Corporate Corruption in Taxation, What Is It?

- Ekonomi

Friday, 23 February 2024 06:14 WIB

Das sein in this matter is in committing a criminal act as a series of offenses, namely the Crime of Taxation (Tipijak) and the Crime of Money Laundering (TPPU), but in the decision the matter that was prosecuted and decided was only one of the offenses. In this case, das sollen has been violated and das sein is related to a series of offenses that are detrimental to state revenue and violate statutory regulations. In line with the large number of TPPU cases resulting from Tipijak carried out by legal entity subjects, the existing law, namely the TPPU Law and/or the KUP Law, can be said to have not provided a deterrent effect and there is still no confirmation for legal entity subjects to receive what kind of punishment, apart from that. This criminal offense of money laundering in the field of taxation can be punished as a Corruption Crime (Tipikor) or not. That is part of the background to the problem of my dissertation which I am presenting on a ppt slide in the framework of the Law Doctoral Promotion Session on February 13 2024 which starts at 08.00 WIB in the Hall of Building D, Floor VIII, Borobudur University, Jalan Kalimalang Number 1, East Jakarta.

To prevent the continued occurrence of criminal acts in the tax sector, a breakthrough is needed, namely being categorized as a criminal act of corruption, because the characteristics of criminal acts in the tax sector are the same as criminal acts of corruption, including that both tax crimes and criminal acts of corruption are equally detrimental to state revenues and state finances. or the country’s economy. Therefore, in order for criminal law enforcement in the tax sector to be more effective, it is best to make criminal acts in the tax sector a criminal act of corruption. By shifting Law Enforcement from Tax Crimes to Corruption, it is hoped that we can minimize and eradicate the occurrence of tax crimes.*)

Article 38 of the KUP Law

Any person who, through negligence:

a. not submitting a Notification Letter; or

b. submit a Notification Letter, but the contents are incorrect or incomplete, or attach information whose contents are incorrect

so that it can cause losses to state income and the act is an act after the first act as intended in Article 13A, fined at least 1 (one) times the amount of tax owed which is not or underpaid and a maximum of 2 (two) times the amount of tax owed who are not or underpaid, or shall be sentenced to imprisonment for a minimum of 3 (three) months or a maximum of 1 (one) year.

Article 39 paragraph (1) of the KUP Law

Any person who intentionally:

- not registering to be given a Taxpayer Identification Number or not reporting his business to be confirmed as a Taxable Entrepreneur;

- misuse or use without right the Taxpayer Identification Number or Taxable Entrepreneur Confirmation;

- not submitting a Notification Letter;

- submit a Notification Letter and/or information whose contents are incorrect or incomplete;

- refuse to carry out an examination as intended in Article 29;

- showing books, records, or other documents that are false or falsified as if they were true, or do not reflect the actual situation;

- does not maintain bookkeeping or records in Indonesia, does not show or lend books, records or other documents;

- not keep books, notes or documents which are the basis for bookkeeping or recording and other documents including the results of data processing from bookkeeping which is managed electronically or organized using an online application program in Indonesia as intended in Article 28 paragraph (11); or

- do not deposit taxes that have been withheld or collected

that can cause losses to state revenues, shall be punished with imprisonment for a minimum of 6 (six) months and a maximum of 6 (six) years and a fine of at least 2 (two) times the amount of unpaid or underpaid tax owed and a maximum of 4 (four) times the amount of tax owed that is not or underpaid.

Article 2 of the Corruption Law

Any person who unlawfully commits an act of enriching himself, another person, or a corporation that could harm the state’s finances is subject to life imprisonment or imprisonment for a minimum of four years and a maximum of 20 years. (Break of Law).

Article 3 of the Corruption Law

Every person with the aim of benefiting himself, another person, or a corporation, abuses the authority, opportunity or means available to him because of his position which could harm the state’s finances, shall be sentenced to life imprisonment or imprisonment for a minimum of one year and a maximum of 20 years. (Abuse of Power).

In accordance with SEMA No. 4 of 2021 concerning Corporate Accountability in the Tax Sector states that every person in the KUP Law is interpreted as an individual and a corporation.

What is very interesting according to the author’s educational background is the meaning of the phrase “harming state revenues” in Article 38 in conjunction with Article 39 of the KUP Law versus the meaning of the phrase “harming state finances” in Article 2 in conjunction with Article 3 of the Corruption Law. What is the difference between “income” and “finances” of that country? This is the same thing, aka not different if seen from the perspective of accounting science, that finance comes from the syllable “money (Cash)” while income means “Revenues” in English, so the accounting journal comes from State Revenue from the tax sector. is:

Debit: Cash on Bank XXXXXXX

Credits: Revenues XXXXXXX

Therefore, what the country that is disadvantaged should return to is its accounting meaning which consists of: Assets; Dividend; Expenses; Liabilities, Equity and Revenues are narrower to make it easier for the Supreme Audit Agency (BPK) as the State Auditor to quickly carry out their work, which with the phrase “harmful to the state” is automatically appointed as an auditor to calculate how much the state has lost, what the mode of tax crime is and who the potential suspects are. . These three things must be known for certain so that Civil Servant Investigators (PPNS) can immediately hand over (P21) the case to the prosecutor’s office for prosecution.

Thus, it is possible that Tipijak is interpreted as Corruption carried out by Corporations, so that it can be called Corporate Corruption in the field of Taxation. (jis).

Jakarta, 17 February 2024

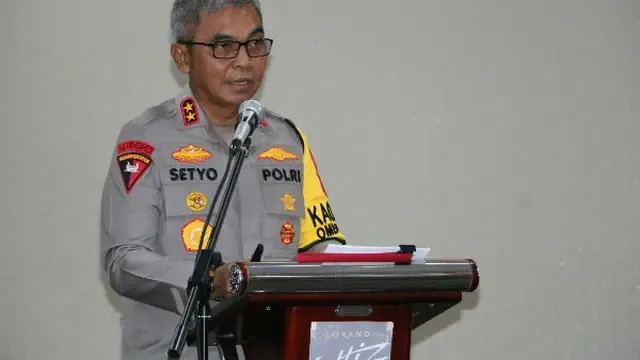

Joko Ismuhadi Soewarsono**)

*) Source: https://magisteroflaw.univpancasila.ac.id/2022/04/07/menggeser-tindak-pidana-pajak-ke-kokerja-bisakah/

**) The author is a doctorate in tax criminal law and a doctorate in accounting.

Share

Berita Lainnya

Hashim Ungkap Prabowo Akan Turunkan Tarif Pajak

OPINI: Aspek Perpajakan Atas Ekonomi Digital

Presiden Terpilih Prabowo Subianto Berupaya Meningkatkan Tax Ratio

Punya Prospek yang Baik, Pemprov Kaltim Pacu Produksi Pisang untuk Pasar Internasional

YouTube Larang Konten AI yang Simulasikan Kematian Anak dalam Kasus Kriminal

Give me a debt, I’ll be free: How to get into debt without having an obligation to pay it back?

Laporan Analisis Pembentukan Badan Penerimaan Negara (BPN) sebagai Reformasi Perpajakan di Indonesia

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION