Advancing Fiscal Resilience: An Integrated Framework for Tax Transformation in Indonesia through STEM CEL, the Ismuhadi Equation, and Tri Hita Karana Philosophy

- Ekonomi

Saturday, 14 June 2025 13:27 WIB

Jakarta, fiskusnews.com:

Executive Summary

This report presents a comprehensive analysis of an ambitious proposal to modernize Indonesia’s tax administration by integrating the Ismuhadi Equation into a Self-Assessment Monitoring System (SAMS) within the Core Tax Administration System (CTAS). This framework, underpinned by the Science, Technology, Engineering, and Mathematics Collaboration Empowering Law-enforcement (STEM CEL) module, aims to automatically trigger “red flags” for tax non-compliance and generate Appeal Tax Deposits. The overarching objective is to significantly increase Indonesia’s Tax Ratio, fostering national prosperity in alignment with the Tri Hita Karana Balinese Philosophy. This innovative approach blends advanced technological capabilities, such as AI and machine learning, with a profound cultural and moral dimension to tax compliance. While offering immense potential for enhanced revenue mobilization, improved compliance, and economic formalization, successful implementation necessitates strategic navigation of critical challenges, including data quality, legal frameworks, public trust, and the imperative for continuous human oversight and adaptive system refinement.

1. Introduction: A Holistic Vision for Indonesia’s Tax Transformation

Indonesia’s pursuit of robust economic development and its aspiration to become a high-income economy by 2045 are intrinsically linked to the effectiveness of its tax revenue collection mechanisms. The proposed framework represents a forward-thinking and multi-faceted approach to addressing persistent fiscal challenges. It envisions a synergistic integration of the STEM CEL module, the Ismuhadi Equation, a Self-Assessment Monitoring System (SAMS), and the Core Tax Administration System (CTAS) to automatically detect tax non-compliance and facilitate the collection of Appeal Tax Deposits. This intricate system is designed with the ultimate goal of increasing Indonesia’s tax ratio, contributing to national prosperity, and uniquely, is anchored in the Tri Hita Karana Balinese Philosophy.

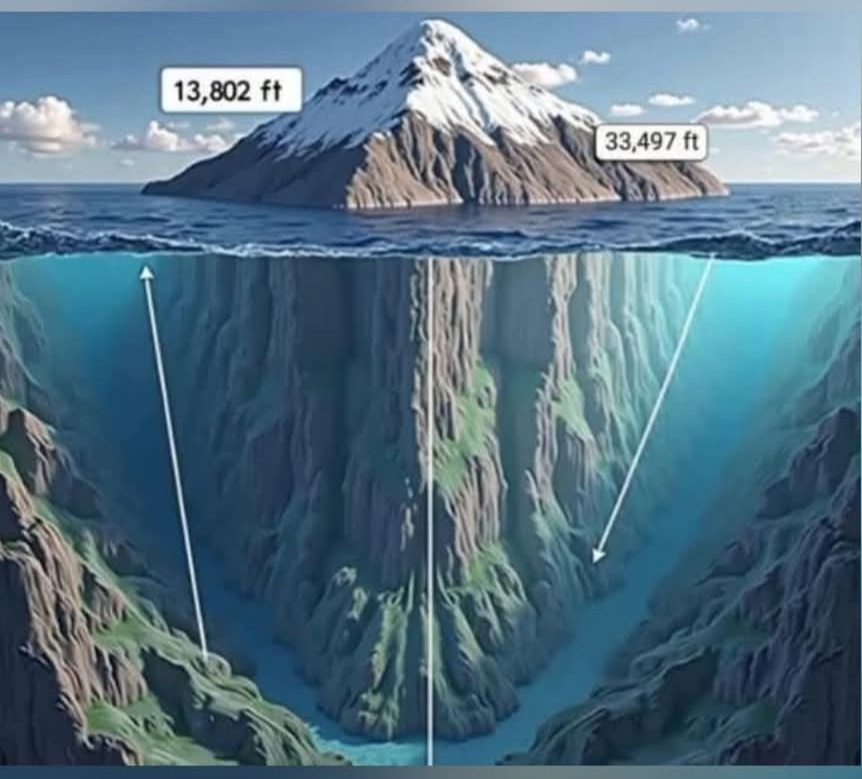

Indonesia has historically grappled with a relatively low tax-to-GDP ratio, which stood at 9.1 percent in 2021, marking a 2.1 percentage point drop over the preceding decade. This figure falls significantly short when compared to regional counterparts such as Cambodia (18 percent), the Philippines and Thailand (around 15 percent), Vietnam (14.7 percent), and Malaysia (11.9 percent). As of October 2024, the tax ratio reached 10.02% of GDP, a slight improvement from 10.21% in 2023, yet it remains below the government’s ambitious target of 11.2% to 12% by 2025. A major impediment to optimizing tax revenue in Indonesia is the pervasive issue of tax evasion and the considerable scale of its underground economy, which research suggests constitutes a significant portion of the nation’s Gross Domestic Product, leading to substantial potential losses in tax revenue. These persistent challenges underscore the critical need for innovative strategies that can enhance tax revenue collection, moving beyond traditional methods to uncover increasingly sophisticated methods of tax evasion and identify hidden economic activities.

2. Foundational Pillars of the Integrated Tax System

The proposed tax transformation framework is built upon several interconnected pillars, each contributing unique capabilities to the overall objective of enhanced tax compliance and revenue mobilization.

2.1 The Ismuhadi Equation: A Forensic Tool for Tax Integrity

Dr. Joko Ismuhadi, an Indonesian tax specialist, introduced the Tax Accounting Equation (TAE) and the Mathematical Accounting Equation (MAE) as crucial analytical tools to detect tax avoidance and evasion. These equations represent a strategic rearrangement of the fundamental accounting equation (Assets = Liabilities + Equity), with a deliberate emphasis on revenue as a critical indicator of a company’s economic activity and its consequent tax obligations.

The TAE is primarily presented in two interrelated forms:

- Revenue – Expenses = Assets – Liabilities

- Revenue = Expenses + Assets – Liabilities

These formulations focus on the relationship between a company’s profitability, as reflected in the income statement (Revenue – Expenses), and its net worth, as shown on the balance sheet (Assets – Liabilities). For specific scenarios where taxable income might be intentionally reported as zero or negative to minimize tax liabilities, Dr. Ismuhadi also formulated the Mathematical Accounting Equation (MAE) as: Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan. This variation is tailored to analyze situations where traditional income-focused equations might not reveal the full picture of potential tax avoidance. The underlying mathematical principle of these equations is to establish an expected equilibrium between key financial reporting components and a company’s tax obligations.

The Ismuhadi Equation offers several critical applications for tax authorities seeking to proactively detect financial irregularities. Its primary benefit lies in its capacity for the early detection of potential tax avoidance schemes by identifying inconsistencies. For instance, if a company reports significantly low revenues or inflated expenses while simultaneously showing an unexplained increase in assets, the TAE can flag this discrepancy as a potential indicator of tax evasion. It can also help in spotting instances where revenues might be deliberately understated or expenses overstated, or detect the use of clearing accounts to temporarily misrecord revenues as liabilities or expenses as assets. By providing a data-driven method, TAE enables tax authorities to prioritize audits and investigations, focusing resources on companies exhibiting suspicious financial patterns rather than relying on random, resource-intensive audits. Furthermore, by identifying discrepancies between reported financial data and expected tax obligations, TAE can provide valuable insights into the scale and nature of the underground economy, directly addressing the core of tax evasion which often involves underreporting income.

A significant aspect of the Ismuhadi Equation is its unique design for the Indonesian financial and regulatory landscape. Developed by an Indonesian tax expert, TAE takes into account the specific challenges and characteristics of the Indonesian economy, including the prevalence of the underground economy and various tax evasion tactics commonly observed in the country. This deep customization for the local context is crucial because it means the tool is not a generic accounting model but one specifically adapted to address known, prevalent patterns of non-compliance within Indonesia. This strategic adaptation enhances its potential effectiveness significantly compared to a universally applied model. The equation’s success, therefore, will also depend on its continuous adaptation as local evasion tactics evolve, necessitating ongoing research and refinement of its application. The growing recognition of TAE’s potential is evidenced by Dr. Ismuhadi’s engagement with the Directorate General of Taxes (DGT), with aspirations for it to become a standard tool for Taxpayer Financial Statement Analysis. This represents a shift towards a mathematically rigorous, quantitative, and forensic approach to combating tax evasion, moving beyond traditional qualitative assessments.

Table 1: Comparison of Fundamental Accounting Equation vs. Ismuhadi Equation (TAE/MAE)

| Feature | Fundamental Accounting Equation | Ismuhadi Equation (TAE/MAE) |

|---|---|---|

| Equation | Assets = Liabilities + Equity | Revenue – Expenses = Assets – Liabilities; Revenue = Expenses + Assets – Liabilities (TAE); Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan (MAE) |

2.2 Self-Assessment Monitoring System (SAMS): Towards Proactive Compliance

Indonesia has operated under a self-assessment tax system since 1984, a global trend that relies on taxpayer self-declaration. This system inherently necessitates robust internal monitoring mechanisms within organizations and advanced external oversight by tax authorities. The proposed Self-Assessment Monitoring System (SAMS) is designed to significantly enhance this oversight by integrating the Ismuhadi Equation within the Core Tax Administration System (CTAS) to automatically identify discrepancies indicative of undeclared income.

The mechanism of integration involves SAMS accessing relevant taxpayer accounting data, including financial statements such as the Balance Sheet, Income Statement, and Cash Flow Statement. Ideally, this process would leverage advanced systems like triple-entry accounting to ensure comprehensiveness and verifiability of data. This requires robust data integration capabilities to pull and harmonize data from diverse internal and external sources. Once data is retrieved, SAMS will utilize the Ismuhadi Equation to compare the actual tax liability (derived from comprehensive accounting data) with the tax liability reported by taxpayers (based on their official tax returns, or SPTs), automatically flagging significant differences.

The system’s real-time monitoring and “red flag” generation capabilities are powered by advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms. These algorithms identify unusual patterns in taxpayer data, such as transaction volumes, reported income, and expense patterns, to detect deviations from established norms or peer group behavior. AI-driven fraud detection has shown significant improvements, increasing from identifying 14.7% of evasion cases in 2021 to 55.0% in 2024, demonstrating the efficacy of such technologies. Predictive analytics, further powered by AI, will forecast tax compliance trends, identify high-risk taxpayers, and optimize audit selection procedures. Taxpayers exhibiting high discrepancies will be automatically identified as high-risk, assigned a compliance risk score based on factors like past compliance history, industry-specific risk indicators, and TAE analysis results. Event-driven alerts will provide real-time notifications for specific taxpayer actions, such as late filing, significant amendments, or large, unusual transactions. Moreover, integration with other government databases will allow SAMS to cross-reference taxpayer information with sources like bank records, property ownership, and vehicle registrations, triggering alerts for inconsistencies indicating undeclared income or hidden assets. This multi-dimensional risk profiling transforms raw data into actionable intelligence, prioritizing resources effectively.

This integration signifies a fundamental transformation in tax enforcement, shifting from a reactive audit model to a proactive, real-time compliance monitoring and early intervention framework. This paradigm shift means that the tax authority moves from primarily reacting to reported non-compliance through post-facto audits to actively anticipating and detecting issues as they arise. This proactive stance, enabled by continuous monitoring and AI-driven analytics, holds the potential to significantly reduce the “tax gap” by allowing for earlier intervention. It also has a psychological impact on taxpayers, who, aware of continuous monitoring, may be encouraged towards greater voluntary compliance.

2.3 Core Tax Administration System (CTAS): The Digital Nexus

The Core Tax Administration System (CTAS), also referred to as the Core Tax System (CTS), serves as the central digital platform for the Directorate General of Taxation (DGT) in Indonesia. This modernized system became effective on January 1, 2025, under Regulation No. 81 of 2024, marking a significant step in streamlining all core tax administration processes. Its functionalities encompass taxpayer registration, tax return reporting, tax payments, audits, and collections.

Key features of CTAS include online tax reporting and payment capabilities, a real-time taxpayer database, automated compliance checks, enhanced data security, and seamless integration with banks and financial institutions. The system aims to achieve greater efficiency by automating manual processes, thereby reducing errors and streamlining tax management. It also promotes more transparency through real-time tracking of tax payments, fostering trust between businesses and regulatory authorities. Automated reminders are a crucial feature, ensuring timely tax filings and minimizing the risk of missed deadlines and penalties. Under the new CTAS, every taxpayer receives a DGT-issued account to manage tax records and filings online, further enhancing digital tax processes.

The seamless integration of the enhanced SAMS, powered by the Ismuhadi Equation, into CTAS is vital for the entire proposal. CTAS provides the foundational IT infrastructure necessary for comprehensive data collection, processing, and analysis, which is critical for the effective functioning of the SAMS module. This means that CTAS is not merely a component of the system but the essential technological backbone that enables the entire proposed framework to function. The success and scalability of the Ismuhadi Equation and SAMS are, therefore, entirely dependent on the robustness, efficiency, and data integration capabilities of CTAS. Any challenges or “kinks” in CTAS’s implementation, such as those that contributed to a drop in state revenue in the first quarter of 2024 , could severely impede or even undermine the broader vision. This highlights the critical importance of the CTAS modernization effort itself as a prerequisite for the success of the SAMS-TAE integration, making its ongoing refinement a top priority for the overall proposal.

2.4 STEM CEL Framework: Leveraging Technology for Empowered Enforcement

The Science, Technology, Engineering, and Mathematics Collaboration Empowering Law-enforcement (STEM CEL) framework represents a strategic initiative to integrate STEM principles and expertise into tax administration practices in Indonesia. Its core purpose is to enhance the detection and prevention of financial crimes, including tax evasion, by leveraging analytical capabilities and technological advancements from STEM fields.

Artificial Intelligence (AI) and Machine Learning (ML) play a pivotal role within STEM CEL, automating processes, detecting anomalies, and identifying fraud within the tax system. These technologies can automate data capture, computation, and output generation, significantly reducing manual effort and improving efficiency in tax compliance. They are extensively used for AI-driven anomaly detection, automated scrutiny selection, and fraud detection, with AI models analyzing massive datasets from financial transactions, behavioral patterns, and external risk factors to detect subtle anomalies that might go unnoticed by traditional systems. AI/ML also enables predictive analytics for forecasting tax liabilities, identifying compliance risks, and optimizing audit case management. Crucially, AI models continuously learn from new fraudulent activities, adapting their detection parameters to emerging fraud tactics and enhancing predictive capabilities for proactive risk mitigation. This adaptive learning capability is vital for combating increasingly sophisticated and evolving tax evasion methods, meaning the system is designed to become more effective over time. Big Data Analytics is indispensable for processing and analyzing these extensive datasets, efficiently sifting through massive volumes of information to pinpoint anomalies indicative of underground economic activities. The Indonesian Tax Authority (DGT) already utilizes data analytics as part of their risk analysis procedures to determine which taxpayers should be subjected to audits, indicating a readiness within the tax administration to embrace and expand the use of data-driven insights.

Forensic accounting, a field that blends accounting principles with investigative techniques, contributes significantly to STEM CEL by providing the expertise to trace illicit financial flows and unravel complex financial schemes designed to evade taxation. This human expertise complements the technological capabilities, particularly in interpreting complex cases and addressing the “last mile analytics problem,” where the insights generated from data analysis require further processing and interpretation by tax officers to become truly actionable. This highlights that while AI and machine learning are the “brain” of the system, automating and predicting, they augment human expertise rather than replacing it. This necessitates a continuous supply of high-quality, diverse training data and expert human oversight to prevent biases, manage false positives, and interpret complex scenarios. Significant investment in training tax officers to effectively utilize these advanced tools and insights will be essential for realizing the full benefits of this component.

Table 2: Key Components and Benefits of the Integrated SAMS-CTAS System

| Component | Core Function | Key Benefits in Integrated System |

|---|---|---|

| Ismuhadi Equation | Forensic tax analysis, discrepancy detection | Early detection of evasion, targeted audits, uncovering underground economy |

| Self-Assessment Monitoring System (SAMS) | Proactive compliance monitoring, red flag generation | Real-time compliance oversight, early intervention, multi-dimensional risk profiling |

| Core Tax Administration System (CTAS) | Centralized tax operations, data management | Streamlined processes, enhanced data security, centralized taxpayer data, improved transparency |

| AI/Machine Learning/Big Data Analytics | Automated anomaly detection, predictive risk assessment | Increased efficiency, reduced manual effort, adaptive fraud detection, optimized audit selection |

| Forensic Accounting | Investigative accounting, complex scheme unraveling | Expert analysis of illicit flows, complements AI insights, ensures actionable intelligence |

3. Strategic Impact: Elevating Indonesia’s Tax Ratio for National Prosperity

The ultimate objective of this intricate system is to significantly increase Indonesia’s tax ratio, thereby contributing to government funds available for public services, infrastructure, and overall national prosperity [User Query].

3.1 Indonesia’s Tax Ratio: Current State, Historical Trends, and Regional Comparisons

As previously noted, Indonesia’s tax-to-GDP ratio has been a persistent challenge, recorded at 9.1 percent in 2021, a 2.1 percentage point drop over the preceding decade. This figure is notably lower than that of its Southeast Asian peers, such as Cambodia (18 percent), the Philippines and Thailand (around 15 percent), Vietnam (14.7 percent), and Malaysia (11.9 percent). While the ratio showed a slight improvement to 10.02% of GDP as of October 2024 from 10.21% in 2023, it remains below the government’s ambitious target of 11.2% to 12% by 2025. Historical data indicates fluctuations, with a ratio of 14.58% between 2001-2017, dropping to 9.77% in 2019. Factors influencing Indonesia’s tax ratio include economic growth, tax system efficiency, political stability, and structural reforms.

This persistently low and declining tax ratio, particularly when viewed against the performance of regional counterparts, underscores the critical national imperative for fiscal sustainability and economic development. The government’s explicit policy not to raise tax rates means that the proposed integrated system is not merely an administrative improvement but a central strategy for revenue mobilization. Its success is fundamentally about broadening the tax base by formalizing the informal sector and bringing currently non-compliant individuals and entities into the tax net. This context elevates the project to a higher strategic importance, as it becomes the primary mechanism for achieving revenue targets given the government’s stated policy on tax rates.

Table 3: Indonesia’s Tax Ratio: Historical Trends, Current Figures, and Comparison with Select Southeast Asian Economies

| Country/Period | Tax-to-GDP Ratio (%) | Source |

|---|---|---|

| Indonesia (2019) | 9.77 | |

| Indonesia (2020) | 10.1 | |

| Indonesia (2021) | 9.1 | |

| Indonesia (2023) | 10.21 | |

| Indonesia (Oct 2024) | 10.02 | |

| Cambodia | 18 | |

| Philippines | ~15 | |

| Thailand | ~15 | |

| Vietnam | 14.7 | |

| Malaysia | 11.9 |

3.2 Government Strategies for Revenue Mobilization without Increasing Tax Rates

The Indonesian government has articulated a clear strategy to increase tax revenue without resorting to higher tax rates. This approach focuses on expanding the tax base by bringing more individuals and entities who are currently outside the tax system into compliance. There has even been consideration of lowering tax rates to levels seen in Singapore, aiming to incentivize compliance and stimulate economic activity.

Key strategies for achieving this include prioritizing digital transformation, enhancing public awareness, and actively expanding the tax base. The DGT’s strategic plan emphasizes proper risk-based oversight and law enforcement to improve tax compliance. The broader tax reform agenda aims to create an easier, more reliable, integrated, accurate, and valid tax administration system.

This government approach can be characterized as a “carrot and stick” strategy. The “carrot” involves not raising tax rates and potentially lowering them, aiming to incentivize compliance and economic growth. The “stick” is the proposed integrated system with its automated detection and appeal deposit mechanisms. For the “carrot” to be effective in fostering voluntary compliance, the “stick” must be perceived as highly effective, fair, and inescapable. If the automated system (SAMS-TAE-CTAS) fails to accurately identify non-compliance, generates a high rate of false positives, or is perceived as unfair, it could severely erode public trust and undermine both the enforcement and incentive strategies. This creates a critical dependency: the success of the government’s broader tax policy, which aims to increase revenue without raising rates, is intrinsically linked to the successful, credible, and equitable implementation of this specific technological and administrative solution. The system’s perceived integrity is as important as its technical prowess.

3.3 How the Integrated System Contributes to Improved Compliance, Reduced Evasion, and Economic Formalization

The integrated system is poised to make substantial contributions to improving tax compliance, reducing evasion, and formalizing the economy. By leveraging the Ismuhadi Equation, the system is expected to significantly improve the detection of non-compliance, thereby directly reducing tax avoidance and evasion [User Query]. The Ismuhadi Equation is specifically designed to uncover hidden economic activities, which will be instrumental in reducing the “underground economy”.

The continuous monitoring capabilities of SAMS, powered by AI and machine learning, are anticipated to promote voluntary compliance, as taxpayers become aware of the enhanced oversight [User Query]. This increased certainty in law enforcement activities plays a crucial role in enhancing taxpayer compliance. Automated red flags and the generation of appeal deposits are designed to streamline enforcement processes, making them more efficient and reducing revenue leakage [User Query]. AI and Machine Learning capabilities within the system are expected to enhance the precision of detecting tax avoidance and evasion risks, leading to increased tax revenue. Overall, these factors are anticipated to lead to higher tax revenue, providing increased government funds for public services, infrastructure development, and ultimately, overall national prosperity [User Query]. The general trend of digitalization in tax administration is also seen as a key factor in decreasing the possibility of tax avoidance.

4. The Philosophical Dimension: Tri Hita Karana and Tax Compliance

A unique and deeply significant cultural dimension of this proposal is its explicit grounding in the Tri Hita Karana Balinese Philosophy. This integration suggests a profound attempt to embed tax compliance within a broader framework of cultural and moral responsibility for national well-being.

4.1 Core Tenets of Tri Hita Karana: Parhyangan, Pawongan, and Palemahan

Tri Hita Karana is a fundamental Balinese philosophy that emphasizes the achievement of harmony and balance through three essential relationships :

- Parhyangan: Harmony with God (spiritual relationship). In Balinese culture, God, known as “Sang Hyang Widhi Wasa,” is revered as the creator of life and the universe. Striving for a harmonious relationship with God involves spiritual devotion, rituals, and offerings, reflecting an appreciation for divine balance and a quest for spiritual enlightenment. This pillar is deeply ingrained in daily life through ceremonies at home and village temples.

- Pawongan: Harmony among Humans (social relationship). This tenet emphasizes the importance of maintaining respect, consideration, and mutual assistance among community members. Communal activities, such as ‘Gotong Royong,’ are common in Bali, highlighting the strength and unity of their society. The belief is that harmony among people is crucial for achieving peace and prosperity.

- Palemahan: Harmony with Nature/Environment (environmental relationship). Palemahan focuses on fostering a harmonious relationship with nature, viewing the environment as a blessing from God. This philosophy is reflected in sustainable practices across Bali, including traditional farming methods, preservation of water bodies, and architecture that complements nature.

The philosophy posits that disrespecting any one of these pillars can disrupt the overall balance in life, leading to disarray.

4.2 Integrating Cultural Values into Tax Compliance: A Moral and Societal Imperative

The proposal’s integration of Tri Hita Karana is a profound idea, suggesting that tax payment is not merely a legal obligation but also a moral one. Fulfilling tax duties can be seen as a form of devotion (Parhyangan) and a contribution to collective well-being (Pawongan). Taxes contribute to a balanced society by supporting public services that benefit all, fostering harmony among people, and enabling sustainable development that respects the environment (Palemahan) [User Query].

This approach aims to foster a sense of responsibility and ethical conduct rooted in Balinese cultural values, encouraging taxpayers to comply not just out of fear of sanctions, but also out of a moral conviction for collective prosperity. Research indicates that cultural values, norms, and traditions significantly influence taxpayer behavior and compliance. For instance, Hinduism encourages tax order as an obligation to the state, aligning with the moral concept based on Tri Hita Karana, where paying taxes is a form of human devotion and concern for God, others, and the environment. This integration is a sophisticated attempt to move beyond a purely coercive model of compliance, which relies solely on the fear of penalties, towards one that fosters voluntary compliance rooted in intrinsic motivation and shared societal values. It acknowledges that technological solutions alone may be insufficient for deep-seated behavioral change. This culturally sensitive approach could be a significant differentiator for Indonesia, potentially leading to more sustainable and widespread compliance improvements by tapping into a moral and ethical framework rather than just a legal one.

4.3 Fostering Voluntary Compliance and Public Trust through Cultural Alignment

The Directorate General of Taxes (DGT) already implements tax awareness programs, such as the “Tax Awareness Inclusion Program” (Pajak Bertutur or Patur), launched in 2014. These initiatives aim to enhance tax knowledge and foster positive attitudes towards taxation, particularly among younger generations, by introducing concepts like “taxes are the backbone of the country”. These programs incorporate local knowledge and translate materials into local languages to enhance understanding and relevance across diverse regions. The Ministry of Finance also actively promotes tax awareness as a crucial theme.

However, scaling these education programs presents challenges, including limited human resources at the DGT to reach all schools and the need to adapt to diverse student populations and teaching methods across Indonesia. Taxpayer behavior is significantly influenced by cultural values, norms, and traditions, which vary across Indonesia’s many ethnic groups and cultures. Building and maintaining public trust through transparency and accountability in tax fund management is essential, as a lack thereof can lead to negative perceptions of taxation, with many informants viewing taxes as a burden due to perceived lack of transparency.

Effectively integrating Tri Hita Karana values into a national tax compliance framework will require a massive, sustained, and culturally nuanced education campaign. This campaign must be capable of overcoming existing resource limitations and catering to the diverse regional cultures within Indonesia, not just Bali. The communication strategy must be adaptable to different local wisdoms and traditions. Furthermore, the rise of “digital natives” presents both a challenge (different learning styles, less conventional reading) and an opportunity (leveraging digital platforms for outreach) for how these cultural values are communicated and internalized by future taxpayers. This suggests that the cultural aspect, while powerful, is a complex, long-term endeavor requiring significant investment in human capital, adaptive communication strategies, and potentially localized implementation.

Table 4: Tri Hita Karana Pillars and their Application to Tax Compliance

| Pillar | Core Tenet | Link to Tax Compliance | Expected Outcome |

|---|---|---|---|

| Parhyangan | Harmony with God (spiritual relationship) | Tax payment as a moral/spiritual obligation, gratitude | Enhanced intrinsic motivation, reduced evasion driven by moral conviction |

| Pawongan | Harmony among humans (social relationship) | Contribution to collective well-being, mutual assistance, social justice | Increased voluntary compliance, stronger social cohesion |

| Palemahan | Harmony with nature/environment (environmental relationship) | Funding for sustainable development, environmental protection | Sustainable fiscal resources for public goods, environmental stewardship |

5. Critical Challenges and Strategic Considerations for Implementation

The ambitious scope of this integrated tax transformation proposal necessitates a thorough understanding and strategic mitigation of several critical challenges.

5.1 Data Quality, Standardization, and Interoperability

The success of the entire integrated system is critically dependent on the availability of high-quality, comprehensive, and integrated financial data. Significant challenges exist with the growing volumes of tax data, including segregated views, limited trust in enterprise data sources, and an inability to reconcile master data gaps prior to tax filings. Tax authorities often do not own or control the source systems for much of the data they use, necessitating complex processes to combine and transform data for tax reporting and analytical needs. Indonesia’s own experience highlights challenges with different data architectures for various tax types, which can complicate data analysis and hinder the maximization of derived value.

This presents a fundamental systemic vulnerability. Inaccurate, fragmented, or non-standardized data will severely undermine the analytical power of the Ismuhadi Equation and the predictive capabilities of SAMS, potentially leading to a high rate of false positives (incorrectly identified discrepancies) or, more critically, missed discrepancies (undetected non-compliance). The most advanced AI/ML algorithms and forensic tools, such as the Ismuhadi Equation, are rendered ineffective if the underlying data is unreliable. This implies a need for a comprehensive, national-level data strategy that extends beyond the DGT, involving cross-agency collaboration (e.g., with banks, other government departments) to standardize data formats, ensure data integrity, and facilitate real-time data exchange. Without a robust and integrated data foundation, the entire sophisticated system risks producing unreliable outputs, leading to inefficient enforcement and erosion of public trust. Robust data governance and interoperability protocols are, therefore, foundational requirements, not merely desirable features.

5.2 Algorithm Accuracy and Minimizing False Positives

The Ismuhadi Equation and any AI/ML models employed to trigger red flags must maintain a high degree of accuracy to avoid false positives and prevent undue burden on compliant taxpayers [User Query]. While AI-driven fraud detection has demonstrated significant improvements in identifying evasion cases , the continuous learning nature of AI models requires ongoing validation to ensure accuracy and adapt to evolving evasion tactics.

An overly aggressive or poorly calibrated system that generates a high volume of false positives could lead to significant administrative burden for both taxpayers, who would be compelled to respond to incorrect flags, and the tax authorities, who would be tasked with processing and resolving these unnecessary disputes. This scenario could severely erode public trust, increase compliance costs for legitimate businesses, and ultimately undermine the system’s efficiency and legitimacy. Therefore, a delicate balance must be struck between maximizing detection rates and ensuring fairness. This requires continuous monitoring, refinement, and the implementation of human-in-the-loop processes for algorithm calibration and exception handling to maintain public confidence and operational effectiveness.

5.3 Legal Framework for Automated Appeal Tax Deposits

The proposal for the automatic creation of “Appeal Tax Deposits” is a strong enforcement mechanism that would require a robust and unambiguous legal framework to ensure fairness and due process for taxpayers [User Query]. Indonesia’s existing legal framework, specifically Law Number 14 of 2002 concerning the Tax Court, already mandates that taxpayers must pay at least 50% of the disputed tax amount before filing an appeal to the Tax Court. This pre-payment is a procedural requirement for the taxpayer to initiate an appeal. Conversely, if the DGT files an appeal, no pre-payment is required from the DGT. International examples illustrate varied approaches; some countries, such as Austria, do not require pre-payment but allow for suspension of collection upon a separate application , while others, like India for GST, permit the use of input tax credit for pre-deposits. The U.S. system allows “deposits” to halt interest accrual without being an assessment.

The concept of “automatic creation of Appeal Tax Deposit” by the proposed system could imply a mandatory pre-payment triggered by the system’s “red flag” prior to the taxpayer initiating an appeal. This would represent a significant shift from the current legal framework, where the deposit is a pre-condition for the taxpayer’s own appeal. Such an automated mechanism might conflict with existing due process rights if it is interpreted as an automatic assessment or demand rather than a prerequisite for the taxpayer’s appeal. Careful legal review and potentially legislative amendments would be required to define the nature, timing, and enforceability of this “automatic deposit” to ensure alignment with existing tax dispute resolution mechanisms and taxpayer rights, particularly regarding the right to an explanation, hearing, and independent appeal.

The design and implementation of the automated system must meticulously uphold fundamental taxpayer rights. Any “automatic creation of Appeal Tax Deposit” must be immediately followed by a clear, detailed notice explaining the discrepancy and the basis for the “red flag”. Furthermore, the system must ensure a transparent, accessible, and timely appeal process where taxpayers can present their case and be represented by counsel. The deposit should ideally be treated as a refundable security rather than a final payment until the dispute is resolved, ensuring that due process is not circumvented by automation. This emphasizes that legal and ethical considerations must be embedded into the system’s architecture, not merely layered on top.

5.4 Taxpayer Education, Acceptance, and Behavioral Aspects

Public awareness and understanding of the new system, especially its philosophical underpinnings rooted in Tri Hita Karana, would be crucial for its acceptance and success [User Query]. The DGT already implements tax awareness programs like “Pajak Bertutur” (Patur) to foster tax knowledge and positive attitudes among the younger generation. However, challenges exist in scaling these education programs due to limited human resources and diverse student populations across Indonesia. Taxpayer behavior is significantly influenced by cultural values, norms, and traditions.

The success of this highly automated and proactive system, which includes “red flags” and “automatic appeal tax deposits,” hinges critically on building and maintaining public trust. Many informants currently view taxes as a burden due to perceived lack of transparency and accountability in managing tax funds , indicating a pre-existing trust deficit. If taxpayers perceive the system as opaque, unfair, or prone to errors (false positives), it could exacerbate existing trust deficits and lead to widespread resistance, undermining compliance efforts. Transparency in the algorithms (explainable AI) and clear, culturally sensitive communication about how “red flags” are triggered, how disputes are handled, and how tax revenues are utilized (linking to Tri Hita Karana) will be paramount to fostering acceptance and transforming compliance from a burden to a shared responsibility.

5.5 Human Oversight, Scalability, and System Maintenance

While the proposed system emphasizes automation, human oversight and intervention will remain necessary for complex cases and appeals [User Query]. Implementing and maintaining such a sophisticated system for Indonesia’s large and diverse taxpayer base would require significant resources and expertise [User Query]. The underlying IT infrastructure, particularly CTAS, must be highly scalable and secure to manage vast quantities of data and enable real-time operations.

Challenges associated with large-scale tax modernization projects include substantial initial investments, longer implementation times, reliance on skilled IT staff, and the need for continuous modernization to avoid obsolescence. While automation significantly enhances efficiency and detection capabilities, complex tax cases, nuanced interpretations of financial data, and ethical considerations (e.g., distinguishing genuine errors from deliberate evasion) will always require human judgment and intervention. The system should be designed to augment the capabilities of tax officers, not replace them. This implies a significant investment in training tax personnel to understand, interpret, and effectively utilize AI-generated insights, as well as to manage the inevitable exceptions and appeals that automated systems will generate. This also points to a shift in the roles of tax professionals, requiring new skill sets focused on data interpretation, dispute resolution, and ethical governance of AI.

5.6 Cybersecurity and Data Privacy

Enhanced data security is a key feature of the new Core Tax System (CTAS). However, addressing cybersecurity and information security remains a significant global challenge in tax administration digitalization. Ensuring the quality and security of data is crucial for its effective utilization. Given the highly sensitive nature of taxpayer financial information, it is essential to assure taxpayers that their data is safe and will not be misused.

Any cybersecurity breach or perceived vulnerability could catastrophically undermine public trust in the entire integrated system, regardless of its analytical capabilities or philosophical underpinnings. Cybersecurity is not merely a technical feature to be implemented; it is a foundational trust enabler that must be continuously prioritized and vigilantly managed. Robust investment in advanced security measures, regular audits, and transparent communication about data protection protocols are non-negotiable for the long-term viability and public acceptance of this ambitious tax transformation.

6. Recommendations for Successful Implementation

To ensure the successful implementation and long-term effectiveness of this transformative tax administration framework, the following strategic recommendations are put forth:

- Phased Rollout and Pilot Programs for Iterative Development: It is advisable to implement the integrated system through a carefully planned phased rollout, commencing with pilot programs to test the integration of the Ismuhadi Equation into SAMS within CTAS. This iterative approach will allow for the identification of unforeseen challenges, the refinement of algorithms and processes, and the optimization of system performance before full-scale deployment across Indonesia’s diverse taxpayer base.

- Investment in Robust Data Governance and Scalable IT Infrastructure: Establishing a robust national data governance framework is paramount. This framework should define clear data ownership, consistent data standards, and rigorous quality controls across all relevant government and financial institutions. Concurrently, prioritizing investment in a highly scalable, secure, and interoperable IT infrastructure, building upon the foundation of the new CTAS, is essential to manage vast quantities of data and enable real-time operations. Addressing existing challenges with fragmented data architectures and ensuring seamless data harmonization from diverse internal and external sources must be a core focus.

- Proactive Legal Reforms and Safeguards for Taxpayer Rights: A comprehensive legal review of the proposed “automatic creation of Appeal Tax Deposits” is critical to ensure its alignment with existing Indonesian tax laws, particularly Law No. 14 of 2002 regarding the 50% pre-payment for appeals. Necessary legislative amendments should be proactively developed and enacted to clearly define the nature, timing, and due process safeguards for such automated enforcement mechanisms, ensuring fairness, transparency, and the protection of fundamental taxpayer rights, including the right to notice, explanation, hearing, and independent appeal. Consideration of international best practices for tax dispute resolution and pre-payment requirements can inform a balanced approach.

- Comprehensive Public Awareness and Education Campaigns, Leveraging Cultural Values: Developing and implementing comprehensive, culturally sensitive public awareness and education campaigns is vital to explain the new system, its benefits, and its operational mechanisms [User Query]. Deeply integrating the Tri Hita Karana philosophy into these campaigns will foster a sense of moral obligation and collective responsibility towards tax compliance, moving beyond mere enforcement. Existing DGT programs like “Pajak Bertutur” (Patur) should be expanded and adapted to reach diverse populations, leveraging digital platforms to effectively engage the “digital native” generation. Prioritizing building and maintaining public trust through transparent communication about the system’s accuracy, data security, and the utilization of tax revenues is also essential.

- Continuous Monitoring, Evaluation, and Adaptive System Refinement: Mechanisms for continuous monitoring and evaluation of the system’s performance should be established, including algorithm accuracy, false positive rates, and overall impact on compliance and revenue. Ensuring adequate human oversight and intervention for complex cases and appeals is crucial, recognizing that AI augments, rather than replaces, human expertise. Robust maintenance protocols and sufficient resource allocation for ongoing system updates, security enhancements, and adaptive refinement of AI models are necessary to counter evolving tax evasion tactics. Finally, positioning tax modernization as a strategic national priority will ensure long-term commitment and funding, making efforts resilient to shifts in government priorities.

Conclusion

The proposed integration of the Ismuhadi Equation into a Self-Assessment Monitoring System within the Core Tax Administration System, buttressed by the STEM CEL framework and guided by the Tri Hita Karana philosophy, represents a highly ambitious yet profoundly transformative vision for Indonesia’s tax administration. The analysis indicates that while the potential for increased tax revenue, improved compliance, and economic formalization is immense, the realization of this vision hinges on a holistic, data-driven, legally sound, and culturally integrated strategy. By strategically addressing the identified challenges—particularly those related to data quality, algorithmic accuracy, legal frameworks, public trust, human-in-the-loop oversight, and cybersecurity—Indonesia can not only modernize its tax system but also foster a deeper sense of national responsibility and collective prosperity, truly embodying the spirit of “Prosperity whole on Tri Hita Karana Balinese Philosophy.”

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

A Comprehensive Profile of Yon Arsal: Expertise in Indonesian Economics, Tax Compliance, and Financial Institutions

Reuni Prodip Pajak ’88 – Ngelumpuk nang Suroboyo, Rek!

Apa Itu Hak Angket DPR? Ketahui Tujuan, Dasar Hukum, dan Mekanisme Pelaksanaannya

UNDANGAN WEBINAR: TEKNIK PENGISIAN SPT PPh BADAN

Mengungkap Aktivitas Ekonomi Bawah Tanah di Indonesia

SOLUSI PERPAJAKAN TERKINI DALAM ERA DIGITAL DAN TRANSPARANSI GLOBAL

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION