Enhancing National Tax Ratio through the Integration of the Tax Accounting Equation with a Self-Assessment Monitoring System within Core Tax Administration

- Ekonomi

Saturday, 31 May 2025 08:19 WIB

Jakarta, fiskusnews.com:

Executive Summary

This report details a transformative approach to tax administration through the strategic integration of the Tax Accounting Equation (TAE) with a Self-Assessment Monitoring System (SAMS) within a modernized Core Tax Administration System (CTAS). This synergy is designed to fundamentally shift tax enforcement from a reactive, post-filing audit model to a proactive, real-time compliance monitoring and early intervention framework.

The proposed integration is projected to yield substantial benefits, including significant enhancements in taxpayer compliance, marked improvements in administrative efficiency, accelerated tax revenue collection, a direct increase in the national tax ratio, and a substantial reduction in costly tax disputes. This initiative represents a critical step towards establishing a data-driven, predictive, and more equitable tax system, aligning with leading global practices in digital tax administration.

1. Introduction: Modernizing Tax Administration for Enhanced Revenue and Compliance

The Evolving Landscape of Tax Compliance and the Global Shift Towards Self-Assessment

The global landscape of tax compliance is increasingly characterized by complex regulations and a widespread adoption of self-assessment systems. This paradigm places a significant responsibility on taxpayers to accurately calculate, report, and remit their tax liabilities. Indonesia, having adopted this self-assessment system in 1984, exemplifies this global trend. This reliance on taxpayer self-declaration necessitates the implementation of robust internal monitoring mechanisms within organizations and advanced external oversight by tax authorities. Such measures are crucial to safeguard against errors and intentional misstatements, thereby ensuring the integrity of the self-assessment process.

The imperative for real-time responsiveness in tax administration is growing rapidly, driven by the digital transformation of global economies and the increasing volume and speed of financial transactions. This evolution compels governments to embark on the digitalization of public finances to create more efficient frameworks for revenue generation and expenditure management. The ability to respond in real-time, or at least within progressively shorter timeframes, is becoming essential to safeguard and ensure tax revenue.

This pervasive digital transformation is not merely an optional upgrade but a fundamental re-engineering of tax processes. Countries are increasingly recognizing that they must adopt such advanced systems to maintain competitive fiscal effectiveness and secure future revenue streams in a rapidly digitizing global economy. Failure to adapt to this evolving landscape risks significant revenue shortfalls and a reduced capacity to fund essential public services.

The Challenge of the “Tax Gap” and the Need for Proactive Approaches

A significant and persistent challenge for tax administrations worldwide is the “tax gap.” This term defines the difference between the projected “true” tax liability and the amount of tax that is actually paid on time. In 2022, underreporting of taxes accounted for the largest portion of the gross tax gap, representing 77% of the total and amounting to $539 billion. This substantial shortfall directly limits a state’s capacity to deliver essential public services and eradicate poverty, underscoring its profound economic and social implications.

Traditional reactive approaches to tax compliance, such as audits conducted only after tax returns have been submitted, are inherently limited in their ability to comprehensively address this significant tax gap. There is a clear and pressing need for a fundamental shift towards more preventive and predictive compliance models. Modern tax administrations are increasingly adopting proactive strategies to influence taxpayer compliance. This involves systematic compliance improvement plans (CIPs) designed to identify and mitigate compliance risks, thereby increasing overall adherence and boosting tax revenue. This strategic evolution moves beyond merely catching fraud after it occurs to actively deterring it and encouraging upfront compliance, a far more cost-effective and impactful approach.

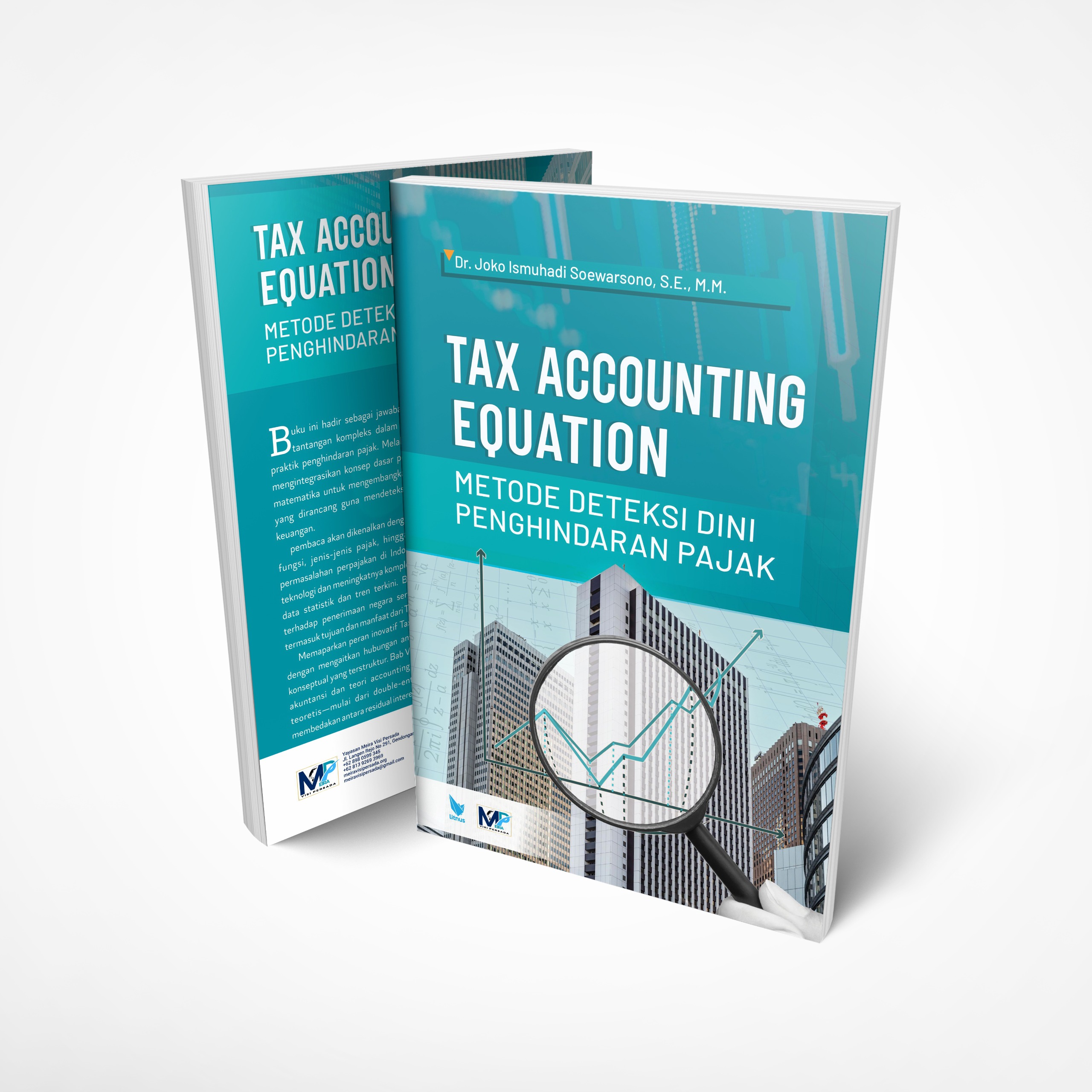

Introducing the Strategic Vision: Integrating TAE with SAMS to Optimize CTAS

The strategic vision presented in this report centers on the integration of Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) with a Self-Assessment Monitoring System (SAMS) to enhance the performance of the Core Tax Administration System (CTAS). This synergy is designed to create a smarter and more responsive tax administration system. Through this integration, taxpayer accounting data can be automatically analyzed to detect anomalies indicative of potential tax under-reporting. The overarching goal is to foster taxpayer compliance and significantly increase the national tax ratio by transforming tax administration into a predictive and effective mechanism for improving compliance and revenue. This comprehensive vision is encapsulated within the broader STEM CEL (Science, Technology, Engineering, and Mathematics Collaboration Empowering Law enforcement) module, which integrates Triple Entry Accounting, TAE, SAMS, and CTAS to create a unified and effective workflow for tax administration and enforcement.

2. Core Components of the Integrated Tax Administration System

2.1 The Tax Accounting Equation (TAE)

The foundational concept underpinning the Tax Accounting Equation (TAE) is the basic accounting equation: Assets = Liabilities + Equity. This equation is the cornerstone of the double-entry accounting system, ensuring that a company’s financial position remains balanced at all times. Within this framework, revenue and expenses directly impact equity, as Net Income (Revenue minus Expenses) ultimately increases or decreases equity at the end of an accounting period.

Dr. Joko Ismuhadi’s Tax Accounting Equation adapts these fundamental accounting principles specifically for Indonesian tax analysis. This adaptation involves strategic rearrangements of the basic equation, notably into “Revenue – Expenses = Assets – Liabilities” and “Revenue = Expenses + Assets – Liabilities”. These formulations emphasize revenue as a critical indicator of a company’s economic activity and its corresponding tax obligations, providing a targeted approach to identifying potential tax evasion.

This adaptation transforms a universal accounting identity into a powerful forensic tool specifically designed for tax analysis. By re-emphasizing the relationship between revenue, expenses, assets, and liabilities, TAE provides a structured framework for identifying financial inconsistencies that are often indicative of undeclared income or participation in the underground economy. This re-purposing shifts the equation from a descriptive financial reporting tool to a diagnostic mechanism for detecting potential tax evasion. Consequently, TAE provides the analytical rigor necessary for the system to move beyond simple data matching, offering a principle-based method to identify subtle financial inconsistencies that might suggest under-reporting.

2.2 Self-Assessment Monitoring System (SAMS)

The Self-Assessment Monitoring System (SAMS) is specifically designed to oversee and analyze taxpayers’ self-declared tax obligations. It achieves this by leveraging detailed financial data, often captured through systems like triple-entry accounting, and advanced analytical capabilities from STEM tools, including data analytics and AI/ML. The core principles of SAMS—self-evaluation, proactive risk identification, and continuous improvement—are derived from applications in other domains like IT and cybersecurity, but hold significant value for modern tax management. Extending these principles to tax compliance empowers organizations to enhance self-awareness regarding their tax obligations, promote accountability, and proactively detect potential issues before they escalate.

SAMS represents a fundamental paradigm shift from traditional reactive auditing, which typically occurs after tax returns are submitted, to a continuous, data-driven monitoring approach. By integrating AI/ML and real-time data analysis, SAMS enables tax authorities to identify potential non-compliance as it happens or even before formal reporting deadlines, rather than waiting for annual returns to be filed and then initiating time-consuming audits. This proactive capability significantly enhances the efficiency and effectiveness of compliance efforts. SAMS acts as the critical bridge between raw accounting data and actionable compliance interventions, transforming passive financial information into dynamic, actionable intelligence, enabling tax authorities to anticipate and prevent non-compliance rather than merely reacting to it.

2.3 Core Tax Administration System (CTAS)

The Core Tax Administration System (CTAS), also referred to as Core Tax System or CTS, serves as Indonesia’s integrated service administration system for the Directorate General of Taxation (DGT). It is designed to streamline all core tax administration processes, encompassing taxpayer registration, tax return filing, payment processing, compliance tracking, and audits.

Indonesia launched its modernized Core Tax System in January 2025, aiming to make tax reporting more manageable, faster, and transparent. Key features of CTAS include online tax reporting and payment capabilities, a real-time taxpayer database, automated compliance checks, enhanced data security, and seamless integration with banks and financial institutions. The enriched data and insights generated by SAMS, including identified risks, anomalies, and compliance scores, are seamlessly integrated into CTAS, providing tax officials with a comprehensive and unified view of taxpayer compliance.

CTAS is not merely a component but the essential operational backbone for the entire tax administration. Its modernization and integration capabilities are crucial because it centralizes all tax-related data and processes. This centralization makes CTAS the primary conduit through which the proactive insights generated by SAMS and TAE can be effectively translated into actionable administrative functions, such as targeted audits, efficient collections, and personalized taxpayer communication. Without a robust and integrated CTAS, the intelligence derived from SAMS and TAE would struggle to achieve its full operational impact, highlighting its foundational role in the overall success of the integrated system.

3. Mechanism of Integration: TAE, SAMS, and CTAS in Action

3.1 Data Retrieval and Harmonization

SAMS will access taxpayer accounting data relevant to the Tax Accounting Equation. This can include data directly from the taxpayer’s accounting system (if integrated), financial statements (such as the Balance Sheet, Income Statement, and Cash Flow Statement), or other data necessary for forming the tax accounting equation (e.g., Revenue – Expenses = Taxable Profit). This process requires robust data integration capabilities to pull and harmonize data from diverse internal and external sources. The system will leverage detailed financial data, ideally captured through advanced systems like triple-entry accounting, to ensure comprehensiveness and verifiability.

The efficacy of the TAE-SAMS integration is critically dependent on the quality, standardization, and real-time accessibility of the underlying accounting data. Companies often face significant challenges with growing volumes of tax data, including segregated views, limited trust in enterprise data sources, and an inability to reconcile master data gaps prior to tax filings. Governments also grapple with the rapid growth in the volume of data required for reporting, with much of this data trapped in spreadsheets or other applications that are not easily accessible or integrated. Indonesia’s own experience highlights challenges with different data architectures for various tax types, which can complicate data analysis. Inaccurate, fragmented, or non-standardized data will severely undermine the analytical power of TAE and the predictive capabilities of SAMS, potentially leading to a high rate of false positives (incorrectly identified discrepancies) or, more critically, missed discrepancies (undetected non-compliance). This makes robust data governance and interoperability foundational requirements, not merely desirable features.

3.2 Discrepancy Calculation and Real-time Monitoring

SAMS will utilize TAE data to compare the actual tax liability (derived from comprehensive accounting data) with the tax liability reported by taxpayers (based on their official tax returns, or SPTs). Significant differences between these two figures will automatically indicate a high level of discrepancy [User Query]. This dynamic integration is achieved through automated rules and algorithms that continuously analyze financial data reported by taxpayers against the principles of the TAE, automatically flagging instances where reported data does not align with the equation.

Furthermore, advanced Artificial Intelligence (AI) and Machine Learning (ML) algorithms are incorporated to identify unusual patterns in taxpayer data that may indicate potential tax evasion or avoidance. These systems analyze data points like transaction volumes, reported income, and expense patterns to detect deviations from established norms or peer group behavior. AI-driven fraud detection has demonstrated significant improvements in effectiveness, increasing from identifying 14.7% of evasion cases in 2021 to 55.0% in 2024. Predictive analytics, powered by AI, further enhances this capability by forecasting tax compliance trends, identifying high-risk taxpayers, and optimizing audit selection procedures.

This capability extends significantly beyond a simple arithmetic comparison of reported versus calculated tax. By incorporating AI/ML and predictive analytics, the system can discern subtle behavioral patterns, deviations from industry norms, and historical trends that indicate a propensity or intent for non-compliance, rather than just identifying the fact of a numerical discrepancy. This allows for a more nuanced, intelligent, and proactive targeting of interventions, moving from a reactive “what is wrong” to a predictive “who is likely to be wrong and why.” This sophisticated analytical capability is a hallmark of modern, data-driven tax administration, enabling continuous compliance monitoring and aligning with global trends towards Continuous Transaction Controls (CTCs).

| Characteristic | Traditional Tax Administration (Reactive) | Integrated TAE-SAMS-CTAS (Proactive) |

|---|---|---|

| Compliance Approach | Post-filing audit-centric, enforcement-driven | Real-time monitoring, prevention, and early intervention-driven |

| Detection Method | Manual review, sampling, historical audit findings, third-party matching (post-filing) | Automated TAE analysis, AI/ML-driven anomaly detection, data mining |

| Intervention Timing | After tax return submission (audit after tax return is submitted) | Pre-filing, real-time, or immediately post-transaction |

| Audit Trigger | Random selection, specific tip-offs, post-filing discrepancy flags | High-risk taxpayer identification based on real-time discrepancy scores |

| Resource Allocation | Broad/Random checks, high manual effort for investigations | Targeted to high-risk cases, optimized by AI/ML, reduced manual effort |

| Taxpayer Engagement | Adversarial (audit, penalties, disputes) | Cooperative (early appeal, self-correction opportunity, guidance) |

| Outcome Focus | Revenue recovery from past non-compliance, punitive measures | Compliance enhancement, prevention of non-compliance, accelerated revenue [User Query] |

| Mechanism | Description | Benefit |

|---|---|---|

| Tax Accounting Equation (TAE) | Compares reported tax liability with accounting data (Revenue-Expenses=Taxable Profit, Assets=Liabilities+Equity) to find inconsistencies. | Direct detection of accounting inconsistencies related to tax obligations and potential under-reporting. |

| AI/Machine Learning (ML) | Identifies unusual patterns, predicts non-compliance, optimizes audit selection, and automates compliance checks based on historical data and behavioral patterns. | Predictive identification of high-risk taxpayers, early detection of potential evasion, and improved audit efficiency. |

| Data Mining Techniques | Uncovers hidden correlations and anomalies not apparent through traditional review methods, such as unusual spikes in expenses or discrepancies between reported and average income for similar businesses. | Discovery of subtle, non-obvious patterns of non-compliance and identification of revenue leakages. |

| Cross-referencing with other government databases | Matches taxpayer information with external data sources like bank records, property ownership, and vehicle registrations to flag inconsistencies. | Verification and enrichment of taxpayer data, identifying undisclosed assets or income, and enhancing accuracy. |

| Event-driven alerts | Notifies tax officials in real-time of specific taxpayer actions like late filing of tax returns, significant amendments to previously filed returns, or large, unusual transactions. | Enables immediate intervention for critical compliance events, preventing escalation of issues. |

3.3 High-Risk Taxpayer Identification

Taxpayers with a high level of discrepancy, indicating a potential mismatch between actual accounting conditions and tax reporting, will be automatically identified as high-risk taxpayers. SAMS incorporates sophisticated real-time monitoring and alert systems to achieve this.

The system employs robust risk scoring mechanisms, assigning a compliance risk score to each taxpayer based on a variety of factors. These factors include past compliance history, industry-specific risk indicators, and the results of TAE analysis. Alerts are then triggered for high-risk taxpayers, effectively prioritizing audit and enforcement efforts towards those with the highest likelihood of non-compliance. Predictive analytics further refines this process by using data on taxpayer characteristics and behavioral approaches to optimize audit selection.

In addition to risk scoring, event-driven alerts provide real-time notifications for specific taxpayer actions, such as late filing of tax returns, significant amendments to previously filed returns, or large, unusual transactions. Furthermore, a critical component of risk identification involves integration with other government databases. SAMS cross-references taxpayer information with data from various sources, such as bank records, property ownership details, and vehicle registrations, triggering alerts for inconsistencies that might indicate undeclared income or hidden assets.

This multi-dimensional risk profiling transforms raw data into actionable intelligence. The system’s ability to integrate data from multiple sources (internal tax data, external government databases, industry benchmarks) and apply sophisticated analytics (TAE, AI/ML) allows for the creation of a comprehensive, multi-dimensional risk profile for each taxpayer. This moves beyond simple rule-based flagging to a more intelligent, dynamic risk scoring that prioritizes resources effectively. This precision targeting enhances efficiency and ensures fairness by focusing resources on genuine risks, potentially reducing the burden on compliant taxpayers.

3.4 The Tax Deposit Appeal Mechanism

Upon the detection of high discrepancies, the system will automatically issue an appeal to the identified taxpayers. This mechanism is designed as a proactive measure to encourage taxpayers to immediately deposit the remaining tax through a designated tax deposit mechanism [User Query]. This provides a crucial opportunity for taxpayers to secure their compliance before formal law enforcement processes, such as the issuance of a Letter of Request for Explanation of Data and/or Information (SP2DK) or a Tax Audit Order (SP2 Tax Audit), are initiated.

The primary purpose of this tax deposit appeal is to prevent the imposition of larger fines that may arise from escalating enforcement actions. By promptly paying taxes through these deposits, taxpayers demonstrate good faith and potentially reduce or even avoid significant penalties. This approach aligns with broader tax administration goals of encouraging voluntary compliance and early resolution, as seen in various international programs. For instance, the IRS offers Pre-Filing Agreements (PFAs) to resolve issues prior to tax return filing for large corporations, promoting tax certainty and reducing post-filing audits. Similarly, Voluntary Correction Programs (VCPs) allow taxpayers to self-correct certain errors without direct IRS contact or fees, thereby preserving tax-favored statuses.

This “tax deposit appeal” mechanism represents a sophisticated application of behavioral economics within tax administration. Instead of immediately resorting to punitive measures, it offers a “soft enforcement” or “pre-compliance review” approach. This leverages the psychological principle that individuals are more likely to comply when given an opportunity for self-correction and to avoid harsher penalties, rather than being subjected to immediate, unavoidable enforcement. Such “nudges,” which can include reminders of penalties or appeals to social norms, have been shown to significantly increase tax compliance and accelerate payments. This proactive settlement mechanism can significantly reduce the administrative burden of audits and disputes, while simultaneously accelerating revenue collection and fostering a more cooperative relationship with taxpayers. The effectiveness of this mechanism will depend on clear communication of its benefits to taxpayers, as suggested by the impact of message wording in behavioral studies.

4. Quantifiable Benefits and Strategic Impact

The integration of TAE with SAMS to enhance CTAS performance is poised to deliver a multitude of quantifiable benefits, leading to a significant strategic impact on national fiscal health.

4.1 Improved Taxpayer Compliance

The existence of a proactive monitoring system will inherently encourage taxpayers to be more compliant in recording and reporting their financial activities, as they will be aware that discrepancies will be detected. This increased transparency acts as a powerful deterrent against non-compliance and implicitly educates taxpayers on accurate reporting, fostering a culture of voluntary compliance rather than forced adherence. Automated reminders, a feature of modern tax systems, further contribute to timely tax filings, minimizing missed deadlines and penalties. This deterrence effect, where the perceived probability of detection increases, directly correlates with higher compliance rates.

4.2 Enhanced Tax Administration Efficiency

The integrated system will significantly improve the efficiency of CTAS by enabling it to focus resources on taxpayers who are truly high-risk, thereby reducing the need for random checks and broad, resource-intensive audits. AI-powered risk assessment tools have demonstrated the ability to reduce manual audit durations by as much as 50%. Predictive analytics further optimizes audit selection procedures, ensuring that resources are allocated to cases with the highest likelihood of non-compliance. This strategic reallocation of scarce human resources from routine, manual tasks to more complex, high-value investigations directly optimizes audit effectiveness and reduces overall operational costs for the tax administration. The OECD notes that advanced analytical technologies can reduce administrative costs by 25-30%.

4.3 Accelerated Tax Revenue Collection

The implementation of tax deposit appeals can significantly accelerate the collection of tax revenues that are due. By encouraging immediate payment of identified discrepancies, the system directly contributes to improved cash flow for the government. Real-time tracking of tax payments fosters trust and enhances financial oversight, further contributing to faster revenue flows. This immediate access to funds allows for more stable budget planning and faster funding of public services, reducing reliance on delayed collections or external financing.

4.4 Direct Contribution to Increased Tax Ratio

By effectively closing the gap between taxes that should be paid and those actually reported, this integration directly contributes to increasing the country’s overall tax ratio. The tax ratio is a critical indicator of a nation’s fiscal health and its capacity to fund public services. Given that underreporting accounts for a substantial portion of the tax gap (77%), reducing this component through proactive detection and early appeals will have a direct and measurable positive impact on the tax ratio. A one-percentage-point increase in voluntary compliance, for instance, could generate approximately $46 billion in additional tax receipts. This makes the integration a direct and powerful lever for strengthening national fiscal health and sustainability.

4.5 Reduced Tax Disputes and Litigation

By encouraging early settlement through tax deposits, the potential for time-consuming and costly tax disputes can be significantly minimized. Early intervention and pre-audit resolution mechanisms, similar to the IRS’s Compliance Assurance Process (CAP) or Pre-Filing Agreements (PFAs) , allow issues to be resolved before they escalate into formal litigation. This approach offers taxpayers a clear pathway to rectify discrepancies, fostering a more cooperative and less adversarial relationship with the tax authority. Reducing disputes not only saves significant administrative and legal costs for both the government and taxpayers but also enhances public trust and the perception of fairness in the tax system, which can further encourage voluntary compliance.

| Feature | Benefit | Explanation |

|---|---|---|

| Proactive Monitoring | Improved Taxpayer Compliance | Encourages taxpayers to be more diligent in recording and reporting, knowing discrepancies will be detected early. |

| AI/ML-driven Anomaly Detection | Enhanced Tax Administration Efficiency | Allows CTAS to focus on truly high-risk taxpayers, reducing manual effort and the need for random checks. |

| Risk-based Targeting | Strategic Resource Allocation | Optimizes deployment of audit resources to cases with the highest likelihood of non-compliance, maximizing impact. |

| Tax Deposit Appeal | Accelerated Tax Revenue | Encourages immediate payment of identified discrepancies, bringing forward tax receipts and improving government cash flow. |

| Early Settlement Opportunity | Reduced Tax Disputes | Minimizes the potential for time-consuming and costly litigation by offering a pre-enforcement resolution pathway. |

| Real-time Data Integration | Increased Tax Ratio | Closes the gap between taxes owed and taxes reported by enabling continuous validation and early discrepancy resolution. |

| Data-Driven Insights | Informed Policy Making | Provides granular data and predictive analytics to inform tax policy development and strategic fiscal planning. |

5. Addressing the Tax Gap through Predictive and Proactive Compliance

The integrated system offers a comprehensive strategy for identifying and closing the tax gap, which comprises non-filing, underreporting, and underpayment. Underreporting, as the largest component (77%), is directly targeted by the system’s core functionalities. Through the application of TAE analysis and AI/ML algorithms, the system can flag potential underreporting by identifying inconsistencies between accounting data and reported tax liabilities. For non-filing, SAMS can leverage cross-referencing capabilities with other government databases and utilize event-driven alerts to identify and flag late or missing filings. For underpayment, the innovative tax deposit appeal mechanism directly encourages early payment of identified discrepancies, thereby reducing the amount of tax that is reported but not paid on time.

This integrated approach represents a comprehensive attack on the tax gap, moving beyond isolated interventions to a synergistic strategy. The system enables a granular, data-driven approach to tax gap analysis, allowing authorities to pinpoint specific sources of non-compliance (e.g., underreporting in certain sectors or taxpayer segments) and deploy highly targeted interventions. This contrasts with broad, less effective measures, maximizing the impact of compliance efforts on revenue.

The role of predictive analytics in this framework extends beyond mere detection to strategic forecasting and optimization of interventions. Predictive analytics, powered by AI, can forecast tax compliance trends and identify high-risk taxpayers, enabling governments to implement proactive policies to reduce tax evasion. This capability allows tax administrations to more accurately forecast future tax revenues for budgetary purposes and assist with cash flow planning. This transforms tax administration from a purely reactive collection agency into a strategic fiscal partner, capable of anticipating future revenue shortfalls or surpluses. This proactive capability supports dynamic policy adjustments and targeted interventions, moving beyond merely reacting to past non-compliance to actively shaping future compliance behavior and optimizing revenue collection.

6. Key Implementation Considerations and Challenges

Implementing a sophisticated integrated system like TAE-SAMS-CTAS requires careful consideration of several key challenges to ensure successful deployment and sustained effectiveness.

6.1 Data Quality and Integration

The success of data-driven compliance fundamentally hinges on the quality, comprehensiveness, and interoperability of underlying accounting and financial data. Companies often face significant challenges with the growing volumes of tax data, including segregated views, limited trust in enterprise data sources, and an inability to reconcile master data gaps prior to tax filings. Tax authorities, while heavy users of data, often do not own or control the source systems, necessitating complex processes to combine and transform data for tax reporting and analytical needs. Indonesia’s own experience highlights challenges with different data architectures for various tax types, which can complicate data analysis and hinder the maximization of derived value.

Achieving high data quality and seamless integration requires a robust data governance framework. This framework must define clear data ownership, establish consistent data standards, implement rigorous quality controls, and develop interoperability protocols across various government and potentially private sector systems. Without such a framework, the advanced technical capabilities of AI/ML will be severely limited by unreliable inputs, leading to inaccurate analyses and ineffective interventions.

6.2 Legal and Regulatory Framework

The shift to real-time monitoring, data sharing, and proactive enforcement mechanisms necessitates a responsive evolution of the existing legal and regulatory framework. The digital economy blurs traditional tax jurisdictions, leading to complexities in determining tax liabilities and enforcement mechanisms that current laws may not adequately address. Challenges persist in updating legal frameworks to accommodate advanced analytical technologies and AI.

The implementation of new mechanisms, such as the “tax deposit appeal,” would require clear legal backing. This legal evolution must balance the need to grant tax authorities the necessary powers for data access and analysis with the imperative to ensure legal certainty for taxpayers, prevent arbitrary enforcement, and uphold principles of fairness and due process. For instance, Indonesia’s Personal Data Protection (PDP) Law (Law No. 27 of 2022) provides a general framework for data protection, but specific guidelines for tax data analytics and automated decision-making may be required. This balance is crucial for maintaining public trust and the legitimacy of the tax system.

6.3 Cybersecurity and Data Privacy

The centralization of vast amounts of sensitive taxpayer data within integrated systems, such as CTAS, creates an attractive target for cybercriminals and poses significant cybersecurity risks. Risks include unauthorized access, misuse, and data breaches, which can harm individuals and erode public trust. The IRS, for example, identifies and mitigates over 1.4 billion cyberattacks annually, highlighting the scale of the threat.

Maintaining taxpayer trust is paramount in an era of increasing data breaches and privacy concerns. Any perceived misuse or vulnerability of sensitive financial data within the integrated system could severely undermine public confidence, leading to reduced voluntary compliance and increased resistance to digital initiatives. Robust, multi-layered cybersecurity measures and strict adherence to privacy regulations are not just technical requirements but fundamental pillars for maintaining public trust and the system’s integrity. This includes implementing strong security protocols (e.g., multi-factor authentication, encryption for data at rest and in transit, secure access controls), conducting regular audits, and fostering a culture of transparency and accountability in data handling.

6.4 Technological Infrastructure and Skill Development

Implementing a sophisticated system that leverages advanced analytics, AI/ML, and big data platforms demands significant investment in cutting-edge technology and robust IT infrastructure. However, the most advanced technology is ineffective without the human capital to design, implement, operate, and continuously refine it. There is often a “lack of skills in these areas in current tax departments” , and a significant challenge lies in transitioning staff from traditional manual systems and outdated procedures to modern computerized systems.

This necessitates a concurrent and sustained investment in human capital. A skilled workforce capable of developing, operating, and interpreting these advanced systems is as crucial as the technology itself. This requires comprehensive training programs for existing staff in data analytics, AI interpretation, and digital literacy, as well as strategies to attract new talent with specialized technology and forensic accounting expertise. Organizational change management is equally important to ensure seamless adoption and maximize the system’s potential.

| Challenge | Description | Mitigation Strategy |

|---|---|---|

| Data Quality & Integration | Fragmented, inaccurate, or non-standardized data from various sources can undermine analytical accuracy. | Implement a robust data governance framework; standardize data architecture (e.g., using APIs, SAF-T); invest in data cleansing and validation tools. |

| Legal & Regulatory Framework | Existing laws may not adequately support real-time data access, automated decision-making, or new enforcement mechanisms like tax deposit appeals. | Conduct a comprehensive legal review; proactively update tax laws and regulations to accommodate digital transformation and new compliance tools. |

| Cybersecurity & Data Privacy | Centralization of sensitive taxpayer data creates a high-value target for cyberattacks and raises privacy concerns, potentially eroding public trust. | Implement strong multi-factor authentication (MFA), encryption, and access controls; conduct regular security audits; ensure transparency in data handling; comply with data protection laws. |

| Technological Infrastructure | Legacy systems, interoperability issues, and the need for scalable cloud-based solutions can hinder seamless integration and performance. | Invest in modern, scalable IT infrastructure; prioritize cloud-based solutions; leverage APIs for seamless integration; ensure system compatibility. |

| Skill Gap & Change Management | Lack of staff expertise in data analytics, AI, and new digital tools; resistance to change among employees and taxpayers. | Develop comprehensive training programs for existing staff; recruit new talent with specialized skills; implement robust change management strategies; foster a culture of continuous learning. |

| Taxpayer Acceptance | Potential for taxpayer distrust or confusion regarding automated processes and new compliance mechanisms. | Implement user-centric design for taxpayer interfaces; conduct extensive communication campaigns to explain benefits and process changes; provide clear guidance and support. |

7. International Best Practices and Case Studies

Global experiences provide strong validation for the strategic direction of integrating advanced analytics and real-time monitoring into tax administration. Many jurisdictions have embarked on similar digital transformation journeys, offering valuable lessons and demonstrating tangible benefits.

Examples of Countries Implementing Real-time Tax Monitoring, E-invoicing, and AI-driven Compliance Systems:

- Brazil: Brazil has implemented a system of universal mandatory electronic invoicing (Nota Fiscal eletrônica – NF-e) for all taxable acts. This system requires real-time submission of invoices to the tax authority for approval, providing greater visibility of economic and taxable activity and effectively combating high levels of unreported economic activity and tax evasion.

- Republic of Korea: South Korea stands out as an early and extensive adopter of Information and Communication Technology (ICT) in tax administration. Its move to an e-tax system, starting in the late 1990s, has achieved dramatic improvements in tax compliance while simultaneously bringing down administrative and compliance costs. Korea’s Electronic Tax Invoicing (ETI) system has been particularly effective in combating VAT tax evasion and fraud.

- OECD Initiatives and Global Trends: The OECD Forum on Tax Administration (FTA) actively brings together tax commissioners from over 50 economies to share knowledge, undertake research, and develop new ideas to enhance tax administration globally. The OECD promotes Compliance Risk Management (CRM) frameworks, which are cyclical processes of risk assessment, strategy design, monitoring, and optimization, increasingly enhanced by big data and AI for accurate risk forecasting and fraud detection. Globally, 60 countries have already implemented digital tax reporting, with another 100 having committed to following suit. A key development is the rise of Continuous Transaction Controls (CTCs), which require real-time or near real-time submission of transaction data to tax authorities, representing the future of compliance.

This widespread adoption of real-time monitoring, e-invoicing, and AI-driven compliance systems by diverse countries and organizations provides strong international validation for Indonesia’s proposed integration. These case studies demonstrate that such digital transformation is not only feasible but also yields significant benefits in terms of compliance, efficiency, and revenue.

Lessons Learned from Voluntary Compliance Programs and Behavioral Economics in Tax Administration:

- Voluntary Correction Programs (VCP): Tax authorities, such as the IRS, offer Voluntary Correction Programs (VCPs) that allow taxpayers to correct certain errors (e.g., in retirement plans) by voluntarily reporting and fixing issues before an audit or formal examination. This approach encourages self-correction, helps preserve tax-favored statuses, and can avoid larger penalties. The IRS’s Compliance Assurance Process (CAP) also aims to resolve issues prior to filing for large corporations, promoting voluntary compliance and reducing post-filing audit length.

- Behavioral Economics (“Nudges”): Studies in countries like the Dominican Republic, Guatemala, and Argentina have demonstrated that subtle behavioral interventions, often referred to as “nudges,” can significantly increase tax compliance and revenue. These nudges can include letters with reminders of penalties, appeals to social norms (e.g., highlighting that most firms pay their taxes), or even rewards for timely payment. Such methods can “bring forward tax compliance” and generate additional tax revenues, particularly in developing countries.

These international experiences underscore that tax compliance can be significantly improved not just through strict enforcement but also by integrating behavioral science insights and offering structured voluntary correction pathways. This suggests that Indonesia’s proposed “tax deposit appeal” mechanism, by providing an early, less punitive path to compliance, aligns with successful global strategies that leverage persuasion and self-correction to foster a more positive compliance environment.

| Country/Organization | Key Initiative/System | Impact/Benefit |

|---|---|---|

| Brazil | Mandatory Electronic Invoicing (Nota Fiscal eletrônica – NF-e) | Provides real-time visibility of economic activity; effectively combats tax evasion and fraud. |

| Republic of Korea | E-Tax System & Electronic Tax Invoicing (ETI) | Achieved dramatic improvements in tax compliance; reduced administrative and compliance costs; effective in combating VAT evasion. |

| OECD (General Trends/Initiatives) | Continuous Transaction Controls (CTCs), AI/ML for Risk Management, Compliance Risk Management (CRM) Framework | Enhanced fraud detection; increased efficiency; standardized tax practices globally; improved resource allocation; proactive compliance. |

| Dominican Republic | Behavioral Economics Nudges (e.g., targeted letters) | Significantly increased tax compliance (e.g., 44% increase in payments for firms receiving penalty reminders); highly cost-effective. |

| Uganda/Rwanda | Tax Gap Toolkit (using data analytics and ML) | Enabled tax authorities to estimate corporate income tax gaps; refined estimations; informed compliance risk management and sector-specific strategies. |

8. Recommendations for Successful Implementation

Successful implementation of the TAE-SAMS-CTAS integration requires a holistic strategy that extends beyond technological deployment to encompass legal reform, human capital development, and active stakeholder engagement.

- Phased Rollout Strategy: It is recommended to implement the integration in manageable phases. This approach allows for thorough testing, gathering of feedback, and iterative improvements, thereby reducing overall project risk and facilitating adaptation to unforeseen challenges. A phased rollout also helps manage organizational change, builds internal capacity, and allows for the demonstration of early successes, which can secure continued stakeholder buy-in and funding. Starting with targeted automation projects that deliver immediate results can build strong momentum for further investment.

- Comprehensive Stakeholder Collaboration: Fostering close collaboration among all relevant parties is essential. This includes government entities (e.g., DGT, Ministry of Finance), taxpayers, and technology providers. Engaging finance, IT, and compliance teams across government ensures alignment of objectives and processes. Dialogue with key external stakeholders, such as business and taxpayer representatives, is crucial for gathering practical insights and ensuring the system meets real-world needs. Promoting collaborations between the public and private sectors on Application Programming Interfaces (APIs) can accelerate the development of user-centric solutions and improve taxpayer experience. This “ecosystem” approach to tax modernization is vital for co-creating a user-centric and trusted tax system.

- Continuous Monitoring and Adaptation: Tax administration operates within a dynamic environment, where tax laws, economic conditions, and taxpayer behaviors are constantly evolving. Therefore, the integrated system must be designed as a “learning system” , with built-in mechanisms for continuous monitoring of its own performance and regular evaluation of compliance outcomes. This allows for agile adjustments based on real-world feedback. Establishing robust feedback loops and a dedicated team for ongoing system refinement, policy adjustments, and regulatory updates will ensure the system remains effective and relevant in the long term.

- Strategic Investment in Human Capital and Technology: Sustained investment in both cutting-edge technology (e.g., AI/ML, big data platforms) and the human capital capable of leveraging these tools is not merely an expense but a strategic imperative for future readiness. This includes significant investment in training programs to upskill existing staff in data analytics, AI interpretation, and digital literacy, as well as recruiting new talent with specialized technology and forensic accounting skills. This balanced investment ensures the tax administration can adapt to emerging complexities, such as those arising from the digital economy and new financial instruments, and maintain its effectiveness in a rapidly changing global landscape.

Conclusion

The integration of the Tax Accounting Equation (TAE) with the Self-Assessment Monitoring System (SAMS), underpinned by a modernized Core Tax Administration System (CTAS), represents a profound leap forward in tax administration. This initiative transforms the tax authority from a predominantly reactive enforcer to a proactive, intelligent, and predictive guardian of fiscal integrity. This shift is not merely an operational upgrade; it is a strategic imperative for national development and fiscal sustainability.

By leveraging the power of data analytics, artificial intelligence, and insights from behavioral economics, this integrated system promises to significantly enhance taxpayer compliance, accelerate revenue collection, reduce disputes, and ultimately contribute to a higher national tax ratio. It fosters a more transparent, efficient, and fair tax environment, building greater trust between the government and its citizens. Ultimately, this modernization effort is crucial for securing the nation’s financial future in the digital age, ensuring that the tax system remains robust and equitable for all stakeholders.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Didampingi Prabowo Subianto, Presiden Jokowi Resmikan RS Pusat Pertahanan Negara Panglima Besar Soedirman

Transformasi Pajak Indonesia: Modernisasi, Penegakan, dan Ketahanan Fiskal

Webinar “Rahasia Menghindari Kesalahan Fatal Pelaporan SPT PPh Orang Pribadi”

Menganalisis Persamaan Akuntansi Pajak Dr. Joko Ismuhadi

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION