Leveraging STEM to Enhance Tax Revenue Collection from Indonesia’s Underground Economy

- Ekonomi

Thursday, 29 May 2025 12:36 WIB

Jakarta, fiskusnews.com:

1. Executive Summary: Unlocking Tax Revenue from Indonesia’s Underground Economy through Technological Integration

The Underground Economy Activity (UEA) presents a persistent and significant challenge to tax revenue collection in Indonesia. This hidden sector of the economy, where transactions are intentionally concealed from government authorities, results in substantial losses of potential tax revenue, hindering the nation’s capacity for public investment and economic development. However, the integration of principles from Science, Technology, Engineering, and Mathematics (STEM) offers a transformative pathway to enhance tax collection from this elusive domain. By leveraging advanced tools such as data analytics, artificial intelligence (AI), digital forensics, and cybersecurity, Indonesian tax authorities can develop more sophisticated methods for detecting and addressing UEA. The Tax Accounting Equation (TAE), the Self Assessment Monitoring System (SAMS), and the Core Tax Administration System (CTAS) serve as crucial frameworks and technological infrastructures that can facilitate this integration, providing the necessary platforms for implementing these advanced analytical techniques. This report aims to analyze the current situation, explore the opportunities presented by STEM integration, discuss the existing challenges, and propose strategic recommendations for bolstering tax revenue from the UEA in Indonesia through the effective application of these cutting-edge tools.

2. The Landscape of Tax Evasion and the Underground Economy in Indonesia

The Underground Economy Activity (UEA) in Indonesia encompasses a wide array of economic endeavors deliberately concealed from government oversight, primarily to evade tax obligations. This includes informal businesses operating outside the formal regulatory framework, income generated from otherwise legal activities that goes unreported (such as earnings from online gambling and gaming), and proceeds from illicit activities like smuggling, drug trafficking, and the trade of unregulated goods. Understanding the multifaceted nature of UEA is crucial for devising effective strategies to bring these activities into the tax net.

Estimates regarding the size and impact of Indonesia’s underground or shadow economy vary considerably, reflecting the inherent difficulty in quantifying such clandestine operations. Studies using the monetary approach during the period of 2001 to 2013 estimated the average size of the underground economy at 8.33% of Indonesia’s Gross Domestic Product (GDP), leading to potential tax losses of approximately 1% of GDP. Another study, examining the years 1990 to 2018, found the average size to be 5.44% of GDP, with average tax losses of 0.70% of GDP, peaking at 21.75% in 1998. More recent data from the Indonesian Financial Transaction Reports and Analysis Center (PPATK) in 2020 suggested a much larger scale, estimating the shadow economy to be between 30% and 40% of Indonesia’s GDP, translating to a staggering value of Rp4,603.5 trillion to Rp6,173.6 trillion. The significant discrepancy in these estimations, ranging from around 5% to 40% of GDP, underscores the considerable challenge in accurately measuring this hidden economic activity. This variability itself highlights the need for more sophisticated detection methods that draw upon the capabilities of STEM fields. Regardless of the precise figure, the potential tax revenue foregone due to UEA is substantial, emphasizing the urgent need for effective countermeasures to safeguard Indonesia’s fiscal health.

Traditional methods of tax collection face inherent limitations when dealing with the underground economy. Detecting and taxing UEA is exceptionally challenging due to its very nature of being concealed from government authorities. Reliance on self-reported tax returns alone is insufficient, as individuals and entities engaged in UEA are highly likely to underreport or completely omit their income from tax declarations. Furthermore, proving instances of misreporting is often difficult without access to third-party information and the application of advanced analytical capabilities that can uncover hidden financial flows and discrepancies.

3. Harnessing the Power of STEM in Tax Administration: A Strategic Imperative

The integration of Science, Technology, Engineering, and Mathematics (STEM) principles into tax administration represents a strategic imperative for Indonesia to effectively combat the challenges posed by the Underground Economy Activity (UEA). By adopting advanced technological tools and analytical frameworks, the Indonesian tax authority can significantly enhance its capacity to detect, investigate, and ultimately collect taxes from this elusive sector.

Data analytics and artificial intelligence (AI) offer powerful capabilities for detecting UEA by enabling the analysis of the vast datasets accumulated by the Directorate General of Taxes (DGT). The exponential growth of data within the DGT, driven by the digitalization of business processes, presents both a challenge and an opportunity. STEM fields provide the necessary tools to process and interpret this massive volume of information. Analyzing data from the Core Tax Administration System (CTAS) and the Self Assessment Monitoring System (SAMS) can reveal anomalies, patterns, and indicators that might signify undeclared income generated from UEA, which traditional manual methods could easily miss. The DGT itself recognizes data analytics as a strategic initiative, employing techniques such as pattern recognition, outlier detection, cluster analysis, network analysis, and text mining to extract valuable insights from tax-related data. Furthermore, a study has proposed the use of machine learning-based predictive analytics as a decision support system to identify taxpayers with a high probability of paying their taxes, demonstrating the practical applicability of data analytics within the Indonesian tax administration. This existing recognition and application of data analytics within the DGT provides a robust foundation for further developing and deploying these techniques specifically to target the unique characteristics of UEA. The next logical progression involves refining these existing analytical methods and creating new models specifically designed to identify the traits and patterns associated with UEA, such as unusual spikes in transaction volumes or inconsistencies in reported income compared to industry benchmarks.

AI algorithms and machine learning can be instrumental in enhancing the detection of UEA through predictive analysis and risk assessment. These technologies can automatically flag suspicious activities by identifying unusual transaction volumes or discrepancies in reported income that deviate from expected norms, potentially indicating undeclared economic activity. The broader potential of AI in taxation extends to fraud detection, conducting risk-based audits more effectively, and streamlining various administrative processes, ultimately augmenting human judgment rather than replacing it. While AI is already being utilized in certain areas of Indonesian public administration, such as the “AI as a Financial Advisor” (AIFA) system for monitoring the finances of subnational governments , its full potential in directly addressing UEA within the tax system remains largely untapped. This presents a significant opportunity for the Indonesian tax authority to develop and implement AI-powered solutions tailored to the specific challenges of the underground economy. The success of the AIFA system in financial oversight suggests that similar AI-driven systems could be developed and integrated within the CTAS and SAMS to specifically target the distinctive characteristics of UEA, such as irregular digital transactions or inconsistencies observed across various data sources.

Digital forensics and cybersecurity are essential components in the effort to combat UEA, particularly given the increasing prevalence of digital transactions and online marketplaces within the underground economy. Expertise in digital forensics plays a crucial role in uncovering UEA by enabling the investigation of digital transactions and activities conducted on online platforms. This includes the critical tasks of gathering digital evidence and tracing the flow of illicit funds within the digital realm. Digital forensics in taxation involves the processing and analysis of electronic data to detect various forms of tax fraud, including evasion and avoidance, by uncovering hidden digital assets and meticulously tracking financial movements. The difficulty in obtaining concrete digital evidence for tax audits in the digital age highlights the importance of employing digital forensic techniques to overcome this challenge. Simultaneously, robust cybersecurity expertise is paramount for ensuring the security and integrity of sensitive tax-related data stored within the CTAS and other digital platforms. As Indonesia increasingly relies on digital infrastructure for tax administration, the potential for cyberattacks becomes a significant concern. Neglecting cybersecurity could have serious consequences for Indonesia’s overall competitiveness, as evidenced by the massive cyberattack on the National Data Centre in mid-2024, which disrupted essential government services. The limited regulatory framework in Indonesia for personal data protection and safeguarding against cyberattacks further underscores the need for strengthening these critical areas. The increasing reliance on digital platforms for tax administration, such as CTAS and SAMS, necessitates the implementation of robust cybersecurity measures and the development of skilled digital forensics capabilities. These are essential to protect sensitive taxpayer information and to effectively investigate UEA, which increasingly operates within the digital space. The current underfunding of cybersecurity efforts within Indonesia is a significant issue that requires immediate attention to mitigate these growing risks.

Network analysis, drawing upon techniques from mathematics and computer science, can provide valuable insights into the interconnectedness of individuals and businesses involved in UEA. By mapping these relationships, tax authorities can gain a better understanding of the structure of underground networks and identify key players orchestrating these illicit activities. Geospatial technology offers another powerful tool by enabling the analysis of geographic data related to economic activity. This analysis could reveal geographical concentrations of potential UEA, allowing tax authorities to allocate their investigative resources more effectively and conduct targeted operations in high-risk areas.

4. The Tax Accounting Equation (TAE): A Framework for Identifying Discrepancies

The Tax Accounting Equation (TAE) presents a valuable framework for Indonesian tax authorities to identify potential discrepancies in financial reporting that could indicate the presence of hidden income from the Underground Economy Activity (UEA). While a single, universally defined “Tax Accounting Equation” does not exist, the fundamental principle involves understanding the relationship between a company’s accounting profits and its taxable income, taking into account both permanent and temporary differences in their calculation.

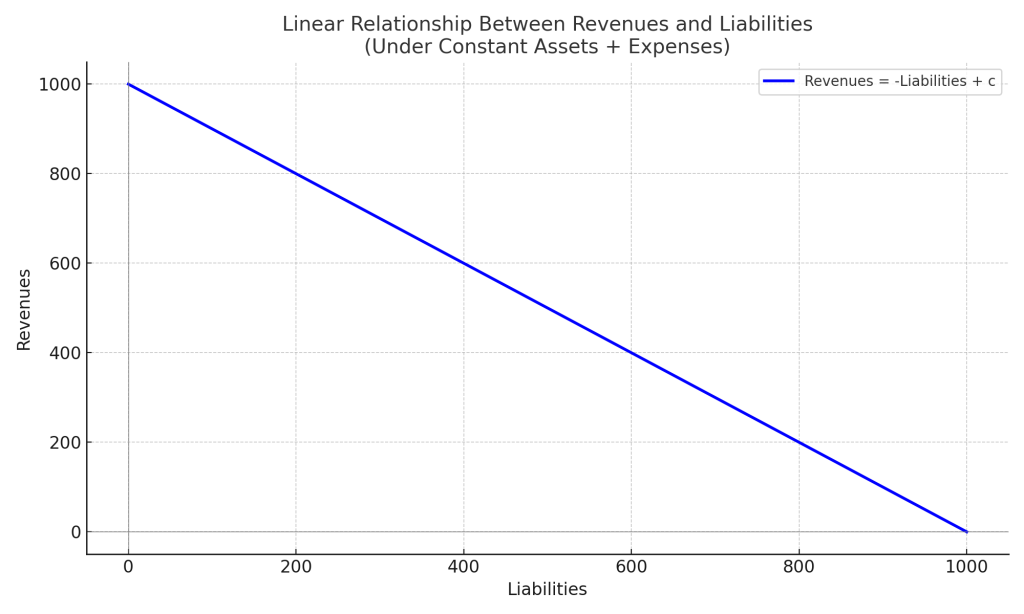

Dr. Joko Ismuhadi, an Indonesian tax specialist, has developed a specific Tax Accounting Equation (TAE) tailored for the context of Indonesian tax analysis. This innovative approach adapts the basic accounting equation (Assets = Liabilities + Equity) to focus on revenue as a key indicator of economic activity and related tax obligations. The TAE is expressed in two primary forms: Revenue – Expenses = Assets – Liabilities, and Revenue = Expenses + Assets – Liabilities. These formulations strategically rearrange the fundamental accounting equation to emphasize the link between a company’s profitability, as reflected in its income statement (Revenue – Expenses), and its net worth, as shown on its balance sheet (Assets – Liabilities). This allows tax authorities to have a more focused lens for identifying potential tax irregularities. Furthermore, for situations where taxable income might be intentionally reported as zero or even negative to minimize tax liabilities, Dr. Ismuhadi has also formulated the Mathematical Accounting Equation (MAE): Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan. The core mathematical principle underpinning these equations is to establish an expected equilibrium between key components of financial reporting and a company’s tax obligations. By mathematically connecting revenue, expenses, assets, and liabilities, TAE provides tax authorities with a quantitative method to assess financial statements. Significant deviations from these anticipated relationships can serve as red flags, indicating potential tax avoidance or even fraudulent activities.

Integrating the logic of Dr. Ismuhadi’s TAE into the Core Tax Administration System (CTAS) holds significant promise for enhancing the DGT’s ability to combat UEA. The CTAS could be designed to automatically analyze the financial reports submitted by taxpayers and identify potential discrepancies or aggressive tax planning strategies that might suggest hidden income from the underground economy. There is a growing recognition within Indonesia regarding the potential benefits of incorporating TAE into the existing methodologies used by the DGT for tax assessment, audit, and investigation processes. The enhanced data infrastructure and real-time access to financial transactions provided by the CTAS could enable the DGT to efficiently implement TAE on a much larger scale. This could involve the development of automated analytical tools capable of applying the equation to vast amounts of financial data, significantly improving the efficiency and effectiveness of identifying potential UEA. The integration of Dr. Ismuhadi’s TAE into the CTAS could provide a powerful, data-driven mechanism for the DGT to proactively identify potential instances of UEA. By analyzing financial data for mathematical inconsistencies that might not be readily apparent through traditional review methods, the system could flag taxpayers whose reported financials deviate significantly from expected relationships, thereby prompting further investigation into potential undeclared income originating from the underground economy.

A Tax Accounting Equation approach can also serve as an effective early detection method for tax avoidance, as highlighted by Indonesian academics. Incorporating this framework into the CTAS would allow for the proactive identification of potential tax issues before they escalate into significant cases of tax evasion related to UEA. By continuously monitoring the financial data submitted through the CTAS using TAE principles, tax authorities can identify trends and anomalies early on, enabling timely intervention and preventing substantial revenue losses.

5. The Role of Integrated Tax Systems: SAMS and CTAS in Combating UEA

Integrated tax systems, particularly the Self Assessment Monitoring System (SAMS) and the Core Tax Administration System (CTAS), play a pivotal role in enhancing Indonesia’s capacity to combat the Underground Economy Activity (UEA) by providing the necessary technological infrastructure for enhanced oversight, data analysis, and enforcement.

Indonesia operates under a self-assessment tax system, where taxpayers bear the responsibility for calculating and reporting their own tax obligations. In this context, the Self Assessment Monitoring System (SAMS) is crucial for overseeing compliance within this system. Integrating STEM tools with SAMS would enable more sophisticated monitoring of taxpayer declarations. AI-powered systems could cross-reference reported income with various data points, including industry benchmarks, broader economic indicators, and third-party information, to identify inconsistencies that might suggest undeclared income derived from UEA. The concept of System Monitoring Self Assessment (SMSA), which involves an organization systematically evaluating its own monitoring capabilities, aligns with the objectives of SAMS in the tax domain. The trend towards self-assessment in tax management within Indonesia, as seen in restaurant tax management, aims to improve efficiency, transparency, and taxpayer awareness. Furthermore, SAMS, enhanced by data analytics, could be utilized to develop more effective risk-based audit strategies. This would allow tax authorities to focus their limited resources on taxpayers and sectors exhibiting a higher likelihood of engaging in UEA, thereby optimizing the impact of audit activities. Analytics can assist tax officers in identifying potential taxpayers with the highest probability of payment, which can inform the development of these risk-based audit strategies.

The Core Tax Administration System (CTAS) represents the central technological infrastructure for managing tax administration in Indonesia. Its primary goal is to integrate all core tax processes, ranging from taxpayer registration to tax collection and enforcement. The CTAS, which became effective on January 1, 2025 , is a major modernization initiative intended to streamline tax administration, enhance efficiency, improve data accuracy, and increase taxpayer compliance through a unified digital platform. Key features of CTAS include online tax reporting and payment, a real-time taxpayer database, automated compliance checks, and integration with financial institutions. The objectives of CTAS include increasing tax revenue by improving compliance and identifying non-compliant taxpayers, as well as reducing administrative costs. The Finance Minister has affirmed that CTAS is the backbone for achieving state revenue targets, with the potential to significantly increase the tax ratio. Integrating the principles of the Tax Accounting Equation (TAE) and the enhanced monitoring functionalities of SAMS within the CTAS would create a formidable tool for combating UEA. This centralized system would facilitate seamless data sharing and analysis across various tax functions, providing a holistic view of taxpayer activities. Furthermore, the automation of data analysis and risk assessment within CTAS, driven by STEM principles, would substantially improve the efficiency of tax authorities in identifying and addressing UEA. CTAS is designed with automated compliance checks and the capability to assist in taxpayer segmentation and profiling, which supports risk-based approaches to enforcement. The successful implementation and comprehensive utilization of CTAS, incorporating integrated data analytics, AI capabilities, and potentially the TAE framework, represent a pivotal opportunity for Indonesia to significantly enhance its ability to detect and collect taxes from the UEA. By strategically embedding advanced analytical tools and frameworks like TAE into the functionality of CTAS, the DGT can move beyond traditional methods and leverage the power of technology to gain a much clearer understanding of economic activities, including those hidden within the UEA.

6. Current Initiatives and the Path Forward for Indonesia’s Tax Authority

The Indonesian tax authority has already embarked on initiatives that leverage technology to enhance tax administration and combat tax evasion, including activities within the underground economy. Ongoing digital transformation efforts, such as the development of the robust Coretax DJP system, are laying the groundwork for the broader adoption of AI in taxation. While the full integration of AI into the tax system is still in its early stages, there is a clear recognition of its significant potential to detect anomalies in financial data, personalize taxpayer education and reminders, and proactively predict and mitigate tax risks. The Ministry of Finance’s use of the “AI as a Financial Advisor” (AIFA) system to monitor the fiscal performance of subnational governments demonstrates an existing capacity within the Indonesian government for implementing AI-driven solutions.

The implementation of the Core Tax Administration System (CTAS) marks a significant milestone in the modernization of Indonesia’s tax administration, having become effective on January 1, 2025. The CTAS project, initiated in 2021, is a complex and extensive undertaking involving the re-engineering of business processes and the adoption of commercial off-the-shelf (COTS) software solutions. While the initial plan anticipated completion within seven years, the system is already operational for various tax types, including Corporate Income Tax (CIT), Value Added Tax (VAT), and Withholding Tax, with increased automation and integration compared to previous systems. The Finance Minister anticipates that CTAS will serve as a crucial foundation for achieving state revenue targets and has the potential to increase Indonesia’s tax ratio. The successful deployment of CTAS is expected to elevate Indonesia’s tax administration system to the standards observed in developed nations, providing a seamlessly integrated platform that encompasses all tax-related business processes.

Despite these advancements, the Indonesian tax authority faces several challenges in fully leveraging technology to combat UEA. The complete adoption of AI in taxation is hindered by factors such as limited technological infrastructure in certain regions, a shortage of skilled AI professionals within the public sector, and the ongoing need to develop robust data governance policies. Broader vulnerabilities within Indonesia’s digital landscape, particularly in cybersecurity, pose a significant risk. Chronic underfunding of cybersecurity initiatives and a historical focus on information control rather than comprehensive national defense have left Indonesia dangerously exposed to cyber threats, as highlighted by the cyberattack on the National Data Centre. Within the specific domain of digital forensics, the DGT faces challenges including a limited number of qualified experts, uneven capabilities among existing personnel, and a scarcity of necessary supporting equipment, which currently restricts the impact of digital forensics on tax revenue. Furthermore, the existing regulatory framework for personal data protection in Indonesia is somewhat limited, which could present challenges for the extensive data processing required for effective UEA detection. Current digital forensic procedures within the DGT also tend to rely on semi-digital methods and have not yet fully embraced modern digital technologies, suggesting a need for the adoption of big data analytics in data acquisition processes. The successful implementation of CTAS presents a significant opportunity, but the DGT must concurrently address critical challenges in cybersecurity, digital forensics capabilities, data governance, and the availability of skilled personnel to fully realize the potential of this modernization effort in combating UEA. A modern tax system like CTAS relies heavily on digital infrastructure and data. Weaknesses in cybersecurity could undermine the system’s integrity, while insufficient digital forensics capabilities would limit the ability to investigate digital aspects of UEA. Addressing these foundational issues is crucial for CTAS to be truly effective in its goals.

7. Recommendations for Strengthening the Fight Against UEA

To further strengthen Indonesia’s efforts in combating the Underground Economy Activity (UEA) and enhancing tax revenue collection, the following recommendations are proposed:

- Enhancing Data Integration and Sharing: Develop comprehensive protocols and build the necessary infrastructure to enable seamless data integration and sharing among various government agencies, including the Ministry of Finance, the Directorate General of Taxes, the Indonesian Financial Transaction Reports and Analysis Center (PPATK) , and other relevant bodies. This enhanced data ecosystem would provide a more holistic view of economic activities across the nation, facilitating the identification of potential UEA that might otherwise remain hidden within individual agency silos.

- Investing in Advanced Analytics and AI Infrastructure: Significantly increase financial investment in acquiring advanced data analytics tools, establishing robust AI platforms, and upgrading the underlying hardware infrastructure required to support sophisticated analysis of large datasets specifically for the purpose of UEA detection. Furthermore, establish dedicated teams comprising skilled data scientists and AI specialists within the tax authority to develop, implement, and maintain these advanced analytical capabilities.

- Developing Robust Digital Forensics and Cybersecurity Frameworks: Substantially increase the allocation of funding and resources to the National Cyber and Crypto Agency (BSSN) and the digital forensics units within the DGT to significantly bolster both cybersecurity defenses and digital investigation capabilities, directly addressing the issue of underfunding. Concurrently, develop comprehensive legal and regulatory frameworks specifically for digital forensics in tax investigations, ensuring legal certainty and admissibility for the use of electronic evidence in tax-related legal proceedings. Implement targeted and comprehensive training programs aimed at increasing both the number and the level of expertise of digital forensics personnel within the DGT, directly addressing the current limitations in human resources and skills.

- Implementing Training Programs for Technology Utilization: Design and implement comprehensive training programs to equip tax officials at all levels with the necessary skills to effectively utilize data analytics tools, AI-powered systems, and the full range of functionalities offered by the CTAS for the specific purpose of identifying and addressing UEA. This training should also include detailed instruction on the principles and application of the Tax Accounting Equation within the context of the new system, enabling tax officials to leverage this framework for enhanced detection of financial discrepancies.

- Exploring Policy Adjustments for Digital Transaction Taxation: Continuously review and adapt existing tax policies to more effectively address the unique challenges presented by the rapidly evolving digital economy and the increasing prevalence of UEA operating within online spaces, taking into careful consideration the difficulties in tracking and taxing income generated from online activities. Explore the potential of leveraging the integrated capabilities of the CTAS to enhance the monitoring and taxation of digital transactions, ensuring that tax policies remain relevant and effective in this dynamic economic landscape.

8. Conclusion: Towards a More Transparent and Efficient Tax System in Indonesia

The integration of STEM principles, particularly data analytics, artificial intelligence, digital forensics, and cybersecurity, alongside the Tax Accounting Equation and enhanced tax systems like SAMS and CTAS, holds immense potential for significantly boosting tax revenue collection from Indonesia’s Underground Economy Activity. While the recent implementation of CTAS represents a critical step forward in modernizing tax administration, realizing the full benefits of this technological advancement necessitates sustained and strategic investment in technological infrastructure, the development of skilled human capital, the implementation of robust cybersecurity measures, and the strategic integration of advanced analytical frameworks. A continued commitment to innovation and the strategic implementation of these recommendations will be essential for achieving a more transparent, efficient, and equitable tax system in Indonesia, ultimately contributing to the nation’s long-term economic growth and sustainable development.

Key Tables:

Table 1: Estimated Size and Tax Loss of Indonesia’s Underground/Shadow Economy

| Year(s) of Estimate | Estimated Size as % of GDP | Estimated Tax Loss (in IDR Trillion) | Estimated Tax Loss as % of GDP | Source |

|---|---|---|---|---|

| 2001-2013 | 8.33% | 11.17 | 1% | |

| 1990-2018 | 5.44% | Not Specified | 0.70% | |

| 2020 | 30-40% | 4,603.5 – 6,173.6 | Not Specified |

Table 2: Key Features and Benefits of Indonesia’s Core Tax System (CTAS)

| Feature | Description | Benefit for Taxpayers | Benefit for Tax Authority |

|---|---|---|---|

| Online Tax Reporting and Payment | Electronic filing and payment of taxes. | More manageable, faster, and transparent tax reporting; reduces time and resources needed for compliance. | Streamlined processes; real-time data; reduced administrative burden. |

| Real-time Taxpayer Database | Centralized and up-to-date system for managing taxpayer information. | Ensures accuracy of records; facilitates easier access to personal tax information. | Improved efficiency in tax administration; reduced errors; enhanced oversight. |

| Automated Compliance Checks | System automatically checks tax filings for adherence to regulations. | Helps avoid mistakes and potential penalties; ensures compliance. | Reduces the need for manual checks; improves the accuracy of tax filings; facilitates risk assessment. |

| Better Data Security | Enhanced security measures for protecting sensitive taxpayer data. | Increased trust in the system; protection of personal and financial information. | Ensures the integrity and confidentiality of tax data; reduces the risk of data breaches. |

| Integration with Financial Institutions | Seamless connection with banks and other financial institutions. | Facilitates smoother tax payments and refunds; simplifies financial transactions related to taxation. | Enables better tracking of financial flows; facilitates reconciliation of tax payments and refunds. |

| Taxpayer Account System | Dedicated online accounts for managing tax records and filings. | Provides a centralized platform for all tax-related activities; enhances convenience and accessibility. | Offers a comprehensive view of taxpayer activities; facilitates better communication and service delivery. |

| Automated Reminders | System-generated alerts for upcoming tax deadlines and obligations. | Minimizes the risk of missed deadlines and penalties; promotes timely compliance. | Improves compliance rates; reduces the need for manual follow-ups. |

| Risk-Based Compliance Data Analysis | Utilizes data to identify and assess taxpayer compliance risks. | May lead to more targeted and less intrusive audits for compliant taxpayers. | Enables more efficient allocation of audit resources; focuses enforcement efforts on high-risk taxpayers, including those potentially involved in UEA. |

Table 3: Challenges and Recommendations for Leveraging STEM in Indonesian Tax Administration

| Challenge | Related Snippet ID(s) | Recommendation |

|---|---|---|

| Limited Infrastructure in Some Regions | Invest in expanding and upgrading technological infrastructure across all regions of Indonesia to ensure equitable access and effective implementation of advanced tax administration systems. | |

| Lack of Skilled AI Personnel in the Public Sector | Develop and implement comprehensive training programs to build a skilled workforce of AI professionals within the Directorate General of Taxes and other relevant government agencies. Consider partnerships with universities and private sector entities to accelerate this process. | |

| Need for Strong Data Governance Policies | Establish clear and robust data governance policies and frameworks to ensure the ethical, secure, and effective use of taxpayer data in AI and analytics applications. This includes defining data access protocols, privacy safeguards, and data quality standards. | |

| Underfunded Cybersecurity Efforts | Significantly increase budgetary allocations for the National Cyber and Crypto Agency (BSSN) and cybersecurity initiatives within the tax authority to strengthen defenses against cyber threats and protect sensitive taxpayer data. | |

| Limited Number of Digital Forensics Experts in DGT | Implement specialized training programs and recruitment drives to increase the number of qualified digital forensics experts within the Directorate General of Taxes. Consider establishing partnerships with external digital forensics firms to augment internal capabilities. | |

| Uneven Human Resource Capabilities in Digital Forensics | Develop standardized training curricula and professional development pathways to ensure a consistent level of expertise and capability among digital forensics personnel across different tax offices and regions. | |

| Limited Availability of Supporting Devices for Forensics | Allocate sufficient funds for the procurement and maintenance of state-of-the-art digital forensics hardware and software tools to equip digital forensics personnel with the necessary resources to conduct effective investigations. | |

| Limited Regulatory Framework for Data Protection | Work towards strengthening the legal and regulatory framework for personal data protection in Indonesia to provide clearer guidelines and safeguards for the collection, processing, and storage of sensitive taxpayer information used in advanced tax administration systems. | |

| Semi-Digital Forensic Procedures | Invest in training and technology adoption to fully modernize digital forensic procedures within the DGT, including the integration of big data analytics technologies for efficient data acquisition and analysis. |

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Puasa sebagai Tameng

Urgensi Pajak Kekayaan di Indonesia: Telaah Mendalam dalam Konteks Undang-Undang Pajak Penghasilan

A Comprehensive Profile of Yon Arsal: Expertise in Indonesian Economics, Tax Compliance, and Financial Institutions

Top 3: Latar Belakang Pendidikan Komeng Buat Modal Jadi Anggota DPD

HALAL BIHALAL PRODIP PAJAK 88: Jabodetabek

The Triple Power of Integration: A Strategic Blueprint for Indonesia’s Enhanced Tax Revenue and Administration

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION