The Tax Accounting Equation: A Novel Approach to Detecting Tax Avoidance in Indonesia

- Ekonomi

Saturday, 26 April 2025 00:02 WIB

Jakarta, fiskusnews.com:

1. Introduction: The Challenge of Tax Avoidance and the Role of Accounting Equations

Tax avoidance and evasion represent a persistent and growing challenge for governments worldwide, significantly impacting their ability to fund public services and infrastructure. This issue is particularly pronounced in emerging economies like Indonesia, where the capacity of multinational corporations and high-net-worth individuals to employ sophisticated strategies for minimizing their tax obligations necessitates the continuous development and implementation of innovative detection and prevention tools. Indonesia faces a unique set of challenges due to the presence of a substantial underground economy, which can serve as a significant facilitator of aggressive tax avoidance and evasion practices. The country’s tax-to-GDP ratio remains comparatively low when juxtaposed with its counterparts in the ASEAN region, indicating potential systemic weaknesses in its revenue mobilization efforts. The magnitude of global financial losses attributable to corporate tax avoidance is estimated to be in the hundreds of billions of dollars annually, underscoring the critical need for more effective methods of identifying and addressing such activities. This global context emphasizes the urgency for new and improved detection methodologies, and the relatively low tax-to-GDP ratio in Indonesia suggests that existing approaches may not be entirely sufficient, thereby highlighting the potential importance of novel tools like Dr. Joko Ismuhadi’s Tax Accounting Equation.

At the heart of financial analysis lies the fundamental role of accounting equations. Luca Pacioli’s basic accounting equation, Assets = Liabilities + Equity, has long served as the cornerstone of financial accounting, illustrating the essential balance between a company’s resources (assets) and its obligations to both external parties (liabilities) and its owners (equity). Expanding upon this foundation, the expanded accounting equation, Assets + Drawings + Expenses = Liabilities + Equity + Revenue, provides a more detailed view of how a company’s operational activities, including revenues and expenses, and owners’ transactions, such as drawings, ultimately impact its equity. These equations collectively provide a robust framework for understanding the financial health and activities of a business at any given point in time. Given their fundamental nature, any significant or unexplained deviation from these established balances can serve as a potential indicator of irregularities, making them a logical starting point for forensic analysis aimed at detecting illicit activities such as tax avoidance.

In response to the ongoing challenges of tax avoidance, Dr. Joko Ismuhadi, an Indonesian tax specialist and academic with extensive practical experience as a tax auditor, has formulated the Tax Accounting Equation (TAE). His work is notable for its unique ability to bridge the gap between practical tax administration and academic innovation within the Indonesian context. Drawing upon his experience and academic pursuits, Dr. Ismuhadi has sought to develop a tool that can specifically address the nuances of tax avoidance and evasion prevalent in Indonesia, particularly among large taxpayers.

2. Foundational Principles: Luca Pacioli’s Accounting Equation and its Expansion

Luca Pacioli’s basic accounting equation, Assets = Liabilities + Equity, stands as an enduring legacy in the field of accounting science. This equation represents the fundamental balance sheet relationship, articulating that what a company possesses in terms of resources (assets) is financed by either what it owes to external parties (liabilities) or the investment made by its owners (equity). Understanding this foundational principle is paramount, as Dr. Ismuhadi’s Tax Accounting Equation is directly derived from it. This basic equation underscores the inherent interconnectedness of all balance sheet items; any change in one element must be accompanied by a corresponding change in one or more of the other elements to maintain the balance.

Building upon this core concept, the expanded accounting equation, Assets + Drawings + Expenses = Liabilities + Equity + Revenue, extends the basic equation by incorporating elements from the income statement. This expanded form illustrates how a company’s operational performance, specifically its revenues and expenses, and transactions with its owners, such as drawings or dividends, ultimately influence its equity, particularly retained earnings. The expanded equation effectively demonstrates the vital link between a company’s operational profitability and its overall financial position as reflected in the balance sheet over a period of time. This connection is central to Dr. Ismuhadi’s premise that inconsistencies or unusual patterns in the relationship between a company’s reported profitability and the changes in its balance sheet can serve as significant indicators of potential tax avoidance activities.

3. Introducing Ismuhadi’s Tax Accounting Equation: Derivation and Significance

Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) is derived from a rearrangement of the expanded accounting equation. This rearrangement strategically focuses on the relationship between the income statement components (Revenue and Expenses) and the balance sheet components (Assets and Liabilities), where the difference between assets and liabilities essentially represents equity. The Tax Accounting Equation is primarily presented in two interrelated forms:

- Revenue – Expenses = Assets – Liabilities

- Revenue = Expenses + Assets – Liabilities (or Revenue = Expenses + Equity)

This specific formulation is particularly relevant in scenarios where a taxpayer might attempt to manipulate their reported taxable income to appear as zero or even negative. Such manipulations would directly impact retained earnings and, consequently, the equity component of the traditional accounting equation. Dr. Ismuhadi’s derivation of the TAE strategically isolates the core elements that are most susceptible to manipulation in tax avoidance schemes, allowing for a more direct analysis of their interrelationship.

The primary significance of Ismuhadi’s Equation lies in its proposition as an early detection tool specifically designed to identify potential tax avoidance and/or evasion, particularly among large taxpayers operating within the Indonesian context. The equation is intended to serve as a means of revealing underground economic activities or the shadow economy that may be conducted by taxpayers whose core business operations are ostensibly legal but become illicit through the act of avoiding and/or evading taxes. By providing a unique lens through which to analyze financial statements, the TAE can function as a valuable forensic tool for Indonesian tax authorities, ultimately enhancing their tax enforcement capabilities and aiding in the discovery of hidden economic activities that often escape taxation. It represents a novel, data-driven approach to pinpointing potential instances of tax evasion and avoidance by meticulously examining the relationships between key components of a taxpayer’s financial statements. The TAE’s significance is further underscored by its potential to act as an “early warning system,” enabling tax authorities to identify and address high-risk cases for more in-depth investigation at an earlier stage, potentially preventing substantial revenue losses.

4. The “Iceberg Phenomenon” and the Disconnect Between Financial Statements

The potential for tax avoidance and evasion is often likened to an iceberg phenomenon, a powerful analogy that illustrates how the majority of such activities remain concealed beneath the surface, with only a small fraction being readily visible. This analogy effectively highlights the considerable challenge faced by tax authorities in detecting the full scope and scale of tax evasion and the intricate network of hidden economic activities that facilitate it. The concept of fraud in general is frequently compared to an iceberg, where the instances of fraud that are actually detected and reported represent only a small portion of the overall fraudulent activity taking place. Similarly, the staggering figure of $483 billion lost to tax havens annually has been described as merely the “tip of the iceberg” in the broader context of global tax abuse, suggesting that the true extent of the problem is far greater. Even in the realm of research, the occurrence of fraud is believed to reflect an iceberg phenomenon, implying that the cases that are uncovered are likely just a small representation of the total instances of misconduct. This pervasive use of the iceberg analogy across various domains underscores the inherent limitations of traditional detection methods and reinforces the need for innovative tools, such as Dr. Ismuhadi’s Tax Accounting Equation, that possess the potential to reveal the hidden aspects of tax avoidance and evasion.

A primary indicator that Dr. Ismuhadi’s Equation seeks to address is a specific disconnect observed in the financial statements of certain large taxpayers. This involves a situation where the balance sheet demonstrates consistent growth, indicating an increase in assets and potentially a decrease in liabilities, while the profit and loss report concurrently shows either persistent losses or a lack of significant growth in profits. This divergence is particularly concerning as it often results in a failure to make substantial contributions to corporate income tax revenue and can even lead to an erosion of state finances through the repeated claiming of Value Added Tax (VAT) refunds. Such discrepancies between a growing balance sheet and a stagnant profit and loss statement are not isolated occurrences and can serve as significant red flags, potentially indicating financial statement manipulation undertaken for various reasons, including the deliberate evasion of tax obligations. Notably, the Internal Revenue Service (IRS) in the United States has identified ongoing discrepancies on the balance sheets of partnerships with assets exceeding $10 million as a key indicator of potential non-compliance with tax regulations. This recognition by tax authorities in other jurisdictions further underscores the significance of the type of financial statement disconnect that Ismuhadi’s Equation is designed to detect. The core issue, therefore, is the presence of this anomaly, which suggests that the reported profitability of a company may not accurately reflect its underlying economic activities and overall financial health, potentially masking tax avoidance or evasion schemes.

5. Tax Avoidance and Evasion by Large Taxpayers: Strategies and Indicators

Large taxpayers often employ sophisticated and multifaceted strategies to minimize their tax liabilities while striving to remain within the bounds of the law, a practice known as tax avoidance. These strategies can encompass a range of techniques, including making tax-efficient investments, strategically utilizing available deductions and credits, and establishing complex financial structures such as trusts. However, some taxpayers may cross the line into illegal activities, known as tax evasion, which involves deliberately misrepresenting their financial affairs to reduce their tax obligations. Common tactics in this realm include practices like transfer pricing, where prices for transactions between related entities are manipulated to shift profits to lower-tax jurisdictions, creating shadow entities in jurisdictions with more favorable tax regimes, and exploiting loopholes within the existing tax laws. Another prevalent strategy, particularly among multinational corporations and high-net-worth individuals, involves offshoring profits to offshore tax havens, which offer looser regulations, more favorable tax laws, lower financial risks, and enhanced confidentiality. Dr. Ismuhadi’s Tax Accounting Equation specifically aims to detect a more direct form of manipulation, which involves the deliberate misclassification of income as liabilities and expenses as assets through the use of clearing accounts. Understanding these common strategies is crucial to appreciating the relevance and potential effectiveness of Ismuhadi’s Equation in targeting specific manipulation techniques that might otherwise go unnoticed.

Several indicators can raise suspicion and point towards potential tax avoidance or evasion activities, particularly when observed in the financial statements of large taxpayers. One significant red flag is the consistent reporting of overpayment on corporate income tax returns coupled with monthly overpaid Value Added Tax (VAT) returns over an extended period. Another key indicator, which Ismuhadi’s Equation directly addresses, is a significant increase in a company’s assets that is not adequately supported or explained by corresponding changes in its liabilities or equity. This could suggest that the company is accumulating wealth that is not being reflected in its reported income, potentially indicating underreported revenue or the overstatement of expenses. Similarly, the reporting of unusually low revenue figures in comparison to the company’s stated expenses and overall net asset position might also suggest the existence of hidden income or the misclassification of revenue. The deliberate practice of recording revenues as liabilities or expenses as assets can create unusual and often inverse relationships within the financial statements, which Ismuhadi’s Equation is designed to highlight. Furthermore, a pattern of rising revenue that is not accompanied by a corresponding growth in cash flow is a common warning sign of financial statement fraud, which can often be intricately linked to underlying tax evasion activities. Dr. Ismuhadi’s Equation effectively focuses on these core indicators of discrepancies between a company’s reported profitability and the growth of its balance sheet, aligning with established red flags that forensic accountants and tax authorities often look for when investigating potential financial manipulation.

6. Ismuhadi’s Equation as a Forensic Tool for Early Detection in Indonesia

Dr. Ismuhadi’s Tax Accounting Equation is explicitly positioned as a forensic accounting tool specifically tailored for Indonesian tax analysis. This designation underscores its primary utility in meticulously scrutinizing financial data with the aim of uncovering evidence of past tax evasion or other forms of financial manipulation. The equation is intentionally designed for the in-depth analysis of financial statements from a tax-centric perspective, with its overarching objective being the early detection of potential tax avoidance and/or embezzlement, particularly within the unique economic and regulatory landscape of Indonesia. By focusing on the specific relationships between key financial components that are most likely to be distorted by tax evasion tactics, the TAE aims to provide tax authorities with a targeted and effective means of identifying suspicious financial reporting.

The core mechanism of the TAE is its ability to facilitate the early detection of potentially misleading accounting transactions, thereby enhancing the overall efficiency of tax audits. By analyzing the fundamental relationship between a company’s income statement (revenues and expenses) and its balance sheet (assets and liabilities), tax authorities can potentially identify inconsistencies and anomalies that might serve as indicators of underlying tax avoidance schemes or other financial irregularities. For instance, the equation can be particularly helpful in pinpointing instances where revenues might have been deliberately understated or expenses inflated, as such manipulations would likely result in a noticeable imbalance when the TAE is applied to the financial data. This emphasis on early detection is of paramount importance for effective intervention by tax authorities, as it allows them to address potential tax avoidance schemes before they become deeply entrenched and lead to substantial and prolonged losses in tax revenue for the state.

Given Indonesia’s specific context as an emerging economy characterized by unique challenges related to tax compliance and a significant informal sector, the development and application of a targeted tool like the TAE holds considerable potential to contribute to the nation’s revenue mobilization efforts. Indonesia has been actively engaged in pursuing various tax reforms aimed at improving overall tax compliance, increasing the level of state revenue, and effectively addressing the persistent issues associated with the underground economy. Dr. Ismuhadi’s Tax Accounting Equation directly aligns with these national objectives by offering a new and innovative method for forensic accounting that can assist in identifying high-risk cases and potentially uncovering sophisticated tax avoidance schemes that might otherwise remain undetected by more conventional methods. By providing a structured framework for the early identification of such potential issues, the TAE can play a crucial role in supporting Indonesia’s ongoing efforts to strengthen its tax administration and ensure a more equitable and efficient tax system.

7. Potential Applications of Ismuhadi’s Equation in Tax Audits and Enforcement

The Tax Accounting Equation developed by Dr. Ismuhadi offers several potential applications that could significantly enhance the effectiveness of tax audits and enforcement efforts, particularly within the Indonesian tax administration.

One key application lies in its ability to help tax officers identify discrepancies and unusual patterns within taxpayers’ financial statements. By applying the TAE, auditors can systematically analyze the relationship between a company’s profitability (revenues minus expenses) and its net asset position (assets minus liabilities). For example, if a manufacturing company reports a significant decline in profitability over a period while simultaneously experiencing a substantial increase in its asset base, this could indicate a potential underreporting of revenue, which the TAE would help to flag. Similarly, in the case of a service-based company that reports unusually low revenue figures in comparison to its stated expenses and overall net assets, the TAE might suggest the presence of hidden income or the improper accounting for revenue. These types of anomalies, when highlighted by the equation, can then become the focal point of more detailed audit procedures.

Furthermore, Ismuhadi’s Equation can be instrumental in detecting potentially misleading accounting transactions that are often employed to obscure taxable income. A common tactic in tax avoidance involves recording revenues as liabilities or expenses as assets, often facilitated through the use of clearing accounts. For instance, a company might reclassify a portion of its sales revenue as “advances from customers,” leading to artificially low revenue figures in the income statement and an increase in liabilities on the balance sheet. Such a manipulation, which aims to defer or avoid immediate taxation, would likely result in an imbalance when analyzed through the lens of the TAE, thus serving as a red flag for tax auditors. By providing a mathematical framework that emphasizes the expected equilibrium between profitability and net assets, the TAE can help uncover these types of unusual and potentially suspicious accounting practices.

Ultimately, the application of Ismuhadi’s Equation has the potential to contribute to a more efficient allocation of audit resources within the Directorate General of Taxes. By providing a structured framework for the early detection of potential tax avoidance indicators, the TAE can enable tax authorities to screen large volumes of financial data more effectively. This allows them to prioritize their audit efforts by focusing on those taxpayers whose financial statements exhibit patterns that are most indicative of intentional misreporting for tax purposes. By making the initial risk assessment process more targeted and data-driven, the TAE can help to streamline the audit process, allowing tax auditors to concentrate their in-depth investigations on the cases with the highest likelihood of significant tax avoidance or evasion.

8. Academic Perspectives and the Need for Validation of Ismuhadi’s Equation

Dr. Ismuhadi’s work, particularly the formulation of the Tax Accounting Equation (TAE), represents a novel contribution that holds considerable potential for influencing tax policy innovation and the administration of tax laws in Indonesia. His research introduces an innovative mathematical model specifically designed for the analysis of financial statements from a tax perspective. This approach has the capacity to stimulate further academic inquiry and discussion within the fields of forensic tax accounting and the broader application of quantitative methods in tax analysis. The development of such a model by an individual with both practical experience in tax auditing and academic credentials lends a unique and valuable perspective to the ongoing efforts to combat tax avoidance.

To fully ascertain the validity and reliability of Ismuhadi’s Equation as an effective tool for detecting tax avoidance, it is crucial to subject it to rigorous academic scrutiny. Dr. Ismuhadi is therefore encouraged to pursue the publication of his work on the TAE in peer-reviewed academic journals. This process would not only facilitate a broader scholarly discussion and critique of the model but also provide an opportunity for its validation by experts in the accounting and taxation fields. Further theoretical development of the TAE, along with empirical testing across various industries and economic contexts within Indonesia, is also necessary to validate its effectiveness and to identify any potential refinements or limitations. Collaboration between Dr. Ismuhadi and other researchers specializing in forensic accounting and taxation in Indonesia could further advance the model and contribute to its empirical validation. Such academic engagement is essential to establish the TAE’s credibility and its potential contribution to the existing body of knowledge in tax compliance and enforcement.

While the provided information highlights the novelty of Ismuhadi’s Equation, it is important to consider its place within the broader context of existing academic literature on financial statement analysis for tax avoidance detection. Prior research has explored the use of various financial ratios, such as those related to profitability, leverage, and firm size, as potential indicators of tax avoidance behaviors. Studies have also investigated the relationship between a company’s level of tax avoidance and the aggressiveness of its financial reporting, employing a range of financial and non-financial measures to assess this connection. Furthermore, the application of advanced analytical techniques, including machine learning and data mining, is being explored as a means of classifying taxpayers based on their risk of tax evasion by analyzing patterns in their financial ratios. Understanding how Ismuhadi’s Equation aligns with, builds upon, or potentially differs from these established academic models is critical for fully evaluating its unique contribution and potential advantages in the field of tax compliance research and practice.

9. Comparison with Existing Methods for Detecting Tax Avoidance

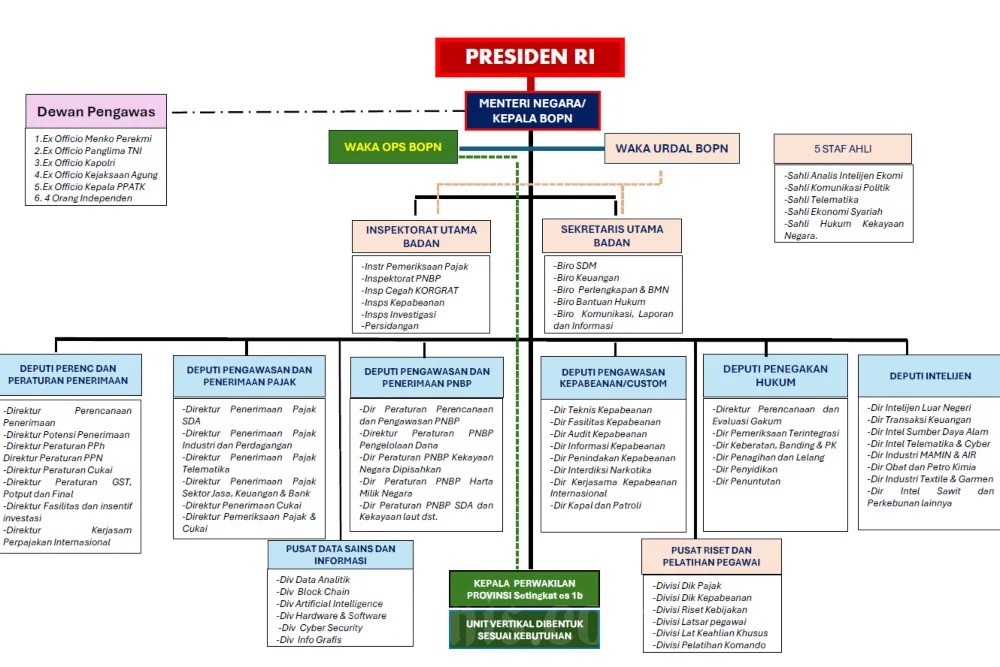

The Indonesian tax authorities, primarily the Directorate General of Taxes (DGT), currently employ a range of methods to detect and combat tax avoidance and evasion. Understanding how Ismuhadi’s Tax Accounting Equation compares to these existing approaches is crucial for assessing its potential value and role in enhancing tax enforcement.

Traditional audit methods remain a cornerstone of the DGT’s tax enforcement strategy. These audits typically involve a detailed and thorough examination of a taxpayer’s financial records, transactions, and compliance with tax laws and regulations. While essential for ensuring tax compliance and detecting irregularities, traditional audits can be time-consuming and require significant resources, particularly when dealing with large and complex taxpayers. This inherent resource intensity underscores the need for more efficient screening tools, such as the TAE, that can help identify high-risk cases for audit.

Recognizing the power of technology in modern tax administration, the DGT in Indonesia is increasingly leveraging technological advancements to improve tax compliance and enhance its ability to detect tax evasion. This includes the implementation of sophisticated data analytics tools and the development of the Digital Tax System (Coretax), which aims to modernize tax administration processes and improve data management. The DGT also utilizes tools like the Smart-Web, an analytical data engine equipped with network-based analysis capabilities, to identify connections between taxpayers, beneficial owners, and members of business groups, aiding in the detection of complex tax avoidance schemes. Ismuhadi’s Equation, with its focus on analyzing financial statement data, could potentially be integrated into these existing technological frameworks, adding another layer of analytical capability to the DGT’s arsenal.

In addition to general audit practices and technological tools, Indonesia has also implemented specific anti-avoidance rules (SAAR) to directly address particular strategies commonly used by taxpayers to reduce their tax obligations. These rules include regulations on thin capitalization, which limits the amount of interest expense that can be deducted, and transfer pricing, which aims to ensure that transactions between related parties are conducted at arm’s length to prevent the artificial shifting of profits. The TAE can be seen as a complementary tool to these specific rules. While SAARs target particular avoidance techniques, the TAE provides a broader analytical framework that can identify potential indicators of avoidance that might then trigger a more focused investigation utilizing the relevant SAARs.

Furthermore, the Indonesian government has, at times, employed voluntary disclosure programs to encourage taxpayers to come forward and declare previously undeclared income and assets, often with reduced penalties. The government also engages in international cooperation initiatives to combat cross-border tax evasion, sharing information and collaborating with tax authorities in other jurisdictions. The insights derived from applying the TAE could potentially help identify taxpayers who might be candidates for voluntary disclosure programs or whose financial activities warrant further scrutiny in the context of international tax cooperation efforts. By highlighting unusual financial patterns that suggest potential tax avoidance, the TAE could contribute to a more targeted and effective approach in these areas.

10. Conclusion and Recommendations for Further Research and Implementation

The Tax Accounting Equation (TAE) developed by Dr. Joko Ismuhadi presents a novel and potentially valuable approach to analyzing financial statements for the early detection of tax avoidance and evasion, particularly within the Indonesian context. Its derivation from fundamental accounting principles provides a logical and structured framework for identifying discrepancies between a company’s reported profitability and the growth of its balance sheet, which are often key indicators of potential financial manipulation aimed at reducing tax obligations. The TAE’s specific focus on the Indonesian economic and regulatory environment, coupled with its potential to uncover hidden economic activities that contribute to the shadow economy, makes it a highly relevant tool for addressing the unique challenges of tax compliance in the country.

To fully realize the potential of Ismuhadi’s Equation, the Directorate General of Taxes (DGT) in Indonesia should consider implementing pilot programs to rigorously test its practical effectiveness in real-world scenarios. These programs could involve applying the TAE to historical financial data of companies known to have engaged in tax avoidance, allowing for a thorough assessment of its detection capabilities and the accuracy of its signals. Simultaneously, the DGT should invest in the development of comprehensive training materials and guidelines for tax auditors on how to properly apply the TAE, interpret the results it generates, and seamlessly integrate it into their existing audit procedures. This will ensure consistent and effective utilization of the tool across different audit teams. Furthermore, the DGT should explore the feasibility of integrating the TAE into its existing tax analysis software and digital systems. Automating the application of the TAE to large datasets could significantly enhance the efficiency of the initial risk assessment process and allow for broader coverage of the taxpayer population. The DGT should also consider incorporating the TAE as an additional layer within its overall risk assessment framework for selecting taxpayers for more in-depth audit scrutiny. Finally, it is crucial to actively solicit feedback from tax auditors who participate in the pilot programs to identify areas for refinement and improvement of both the equation itself and its implementation processes.

For the academic community, further research on Ismuhadi’s Tax Accounting Equation is strongly recommended. Dr. Ismuhadi should be provided with support in his efforts to publish his work in peer-reviewed academic journals to foster broader scholarly discussion, critique, and ultimately, validation of the model. Future research should focus on refining the TAE to address its potential limitations, such as developing more precise thresholds for imbalances that are strongly indicative of tax avoidance while minimizing the risk of false positives. Conducting empirical studies to rigorously validate the effectiveness of the TAE across a diverse range of industries and economic contexts within Indonesia is also essential. Researchers could also explore the potential for integrating the TAE with other established forensic accounting techniques and advanced data analytics tools to create even more comprehensive and robust tax evasion detection systems. Comparative studies that assess the effectiveness of the TAE against other existing methods for detecting tax avoidance, both within Indonesia and in other international jurisdictions, would also be valuable. Additionally, qualitative research could be undertaken to gather the perspectives of tax professionals and academics regarding the potential benefits and limitations of the TAE in practical application.

In conclusion, Dr. Ismuhadi’s Tax Accounting Equation presents a promising and innovative tool for enhancing tax enforcement in Indonesia. By focusing on the fundamental relationship between a company’s profitability and its balance sheet, the TAE offers a structured and data-driven approach to identifying potential instances of tax avoidance. While further research, validation, and strategic implementation are crucial next steps, the TAE represents a significant advancement towards modernizing tax analysis methodologies and addressing the persistent and complex challenge of the underground economy and tax evasion, particularly by large taxpayers in Indonesia.

Key Valuable Tables:

1. Table: Forms of Ismuhadi’s Tax Accounting Equation

| Equation Type | Formula |

|---|---|

| Basic Accounting Equation | Assets = Liabilities + Equity |

| Expanded Accounting Equation | Assets + Drawings + Expenses = Liabilities + Equity + Revenue |

| Ismuhadi’s Tax Accounting Equation (Form 1) | Revenue – Expenses = Assets – Liabilities |

| Ismuhadi’s Tax Accounting Equation (Form 2) | Revenue = Expenses + Assets – Liabilities (or Revenue = Expenses + Equity) |

2. Table: Potential Indicators of Tax Avoidance Detectable by Ismuhadi’s Equation

| Indicator | TAE Implication |

|---|---|

| Balance Sheet Growth with Profit and Loss Stagnation | Suggests potential underreporting of revenue or overstatement of expenses, leading to an imbalance in the TAE. |

| Consistent VAT Refund Requests Despite Asset Growth | Indicates a disconnect between reported low profitability and increasing assets, potentially due to hidden income not reflected in revenue. |

| Recording Revenue as Liabilities | Leads to artificially low revenue figures in the TAE, potentially flagging tax avoidance. |

| Recording Expenses as Assets | Reduces reported expenses, potentially leading to an imbalance in the TAE as the profitability side appears lower than expected. |

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Selamat jalan, Bapa Suci

Webinar “Rahasia Menghindari Kesalahan Fatal Pelaporan SPT PPh Orang Pribadi”

The Evolving Landscape of the Accounting Equation: A Legacy from Pacioli to Soewarsono

Non-Conviction Based Asset Forfeiture: A Potential Mechanism for Enhancing Tax Revenue and Deterring Tax Crimes

MA Gelar Uji Publik Rancangan Peraturan tentang Penanganan Perkara Tindak Pidana Perpajakan

The Tax Accounting Equation: A Forensic Tool for Detecting Underground Economic Activity and Tax Evasion

Jaminan Kerahasiaan atas Data dan Informasi Wajib Pajak

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION