Integrating Advanced Accounting Principles into Indonesia’s Core Tax Administration System

- Ekonomi

Sunday, 01 June 2025 00:13 WIB

Jakarta, fiskusnews.com:

1. Executive Summary

This report assesses the potential integration of Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) and triple-entry bookkeeping principles into Indonesia’s Core Tax Administration System (CTAS) within a Self-Assessment Monitoring System (SAMS). The aim is to evaluate how these advanced accounting methods could enhance tax revenue and deposit rates in Indonesia. The analysis indicates that while the full implementation of triple-entry bookkeeping across the Indonesian tax system may present considerable challenges, the integration of Dr. Ismuhadi’s TAE into the existing CTAS framework offers a promising avenue for improving tax compliance and detection of financial irregularities. By leveraging the data infrastructure and analytics capabilities of CTAS, TAE can function as a powerful tool for real-time monitoring and risk assessment, ultimately contributing to increased tax revenue and more accurate tax deposits. Recommendations include a phased approach to integration, starting with pilot programs and thorough stakeholder engagement to ensure successful implementation and alignment with Indonesia’s legal and regulatory landscape.

2. Introduction: Enhancing Tax Compliance and Revenue in Indonesia

Overview of Indonesia’s Current Tax System

Indonesia operates a self-assessment tax system, a framework where taxpayers bear the primary responsibility for calculating, paying, and reporting their tax obligations in accordance with the nation’s tax laws and regulations. This system places significant trust in taxpayers to voluntarily comply with these regulations. A substantial portion of the individual income tax collected in Indonesia is facilitated through withholding mechanisms managed by third parties, such as employers deducting tax from salaries. This reliance on self-assessment underscores the critical need for robust monitoring mechanisms to ensure the accuracy of taxpayer-reported information and to identify potential instances of non-compliance. Without effective oversight, the self-assessment system could be vulnerable to inaccuracies or intentional misstatements, potentially leading to revenue leakage.

Challenges in Achieving Optimal Tax Revenue and Deposit Rates

Despite operating under a self-assessment regime, Indonesia has faced challenges in achieving optimal tax revenue and deposit rates. The country’s tax-to-GDP ratio has historically been lower when compared to many other nations. Evidence suggests the presence of significant tax evasion activities and a considerable underground economy, which contribute to this shortfall. The tax gap, representing the difference between the amount of tax potentially collectible and the amount actually collected, remains substantial, particularly in the realm of personal income tax. These factors collectively indicate a necessity for enhancing the tax administration’s capabilities in detecting and enforcing tax compliance to improve overall revenue collection. The persistent gap between potential and actual tax revenue suggests that current administrative practices may not be fully effective in capturing all taxable economic activity within the country.

The Role of Technology and Innovative Approaches

To address these challenges, Indonesia is actively pursuing tax reforms, most notably through the introduction of the Core Tax Administration System (CTAS). CTAS is designed to modernize the nation’s tax infrastructure and significantly boost revenue generation. This system aims to integrate all tax-related processes into a unified digital platform, leveraging accurate data to improve oversight and enhance tax collection efficiency. A key component of CTAS is its emphasis on data analytics, which is intended to facilitate more effective risk-based compliance analysis. This technological advancement provides a foundation upon which more sophisticated accounting methods can be integrated for enhanced tax oversight. The ongoing digitalization of the tax system presents a unique opportunity to embed advanced analytical tools directly into the tax administration’s daily workflow, potentially leading to more effective monitoring and enforcement of tax regulations.

Introducing the Concept of Integrating Advanced Accounting Modules

In light of these developments, the proposition of integrating triple-entry bookkeeping and Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) into CTAS within a Self-Assessment Monitoring System (SAMS) represents a potential step towards a more proactive and forensic approach to tax compliance in Indonesia. This integration could provide tax authorities with enhanced tools for detecting financial irregularities and ensuring the accuracy of self-assessed tax liabilities, ultimately contributing to the overarching goal of increasing tax revenue and improving deposit rates.

3. Understanding Triple-Entry Bookkeeping: Implications for Tax Transparency

Defining Triple-Entry Bookkeeping and Its Evolution

Traditional double-entry bookkeeping, the standard method used in financial accounting, operates on the principle that every financial transaction is recorded with two corresponding entries: a debit and a credit. This system ensures that the fundamental accounting equation (Assets = Liabilities + Equity) remains balanced. In contrast, triple-entry bookkeeping extends this concept by incorporating an additional, third layer of verification and transparency. This often involves a cryptographic signature or a shared record of the transaction on a distributed ledger, such as a blockchain. The initial concept of triple-entry bookkeeping was introduced by Yuji Ijiri, who proposed a third entry to explain changes in income, focusing on tracking the rate of change in certain accounts. Later, Ian Grigg further developed this idea, emphasizing the use of digitally signed receipts backed by cryptography, shared between the transacting parties and a third entry, to enhance trust and mitigate transaction fraud. This evolution highlights the potential of triple-entry bookkeeping to provide a more secure and verifiable record of financial transactions compared to the traditional double-entry system.

Exploring the Benefits of Enhanced Transparency, Security, and Auditability

The implementation of a triple-entry system offers numerous advantages in terms of reconciliation, transparency, trust, and auditing capabilities. Such systems allow for a more comprehensive reconciliation of balances, individual transactions, and the overall reporting process. Particularly in blockchain-based triple-entry systems, every transaction is recorded on an immutable audit trail that can be readily accessed and verified by all relevant parties, significantly reducing the need for time-consuming reconciliation processes. The use of cryptographic signatures ensures the authenticity of each transaction and provides assurance against tampering, assuming the underlying blockchain technology is secure. Furthermore, the time-stamped, encrypted, and linked nature of transactions within a triple-entry framework enhances the accuracy and reliability of financial records. These inherent features can directly address common issues of fraud and errors that often precede or contribute to tax evasion, as the increased transparency and security could deter taxpayers from engaging in practices like underreporting income or overstating expenses.

Assessing the Potential Relevance of Triple-Entry Bookkeeping within the Context of Indonesia’s Tax System and CTAS

While the widespread adoption of triple-entry bookkeeping across all taxpayers in Indonesia might present significant logistical and infrastructural challenges at this stage, the underlying principles of enhanced transparency and security could be selectively applied within the context of Indonesia’s tax system and the newly implemented CTAS. For instance, the Indonesian tax authorities could consider mandating or offering as an option a triple-entry recording module within CTAS for high-risk sectors or large taxpayers who contribute significantly to the national revenue. This phased approach would allow the authorities to assess the practical benefits and challenges associated with triple-entry bookkeeping in a controlled environment before considering broader implementation. Integrating such a module within CTAS, which already aims to streamline and digitize tax administration, could further strengthen the system’s robustness by providing an additional layer of transaction verification and potentially reducing the incidence of tax fraud and evasion.

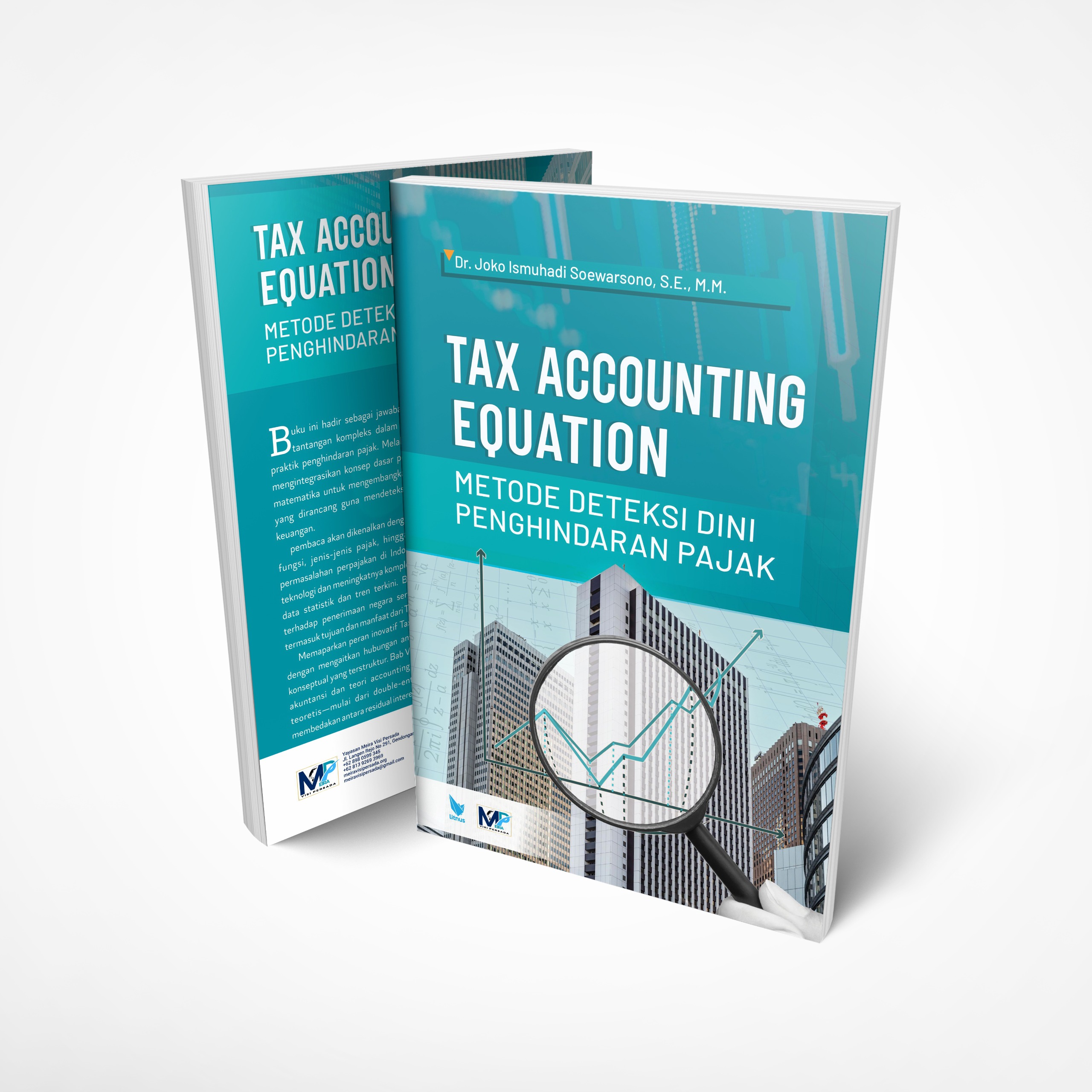

4. Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE): A Forensic Tool for Indonesian Tax Analysis

In-depth Analysis of the TAE’s Formulations and Underlying Principles

Dr. Joko Ismuhadi, an Indonesian tax specialist, formulated the Tax Accounting Equation (TAE) as a novel tool designed for the specific context of Indonesian tax analysis. TAE is presented in two primary, interrelated forms: Revenue – Expenses = Assets – Liabilities, and Revenue = Expenses + Assets – Liabilities. These formulations represent a strategic rearrangement of the fundamental accounting equation (Assets = Liabilities + Equity), with a deliberate emphasis on revenue as a critical indicator of a company’s economic activity and its subsequent tax obligations. By focusing on the relationship between a company’s profitability, as reflected in the income statement (Revenue – Expenses), and its net worth, as shown on the balance sheet (Assets – Liabilities), TAE aims to provide tax authorities with a more targeted lens for identifying potential tax irregularities. Furthermore, for specific scenarios where taxable income might be intentionally reported as zero or negative to minimize tax liabilities, Dr. Ismuhadi also formulated the Mathematical Accounting Equation (MAE): Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan. This equation further expands the analysis by including dividends and other elements, offering an even more comprehensive view of a company’s financial activities and potential tax discrepancies.

Highlighting Its Specific Design for Early Detection of Tax Avoidance and Financial Irregularities

The Tax Accounting Equation is specifically designed as an analytical tool to facilitate the early detection of tax avoidance schemes and various forms of financial irregularities. By analyzing taxpayers’ financial statements through the framework of TAE, tax officials can identify inconsistencies that might suggest intentional misreporting of revenue or expenses. For instance, an unusual increase in a company’s assets without a corresponding increase in reported revenue or equity could be flagged by TAE as a potential indicator of tax evasion. Moreover, TAE places a significant focus on the analysis of liability accounts, particularly bank overdrafts. Discrepancies or unusual patterns in these accounts can serve as strong indicators of hidden economic activity or unreported income. The equation’s emphasis on these specific financial relationships makes it a particularly valuable tool for forensic tax analysis within the Indonesian context, where tax evasion and the underground economy pose significant challenges.

Discussing the Potential of TAE as a Forensic Approach to Enhance Tax Analysis Capabilities

Dr. Ismuhadi’s Tax Accounting Equation holds significant potential for enhancing Indonesia’s tax analysis capabilities by providing a mathematically rigorous framework for examining financial data. This approach contributes to a more sophisticated, forensic, and data-driven methodology for combating tax evasion. By mathematically linking key financial reporting components such as revenue, expenses, assets, and liabilities, TAE enables tax authorities to move beyond traditional qualitative assessments of financial statements towards a more quantitative methodology for identifying potential irregularities. Furthermore, integrating TAE into existing tax enforcement strategies can provide an additional layer of analysis that focuses on the core relationships within financial statements, potentially uncovering inconsistencies that might not be apparent through other forms of financial analysis or traditional auditing procedures. This focused approach adds a valuable dimension to the tax enforcement toolkit, allowing tax authorities to more effectively target their resources and improve the detection of hidden income and other tax evasion tactics prevalent in the Indonesian financial landscape.

5. Indonesia’s Core Tax Administration System (CTAS): A Foundation for Digital Tax Governance

Detailed Overview of CTAS Functionalities

Indonesia’s Core Tax Administration System (CTAS) represents a significant step towards modernizing the country’s tax administration. Effective from January 1, 2025, CTAS is an integrated service administration system developed for the Directorate General of Taxation (DGT). Its primary function is to streamline all core tax administration processes, encompassing taxpayer registration, tax return reporting, tax payments, audits, and collections, all within a unified platform. CTAS aims to replace outdated manual procedures with automated and digitized processes, thereby enhancing efficiency and reducing errors. Key functionalities of the system include online tax reporting and payment capabilities, a real-time taxpayer database for up-to-date information, and automated compliance checks to ensure adherence to tax regulations. Additionally, CTAS provides a comprehensive taxpayer account system, facilitates the management of tax deposits and payments, and handles procedures for tax overpayments. A significant aspect of CTAS is its integration of various existing tax applications, such as e-Faktur and DJP Online, into a single, cohesive platform. This integration provides a robust digital infrastructure that holds the potential to support the incorporation of advanced accounting modules for enhanced tax oversight.

Examining the Objectives of CTAS in Increasing Tax Revenue, Improving Taxpayer Compliance, and Modernizing Tax Administration Processes

One of the fundamental objectives of CTAS is to bolster tax revenue by significantly increasing taxpayer compliance and more effectively identifying individuals and entities that are not meeting their tax obligations. The system is also designed to provide enhanced services to taxpayers, aiming to simplify the process of fulfilling their tax responsibilities and thereby encouraging greater compliance. CTAS seeks to improve the overall tax database across all stages of tax administration, from initial registration to final payment and reporting, and to enable taxpayers to complete their tax obligations online without the need for physical visits to tax offices. Furthermore, a key objective is to reduce the administrative burden associated with tax compliance by minimizing the reliance on paperwork and improving the accessibility of taxpayer information through digital channels. These core objectives of CTAS align closely with the potential benefits that could be realized through the integration of Dr. Ismuhadi’s TAE and triple-entry bookkeeping principles, suggesting a synergistic relationship that could further enhance the modernization and effectiveness of Indonesia’s tax administration.

Assessing the Current Implementation Status and the Potential of CTAS for Advanced Data Utilization

The implementation of CTAS became effective on January 1, 2025, marking a significant milestone in Indonesia’s tax reform efforts. The system is designed to leverage pre-populated data services to streamline processes, such as the annual tax return filing, making it faster and more accurate for taxpayers. CTAS places a strong emphasis on improving data analytics capabilities to facilitate risk-based taxpayer compliance, allowing for more targeted and efficient oversight. A key feature of CTAS is its aim to create greater transparency in taxpayer accounts by providing a comprehensive view of all tax-related transactions. Given its robust focus on data management and analytics, CTAS presents a favorable environment for integrating advanced accounting methodologies like Dr. Ismuhadi’s TAE. The system’s infrastructure for handling and analyzing large volumes of taxpayer data can be readily leveraged to implement and monitor the mathematical equations of TAE, potentially enhancing the existing data analytics capabilities and providing tax authorities with more sophisticated tools for detecting financial irregularities and improving overall tax compliance.

6. Integrating the Tax Accounting Equation into the Core Tax Administration System

Analyzing the Technical Feasibility of Integrating TAE as a Module within CTAS

Given that CTAS is built upon a modern information technology architecture, it possesses the inherent flexibility to accommodate the addition of new modules and functionalities. The system is already engineered to handle complex tax calculations and manage substantial volumes of data, indicating a foundational capacity to incorporate the mathematical formulas inherent in Dr. Ismuhadi’s Tax Accounting Equation (TAE). While a thorough technical assessment would be necessary to detail the specific steps involved, the contemporary design of CTAS suggests that the integration of TAE as a supplementary module is technically feasible. This would likely involve developing software components within the CTAS framework that can perform the TAE calculations using the financial data already stored and processed by the system. The modularity of modern software architectures often allows for such extensions without requiring a complete overhaul of the existing system.

Exploring How CTAS’s Data Infrastructure and Analytics Capabilities Can Be Leveraged to Implement and Monitor TAE

The robust data infrastructure of CTAS, including its real-time taxpayer database, can readily provide the necessary financial data inputs required for the Tax Accounting Equation calculations. Furthermore, the system’s built-in data analytics tools and capabilities can be effectively utilized to monitor the results generated by TAE. CTAS can be configured to automatically compare the financial data reported by taxpayers against the benchmarks established by the TAE formulas, flagging any significant variances or deviations that might warrant further scrutiny by tax officials. The automated compliance checks already in place within CTAS could also be enhanced to incorporate TAE as an additional layer of analysis, providing a more comprehensive assessment of taxpayer-reported data. This synergy between CTAS’s existing framework and the analytical power of TAE would create a more potent system for ensuring the accuracy of self-assessments and identifying potential tax irregularities.

Discussing the Potential Benefits of This Integration

The integration of Dr. Ismuhadi’s Tax Accounting Equation (TAE) into Indonesia’s Core Tax Administration System (CTAS) holds several significant potential benefits for enhancing tax governance. Firstly, TAE’s specific focus on revenue and its relationship with assets and liabilities can substantially improve the early detection of tax avoidance schemes within the CTAS framework. By analyzing these core financial relationships, the system can identify anomalies that might indicate intentional misreporting. Secondly, deviations from the expected balances as per TAE can serve as critical red flags, enabling CTAS to enhance its risk assessment algorithms and more effectively target tax audits towards taxpayers who exhibit a higher likelihood of non-compliance. This leads to a more efficient allocation of audit resources. Thirdly, the integration of TAE provides a quantitative and mathematically grounded method for monitoring the accuracy of self-assessed tax data, supplementing traditional verification processes and potentially uncovering discrepancies that might otherwise go unnoticed. Ultimately, by more effectively identifying and addressing tax avoidance and evasion, the integration of TAE into CTAS has the potential to significantly boost overall tax revenue and encourage more accurate and timely tax deposits from taxpayers across Indonesia.

7. Self-Assessment Monitoring System (SAMS) with Integrated TAE

Defining the Concept of a SAMS in the Context of Indonesia’s Tax Administration

In the context of Indonesia’s tax administration, a Self-Assessment Monitoring System (SAMS) would represent a framework designed to continuously oversee tax data that has been self-assessed by taxpayers. The primary goal of such a system is to compare this data against expected norms, historical patterns, and established financial relationships to identify any potential discrepancies that might indicate errors or intentional misstatements. Given its existing data analytics capabilities and its role in processing and analyzing taxpayer-submitted information, Indonesia’s Core Tax Administration System (CTAS) already embodies the foundational elements of a SAMS. It provides the infrastructure for collecting, storing, and analyzing tax-related data, which are essential components of any monitoring system.

Explaining How the Integration of TAE within CTAS Can Function as an Advanced Self-Assessment Monitoring Tool

The integration of Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) into CTAS would significantly enhance its capabilities as an advanced self-assessment monitoring tool. TAE provides specific mathematical relationships between key financial variables, such as revenue, expenses, assets, and liabilities, which can serve as objective benchmarks for monitoring the accuracy and consistency of self-assessed tax data. CTAS can be programmed to automatically apply these TAE benchmarks to the financial information reported by taxpayers. The system could then flag any instances where a taxpayer’s reported data deviates significantly from the expected relationships defined by TAE. This automated comparison allows for a continuous and systematic monitoring of self-assessments, moving beyond traditional periodic audits to a more dynamic and responsive oversight mechanism.

Highlighting the Potential for Real-Time Monitoring and Proactive Identification of Potential Tax Irregularities

One of the most significant advantages of integrating TAE within CTAS as part of a SAMS is the potential for real-time monitoring and the proactive identification of potential tax irregularities. By continuously analyzing taxpayer data against the TAE benchmarks, CTAS could potentially identify suspicious patterns or significant deviations as they occur or shortly thereafter. This near real-time monitoring capability would allow tax authorities to intervene much earlier in the process, potentially preventing tax evasion or addressing errors before they escalate into substantial revenue losses for the government. This proactive approach, enabled by the analytical power of TAE and the technological infrastructure of CTAS, represents a substantial improvement over reactive measures like post-filing audits, leading to a more efficient and ultimately more effective tax administration system in Indonesia.

8. Considerations, Challenges, and Recommendations for Implementation

Addressing Potential Challenges in Integrating TAE into CTAS

The integration of Dr. Ismuhadi’s Tax Accounting Equation (TAE) into Indonesia’s Core Tax Administration System (CTAS), while promising, may encounter several challenges. One potential hurdle involves ensuring data compatibility, as the financial data within CTAS must be in a format suitable for TAE calculations. This might necessitate data cleansing and standardization processes to ensure accuracy and consistency. Another challenge lies in the technical modifications required to develop and deploy the TAE module within the existing CTAS architecture, which could demand significant IT resources, expertise, and time. Furthermore, tax officials would need comprehensive training on how to interpret the results generated by the TAE module and how to appropriately act upon the identified deviations. It is also important to anticipate the potential for false positives, where legitimate business activities might be flagged as irregularities by the TAE, necessitating the implementation of a robust system for review and verification to avoid unnecessary burdens on compliant taxpayers.

Discussing the Legal and Regulatory Implications of Implementing TAE as a Monitoring Tool

The implementation of TAE as a monitoring tool within CTAS would also carry legal and regulatory implications that need careful consideration. It is crucial to ensure that the use of TAE for monitoring purposes aligns fully with existing Indonesian tax laws and regulations, providing a clear legal basis for its application. Additionally, any potential privacy concerns related to the automated analysis of taxpayer data using TAE must be thoroughly addressed, ensuring compliance with data protection laws. Establishing clear guidelines and protocols on how the results generated by TAE will be used in tax audits and enforcement actions is also essential to maintain fairness and transparency in the tax administration process. These legal and regulatory considerations underscore the need for a comprehensive framework to govern the use of TAE within CTAS.

Providing Detailed Recommendations for a Phased Approach to Integration

To ensure a successful integration of Dr. Ismuhadi’s Tax Accounting Equation (TAE) into Indonesia’s Core Tax Administration System (CTAS), a phased approach is highly recommended. Initially, the Indonesian tax authorities should consider launching pilot programs targeting specific sectors or a carefully selected subset of taxpayers. These pilot initiatives would serve to assess the real-world effectiveness of TAE in identifying tax irregularities and provide valuable feedback before a broader rollout. Engaging directly with Dr. Joko Ismuhadi and other tax experts throughout this process is crucial to leverage their insights and ensure the proper implementation of TAE within the Indonesian context. Simultaneously, investing in comprehensive training programs for tax officials is essential to equip them with the necessary skills to understand, interpret, and effectively utilize the results generated by the TAE module. An iterative approach to the development and deployment of the TAE module within CTAS would allow for continuous feedback and necessary adjustments based on the pilot program outcomes. Clear performance metrics should be established from the outset to monitor the impact of TAE integration on key indicators such as tax revenue, compliance rates, and the effectiveness of tax audits. Furthermore, the Indonesian tax authorities should also explore the feasibility of integrating a triple-entry bookkeeping module into CTAS, perhaps starting with a voluntary adoption program for certain taxpayer segments to gauge its potential benefits and challenges. This phased and well-managed implementation strategy will be critical for maximizing the success of integrating advanced accounting principles into Indonesia’s tax administration system.

9. Conclusion: Towards a More Robust and Efficient Tax Administration in Indonesia

The integration of Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) into Indonesia’s Core Tax Administration System (CTAS) holds significant promise for enhancing tax compliance and increasing revenue within the country. By leveraging the analytical capabilities of TAE within the technological infrastructure of CTAS, Indonesia can move towards a more proactive and data-driven approach to tax administration. While the full-scale implementation of triple-entry bookkeeping may present longer-term considerations, the focused integration of TAE offers a more immediate and potentially impactful pathway to improving the detection of financial irregularities and ensuring the accuracy of self-assessed tax liabilities. A strategic and well-planned phased approach, accompanied by thorough stakeholder engagement and capacity building for tax officials, will be essential to successfully harness the power of these advanced accounting principles. Through such technological advancements and innovative methodologies, Indonesia can continue to build a more robust, efficient, and equitable tax administration system for the future.

Valuable Tables:

Table 1: Comparison of Double-Entry and Triple-Entry Bookkeeping

| Feature | Double-Entry Bookkeeping | Triple-Entry Bookkeeping |

|---|---|---|

| Number of Entries | Two (Debit and Credit) | Three (Debit, Credit, and a third verifying entry) |

| Ledger Type | Primarily internal ledgers maintained by each party | Shared, often cryptographically secured ledger (e.g., blockchain) |

| Verification Method | Reconciliation between parties | Cryptographic linking and independent verification on the shared ledger |

| Transparency Level | Less transparent; relies on trust and periodic audits | More transparent; shared record accessible to relevant parties |

| Security Level | Vulnerable to tampering within individual ledgers | Highly secure due to cryptographic seals and immutability of the shared ledger |

| Auditability | Requires manual reconciliation and can be time-consuming | Automated audit trail; transactions are readily verifiable by all involved parties |

Table 2: Key Formulations and Principles of Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE)

| Equation Formulation | Underlying Principles |

|---|---|

| Revenue – Expenses = Assets – Liabilities | Focuses on the relationship between a company’s profitability (Income Statement) and its net worth (Balance Sheet). |

| Revenue = Expenses + Assets – Liabilities | Rearrangement emphasizing revenue as a key indicator of economic activity and tax obligations. |

| Assets + Dividen + Beban = Kewajiban + Ekuitas + Pendapatan (MAE) | Specifically formulated for scenarios where taxable income might be intentionally reported as zero or negative to minimize tax liabilities, providing a more comprehensive view. |

| Early detection of potential tax avoidance schemes and financial irregularities by identifying inconsistencies in financial reporting. | |

| Serves as a forensic tool for uncovering activities within the underground economy, particularly through the analysis of liability accounts like bank overdrafts. | |

| Provides a targeted and quantifiable enhancement to traditional tax audit methodologies, allowing for a more data-driven approach to risk assessment and the identification of potential tax evasion. |

Table 3: CTAS Functionalities and Alignment with TAE Integration

| CTAS Functionality | Potential for TAE Integration |

|---|---|

| Data Analytics | CTAS’s existing analytics tools can be leveraged to implement and monitor TAE calculations on taxpayer data, identifying significant deviations from expected financial relationships. |

| Automated Compliance Checks | TAE can be incorporated as an additional layer of scrutiny within the automated compliance checks, providing a more comprehensive assessment of the accuracy and consistency of self-assessed tax data. |

| Real-Time Taxpayer Database | Provides the necessary, up-to-date financial data required for performing TAE calculations, ensuring that the analysis is based on the most current information available. |

| Audit Capabilities | Deviations from TAE benchmarks can be used to enhance the risk scoring mechanisms within CTAS, allowing for more targeted and efficient tax audits focused on taxpayers exhibiting suspicious financial patterns as indicated by TAE results. |

| Integrated Taxpayer Account Management | The system’s ability to provide a comprehensive view of taxpayer transactions and financial information can facilitate a more thorough analysis using TAE, potentially uncovering discrepancies that might be indicative of tax avoidance or evasion. |

| Pre-populated Data Services | The pre-populated data can be used as a basis for comparison against the expected outcomes of TAE calculations, further enhancing the system’s ability to identify potential irregularities in taxpayer-reported information. |

| Tax Deposit & Payment Management | Analyzing the relationship between reported revenue and the levels of tax deposits and payments through the lens of TAE can help identify potential underpayment or inconsistencies that might suggest tax evasion. |

| Tax Overpayment Handling | Examining patterns of tax overpayments in conjunction with TAE results could potentially reveal strategies aimed at concealing income or manipulating financial reporting for tax purposes. |

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Ajak Mengamati Perkembangan Teknologi Dengan Nonton Da Vinci – Penggunaan AI di Vidio

Perkembangan Persamaan Akuntansi: Warisan dari Pacioli hingga Soewarsono

OPINI: Transfer Pricing dan Aspek Perpajakannya

Ekonom Dunia Prediksi Ekonomi Global Tumbuh 2,6 Persen pada 2024

P3KPI selenggarakan Edukasi Coretax

Dewan Pakar TKN Prabowo Sebut Pembentukan BPN Bakal Tertunda

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION