indicators of potential irregularities.

Comparison:

| Feature | Dr. Joko Ismuhadi’s TAE | Traditional Tax Audit Methods |

| Primary Goal | Early detection of potential tax irregularities | Verification of tax compliance |

| Methodology | Equation-based analysis of financial statement relationships | Direct examination of records and indirect financial analysis |

| Focus | Inconsistencies in fundamental financial relationships | Specific income/expense items and overall financial activity |

| Approach | Proactive, data-driven | Reactive, often based on general risk or random selection |

| Efficiency | Potential for efficient initial screening | Can be time-consuming and resource-intensive |

| Detection of Sophisticated Evasion | Designed to flag potential complex schemes | May not always uncover highly concealed methods |

| Complementary Use | Can enhance traditional methods | TAE can provide targeted leads for traditional audits |

Conclusion:

Dr. Ismuhadi’s TAE offers a novel and potentially powerful tool that can complement traditional tax audit methods in Indonesia. By focusing on the mathematical relationships within financial statements, TAE can provide an efficient initial screening mechanism to identify high-risk cases and potentially uncover sophisticated tax avoidance schemes. While traditional methods remain crucial for detailed verification and comprehensive review, the integration of TAE into the tax enforcement toolkit could lead to a more proactive, data-driven, and effective approach to combating tax evasion and enhancing revenue collection in Indonesia.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

KOMISI (Kelas Online akadeMISI): Seri Pajak Internasional Episode 2 bertajuk Isu-Isu Pajak Internasional & Solusinya

Mengungkap Ekonomi Tersembunyi: Pendekatan Inovatif Dr. Joko Ismuhadi dalam Mendeteksi Penghindaran Pajak di Indonesia

Webinar Seminar Nasional “Tepatkah Pemberian Izin Tambang untuk Perguruan Tinggi?”

Universitas Borobudur Meraih Akreditasi Unggul, Tertinggi di seluruh Indonesia

Mengungkap Aktivitas Ekonomi Bawah Tanah: Analisis Persamaan Akuntansi Pajak Dr. Joko Ismuhadi

Joko Ismuhadi: Pendekatan Terpadu untuk Meningkatkan Administrasi dan Penegakan Pajak di Indonesia

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION