The Tax Accounting Equation: A Novel Tool for Enhanced Tax Enforcement and Underground Economy Detection

- Ekonomi

Wednesday, 30 April 2025 14:53 WIB

Jakarta, fiskusnews.com:

I. Introduction

Tax avoidance and the pervasive nature of the underground economy represent significant challenges for revenue authorities worldwide, particularly in developing nations like Indonesia. These illicit activities erode the tax base, hinder economic development, and necessitate the development of innovative analytical tools to enhance detection and enforcement efforts. Within this context, the work of Dr. Joko Ismuhadi, an Indonesian tax specialist and academic, stands out. Dr. Ismuhadi uniquely bridges the realms of tax practice and academic innovation, bringing a wealth of experience from his role as a tax auditor within the Directorate General of Taxes in Jakarta to his scholarly pursuits. This dual perspective has informed his development of a novel concept called the Tax Accounting Equation (TAE), an analytical tool specifically aimed at detecting early signs of tax avoidance and uncovering the often-hidden activities of the underground economy. Dr. Ismuhadi’s TAE offers a structured method to analyze financial data through a tax lens, providing a quantitative framework for identifying potential discrepancies and irregularities in financial reporting that could indicate tax avoidance strategies. This report aims to provide a comprehensive analysis of the Tax Accounting Equation, exploring its theoretical foundation, objectives, practical applications, potential effectiveness, limitations, adoption, and reception within the academic and professional communities.

II. Deconstructing the Tax Accounting Equation

The Tax Accounting Equation, as conceived by Dr. Ismuhadi, is not an entirely new concept but rather an adaptation and extension of fundamental accounting principles to incorporate tax-specific considerations. Understanding the TAE requires a grasp of the foundational accounting equations upon which it is built.

The bedrock of accounting is the basic accounting equation, which posits that a company’s total assets are equal to the sum of its liabilities and its owners’ equity: Assets = Liabilities + Equity. This equation represents the fundamental balance inherent in double-entry bookkeeping, where every transaction affects at least two accounts, ensuring that the accounting equation remains in equilibrium. Assets represent the valuable resources controlled by a company, while liabilities represent its obligations to external parties, and equity represents the owners’ stake in the company. This straightforward relationship is considered the foundation of the double-entry accounting system, illustrating how a company’s resources are financed.

The expanded accounting equation provides a more detailed view by breaking down the equity component to include the impact of revenues, expenses, and withdrawals or dividends: Assets = Liabilities + Owner’s Capital + (Revenues – Expenses – Withdrawals). This expansion illustrates how the operational activities of a business, reflected in its revenues and expenses, ultimately affect the owners’ equity. It shows that income generated by the business increases owner’s equity, while expenses and withdrawals decrease it. Dr. Ismuhadi also presents a slightly different arrangement, which he terms the “Mathematic Accounting Equation”: Assets + Dividend + Expenses = Liabilities + Equity + Revenues. This rearrangement emphasizes the interconnectedness and overall balance of all these financial elements.

The Tax Accounting Equation uniquely integrates core tax concepts with these fundamental accounting principles and mathematical applications. It is not merely a restatement of existing equations but is specifically designed with the objective of tax analysis, focusing on how accounting information can be leveraged to reveal potential tax discrepancies. Dr. Ismuhadi’s approach highlights the crucial role of financial statement analysis in effectively applying the TAE to identify tax-related issues. Tax examiners need a strong understanding of financial statements to utilize the TAE for uncovering potential intentional misstatements or omissions related to tax liabilities. The formulation of the TAE is underpinned by the principle that taxable income is essentially net income after any necessary fiscal corrections have been made. This implies that the TAE implicitly aims to detect manipulations in financial reporting that could lead to an understatement of taxable income.

The core mathematical formulation of the Tax Accounting Equation, as developed by Dr. Ismuhadi, is: Revenue – Expenses = Assets – Liabilities. This simplified equation focuses on the fundamental relationship between a company’s profitability, as depicted in its income statement (Revenue minus Expenses), and its net worth, as represented in its balance sheet (Assets minus Liabilities), which in this context represents equity. Dr. Ismuhadi also presents a rearranged form of the TAE: Revenues = Expenses + Assets – Liabilities. This alternative form is used for analytical purposes, particularly in detecting potential tax avoidance. It highlights a potential inverse relationship between revenues and liabilities, suggesting that if revenues decrease without a corresponding increase in liabilities, or vice versa, it could be a sign of manipulation.

To provide a clearer understanding of how the TAE fits within the broader accounting framework, the following table compares the different accounting equations discussed:

Table 1: Comparison of Accounting Equations

| Equation Name | Formula | Primary Focus |

|---|---|---|

| Basic Accounting Equation | Assets = Liabilities + Equity | Fundamental relationship between a company’s resources and its financing sources. |

| Expanded Accounting Equation | Assets = Liabilities + Owner’s Capital + (Revenues – Expenses – Withdrawals) | Incorporates income statement elements to show their impact on equity. |

| Mathematic Accounting Equation (Dr. Ismuhadi) | Assets + Dividend + Expenses = Liabilities + Equity + Revenues | Emphasizes the overall balance and interconnectedness of all financial elements. |

| Tax Accounting Equation (TAE) | 1. Revenue – Expenses = Assets – Liabilities | Focuses on the relationship between profitability (income statement) and net worth (balance sheet) for tax analysis. |

| Tax Accounting Equation (TAE) (Rearranged) | 2. Revenues = Expenses + Assets – Liabilities | Highlights a potential inverse relationship between revenues and liabilities as an indicator of potential tax avoidance. |

III. Objectives and Applications of the TAE in Tax Enforcement

The Tax Accounting Equation developed by Dr. Ismuhadi is designed with specific objectives in mind, primarily centered around enhancing tax enforcement and gaining insights into the underground economy. Its applications are envisioned as a valuable tool for tax authorities in their efforts to ensure tax compliance.

A key objective of the TAE is the early detection of indicators that might suggest tax avoidance strategies. The equation is formulated to identify potential discrepancies and irregularities within financial reporting that deviate from expected norms, thus acting as an early warning system for tax examiners. For instance, if a company reports significantly low revenues or inflated expenses while simultaneously showing an unexplained increase in its assets, the TAE could flag this imbalance as a potential area requiring further scrutiny. These inconsistencies between the income statement and the balance sheet, as highlighted by the TAE, can serve as red flags for tax auditors, prompting them to investigate further. Dr. Ismuhadi suspects that taxpayers might intentionally misrecord accounting transactions, such as recording revenues as liabilities or expenses as assets, to manipulate the relationships within the TAE and obscure their true financial performance for tax purposes.

Beyond detecting tax avoidance, the TAE is also intended as a tool for uncovering activities within the underground economy. By analyzing the relationships between accounting components through a tax-focused lens, the equation aims to shed light on hidden economic activities that often evade traditional taxation methods. Dr. Ismuhadi’s book, “Tax Accounting Equation: Uncover Underground Economy,” directly reflects this objective. The TAE offers a potential method to gain insights into these often-hidden activities by focusing on inconsistencies in reported financial data that might suggest the existence of unreported income or assets.

Dr. Ismuhadi posits the TAE as a valuable instrument for tax authorities to improve tax audits and overall enforcement efforts. By providing a structured mathematical framework for analyzing financial statements from a tax perspective, the TAE has the potential to make tax audits more targeted and efficient. When the application of the TAE reveals potential discrepancies, it can act as a red flag, prompting tax authorities to conduct more in-depth investigations into the taxpayer’s financial records and transactions. This targeted approach can help tax authorities allocate their limited resources more effectively, focusing on high-risk cases where tax avoidance or underground economy activity is suspected.

Furthermore, the TAE is presented as a forensic tool that allows tax examiners to delve deeper into financial data and potentially uncover intentional misstatements or omissions related to tax liabilities. The forensic nature of the TAE implies its use in analyzing historical financial data to identify patterns of tax avoidance or other financial irregularities. By providing a quantitative framework, the TAE can assist tax authorities in scrutinizing financial data to uncover evidence of past tax evasion or financial manipulation that might not be readily apparent through traditional audit procedures.

IV. Analyzing the Effectiveness of the Tax Accounting Equation

The Tax Accounting Equation holds potential as an effective tool for identifying irregularities in financial reporting that could be indicative of tax avoidance, particularly due to its focused approach on the interplay between the income statement and the balance sheet. Analyzing this relationship can reveal manipulations that might remain hidden when examining each financial statement in isolation. For instance, the TAE’s sensitivity to scenarios where revenues are significantly low or expenses are inflated while assets inexplicably increase can serve as a strong indicator of potential tax evasion. Moreover, its design to detect potentially misleading accounting transactions, such as the recording of revenues as liabilities or expenses as assets through the misuse of clearing accounts, highlights its forensic capabilities. The TAE’s relevance extends to the analysis of transactions within interconnected group companies, where complex financial engineering activities might be employed to minimize overall tax liability.

Given that Dr. Ismuhadi is an Indonesian tax specialist, it is reasonable to infer that the TAE is specifically tailored to the Indonesian tax system, taking into account its unique tax laws and financial reporting practices. This localization could potentially enhance the TAE’s effectiveness within the Indonesian context compared to more generic tax analysis tools. The public discussions surrounding the TAE on platforms like YouTube, which highlight its potential to modernize traditional accounting methodologies and address tax evasion in Indonesia’s underground economy, further suggest a perceived value and applicability within the country. These discussions indicate a recognized need for innovative tax enforcement mechanisms in Indonesia, and the TAE appears to be viewed as a promising step in that direction.

Dr. Joko Ismuhadi Soewarsono’s ongoing doctoral research contributes to the academic discourse on taxation and financial governance within Indonesia, positioning the TAE within a framework of scholarly inquiry. This academic engagement is crucial for establishing the theoretical validity and potential effectiveness of the TAE. The public attention and discussions it has generated underscore its potential to address the significant challenge of tax evasion, particularly within Indonesia’s substantial underground economy. The TAE’s focus on the relationship between profitability and net worth offers a targeted approach for identifying discrepancies in financial reporting that might indicate tax avoidance, serving as an initial screening mechanism to flag anomalies and prompt more detailed audits.

V. Limitations, Critiques, and Alternative Perspectives

While the available information strongly advocates for the potential of the Tax Accounting Equation, the research material does not explicitly detail any limitations or critiques of the concept from tax or accounting professionals. This absence might suggest that the TAE is a relatively new concept, and comprehensive critical analyses are not yet widely available in the sources reviewed. It is important to acknowledge that any novel analytical tool will likely have limitations that emerge through further research and practical application.

One potential limitation could be the reliance solely on financial statement analysis. Sophisticated tax avoidance schemes might not always leave easily detectable traces within the financial statements themselves, potentially involving complex legal structures or transactions that are not fully captured by accounting equations like the TAE. Furthermore, as tax enforcement tools like the TAE become known, there is a possibility that businesses engaging in tax avoidance could adapt their accounting practices to circumvent detection by this specific method. This constant evolution of tax avoidance strategies necessitates ongoing development and refinement of detection tools.

The provided snippets do not offer a direct comparison of the TAE with other established tax avoidance detection methodologies currently employed by tax authorities. Understanding how the TAE compares to these existing methods in terms of its effectiveness, efficiency, and cost of implementation would be crucial for a comprehensive assessment of its value. Traditional tax audit procedures and risk assessment models play a significant role in tax enforcement, and the TAE might serve as a complementary tool to enhance these existing methods rather than a complete replacement. A multi-layered approach, integrating the TAE with traditional audit techniques, data analytics, and other forensic accounting methods, could potentially be the most effective strategy for combating tax avoidance and uncovering the underground economy.

The research material primarily presents the TAE from the perspective of its creator. A more balanced evaluation would benefit from incorporating alternative viewpoints and critical assessments from other experts in the field of tax accounting and enforcement. Diverse perspectives could provide a more nuanced understanding of the TAE’s potential strengths and weaknesses, as well as its overall place within the broader landscape of tax compliance and enforcement strategies.

VI. Adoption and Reception of the Tax Accounting Equation

The available information suggests a potential initial adoption and reception of the Tax Accounting Equation within certain circles in Indonesia. Dr. Ismuhadi’s affiliation with the Directorate General of Taxes as a tax auditor strongly implies that the TAE has been, or at least is intended to be, considered and potentially utilized within the Indonesian tax administration. The stated objective of the TAE is to serve as a valuable tool for tax authorities in examining financial statements to detect potential tax evasion. However, the research material does not provide explicit confirmation of widespread adoption or systematic utilization of the TAE by Indonesian tax authorities or other organizations. One snippet mentions the absence of a dedicated external software solution for Indonesian tax auditors, which might suggest that the TAE is currently employed through manual analysis or within internal systems.

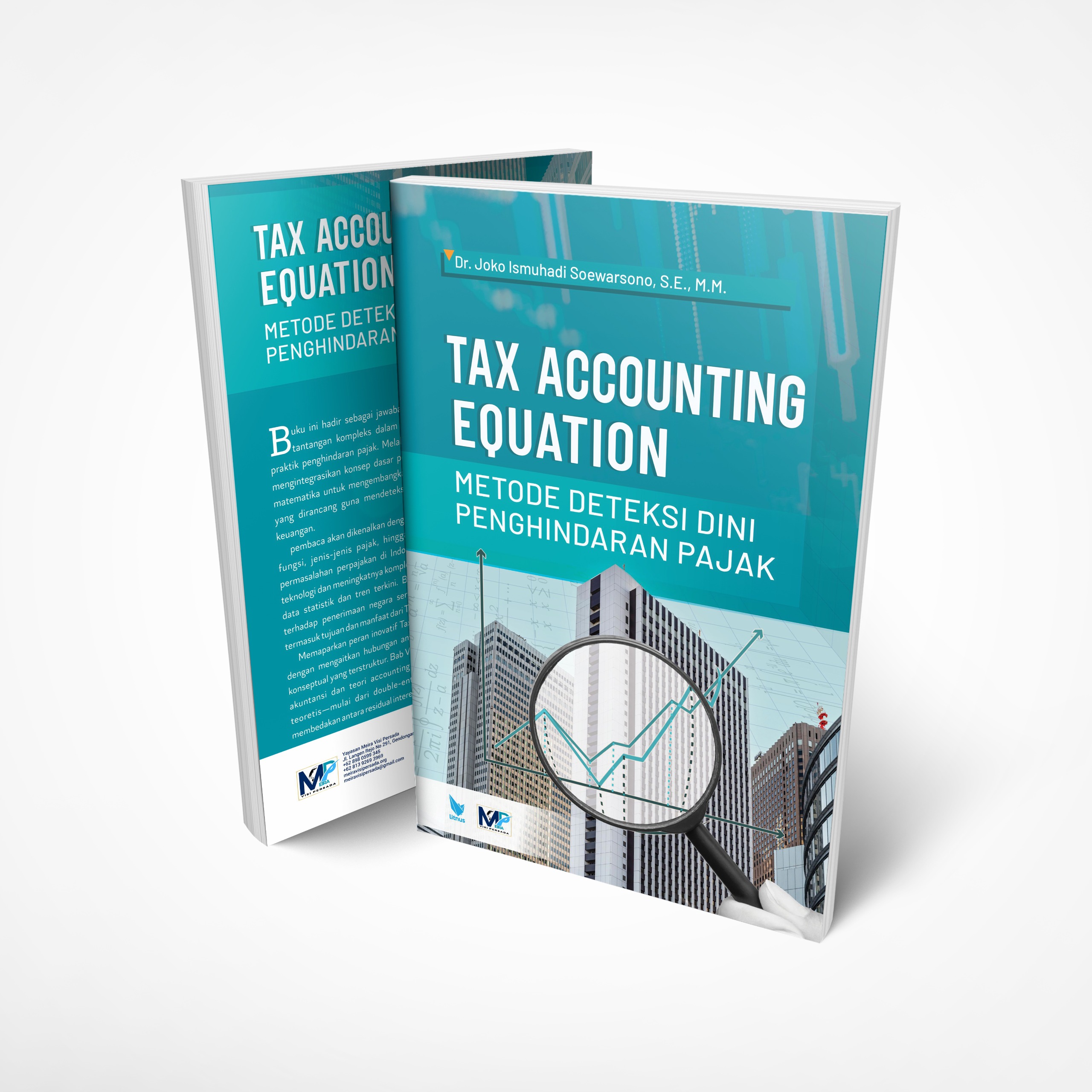

Dr. Ismuhadi’s authorship of books on the TAE, including “Tax Accounting Equation: Uncover Underground Economy” and “Tax Accounting Equation Metode Deteksi Dini Penghindaran Pajak (Tax Accounting Equation: Early Detection Method for Tax Avoidance),” indicates a concerted effort to disseminate the concept. The publication of the latter book by Penerbit Litnus provides a tangible avenue for accessing and reviewing his work. Additionally, a document titled “Tax Accounting Equation (TAE)” authored by Dr. Ismuhadi in his capacity as a Senior Tax Auditor within the Directorate General of Taxation suggests that the concept has been formally documented and likely shared within the Indonesian tax authority. Despite these indicators of dissemination, the provided snippets lack reviews or detailed analyses of these publications within the academic and professional communities, making it difficult to fully gauge their reception and impact.

Searches for discussions about the TAE within official Indonesian tax websites (pajak.go.id) and broader Indonesian tax professional forums did not yield direct mentions or active discussions of the concept. This absence could indicate that the term “Tax Accounting Equation” is not yet widely adopted in official publications or broader public discourse within the Indonesian tax profession. It might also suggest that discussions are taking place within more specific academic or internal tax authority circles that were not captured by the searches.

VII. Case Studies and Practical Examples

The research material offers some insights into the genesis and intended application of the Tax Accounting Equation, but it lacks detailed, specific case studies demonstrating its practical use in identifying or analyzing potential tax discrepancies that led to concrete findings. The development of the TAE was motivated by Dr. Ismuhadi’s observations of taxpayers in the crude palm oil (CPO) industry who consistently reported losses in their income tax returns while simultaneously claiming overpaid Value Added Tax, requesting restitution. This observation of real-world tax discrepancies served as the impetus for his research and the subsequent formulation of the TAE.

While the snippets do not provide fully elaborated case studies, they do offer illustrative scenarios of how the TAE is intended to flag potential tax discrepancies. For instance, the TAE can highlight situations where a company reports significantly low revenues or inflated expenses alongside an unexplained increase in assets, suggesting a potential manipulation of financial reporting for tax avoidance purposes. Dr. Ismuhadi’s work also points to specific accounting manipulations that the TAE is designed to detect, such as the misuse of clearing accounts and the recording of revenues as liabilities or expenses as assets. These scenarios provide a basic understanding of the analytical logic behind the TAE’s formulation and its intended application in uncovering specific tactics used for tax avoidance. However, more detailed, real-world examples where the TAE has been applied and its effectiveness has been demonstrably proven are not evident in the provided research material.

VIII. Conclusion and Recommendations

The Tax Accounting Equation, developed by Dr. Joko Ismuhadi, presents a potentially valuable and innovative approach to tax analysis, particularly within the Indonesian context. Its foundation in fundamental accounting principles, coupled with its unique integration of tax concepts, offers a structured method for the early detection of tax avoidance and the potential uncovering of activities within the underground economy. By focusing on the relationship between a company’s profitability and its net worth, the TAE provides a framework for identifying inconsistencies in financial reporting that could signal intentional misstatements or omissions related to tax liabilities. Its potential to enhance the efficiency of tax audits and serve as a forensic accounting tool warrants further consideration.

Despite its promise, the TAE’s effectiveness and widespread applicability require further scrutiny. The current lack of publicly available limitations, critiques, or comparisons with existing tax avoidance detection methodologies necessitates ongoing research and evaluation. While Dr. Ismuhadi’s publications and his position within the Indonesian tax authority suggest an initial reception and potential adoption within certain circles, the extent of its utilization and impact on tax enforcement remain unclear.

To further assess the value of the TAE, it is recommended that further investigation be conducted into its adoption and utilization by Indonesian tax authorities. Documenting and analyzing real-world case studies where the TAE has been applied would be crucial for demonstrating its practical effectiveness in identifying and analyzing potential tax discrepancies. Future research could also explore empirical testing of the TAE across different industries and economic contexts to validate its effectiveness and identify potential refinements. Furthermore, investigating the integration of the TAE with other forensic accounting techniques and data analytics tools could lead to the development of more comprehensive and advanced tax evasion detection systems. Continued dialogue and rigorous evaluation of innovative tools like the TAE are essential for strengthening tax compliance and enhancing revenue collection efforts in Indonesia and beyond.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Dr. Joko Ismuhadi’s Tax Accounting Equation: A Forensic Approach to Indonesian Tax Analysis

Corruption Corporation of Taxation in Indonesia, What is That?

Jepang dan Inggris Resesi, Bos BI Cemas Ganggu Ekonomi Dunia

Universitas Borobudur Meraih Akreditasi Unggul, Tertinggi di seluruh Indonesia

Ismuhadi’s Equation: A Novel Forensic Accounting Tool for Enhanced Tax Enforcement in Indonesia

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION