The Tax Accounting Equation: A Forensic Tool for Enhanced Tax Enforcement in Indonesia

- Ekonomi

Thursday, 24 April 2025 06:55 WIB

Jakarta, fiskusnews.com:

1. Introduction

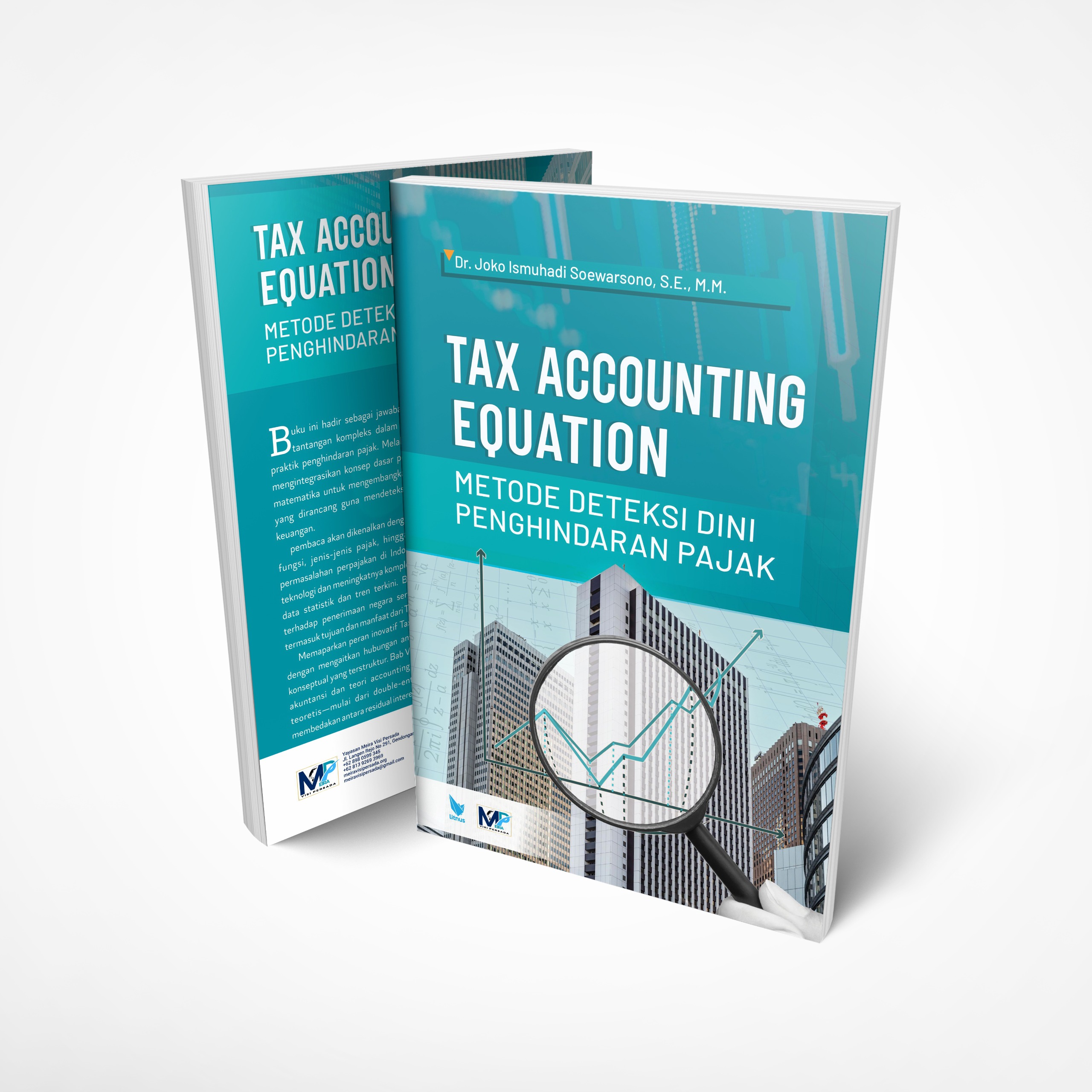

Tax avoidance represents a persistent and escalating challenge for governments worldwide, significantly impacting national revenue streams, particularly in emerging economies like Indonesia. The ability of multinational corporations and high-net-worth individuals to employ sophisticated strategies to minimize their tax liabilities necessitates the development and implementation of innovative tools for detection and prevention. Within this context, the work of Dr. Joko Ismuhadi stands out. Dr. Ismuhadi is an Indonesian tax specialist and academic who uniquely bridges the realms of tax practice and academic innovation. His distinguished career is characterized by a blend of practical experience gained through years as a tax auditor and academic rigor demonstrated by his ongoing doctoral research in both tax accounting and tax law. This combination of practical insights and theoretical knowledge positions him as a credible voice in proposing novel solutions to the complex issue of tax avoidance.

A key aspect of Dr. Ismuhadi’s contribution to the field is the formulation of the Tax Accounting Equation (TAE), an innovative mathematical model specifically designed for the analysis of financial statements from a tax perspective. The TAE is presented in two interrelated forms: Revenue – Expenses = Assets – Liabilities and Revenue = Expenses + Assets – Liabilities. The primary objective of this model is the early detection of potential tax avoidance and/or embezzlement, specifically within the Indonesian context. Dr. Ismuhadi proposes the TAE as a valuable forensic tool for Indonesian tax authorities, aimed at enhancing tax enforcement capabilities and uncovering hidden economic activity that often evades taxation. Given Indonesia’s status as an emerging economy where tax compliance and the informal sector present unique challenges, a targeted tool like the TAE holds the potential to significantly contribute to revenue mobilization efforts.

2. Theoretical Underpinnings of the Tax Accounting Equation (TAE)

The foundation of all accounting principles lies in the fundamental accounting equation: Assets = Liabilities + Equity. This equation serves as the bedrock of financial analysis and reporting, illustrating the inherent balance between a company’s economic resources (assets) and its obligations to external parties (liabilities) and its owners (equity). This straightforward relationship underpins the double-entry bookkeeping system, ensuring that every financial transaction is recorded in at least two accounts to maintain this equilibrium. Building upon this basic structure is the expanded accounting equation, which provides a more granular view of equity by incorporating the components that affect it: Assets = Liabilities + Owner’s Capital + (Revenues – Expenses – Withdrawals/Dividends). This expanded form details how a company’s operational activities (revenues and expenses) and distributions to owners (withdrawals or dividends) impact the equity section, offering a more comprehensive understanding of financial performance.

Dr. Ismuhadi’s Tax Accounting Equation (TAE) is specifically derived from these fundamental and expanded accounting equations. Recognizing the need for a tool tailored for tax analysis, particularly in identifying potential tax avoidance, Dr. Ismuhadi focused on the relationship between the income statement, which summarizes revenues and expenses, and the balance sheet, which presents assets and liabilities. This focus led to the formulation of the TAE in two distinct but related forms. The first form, Revenue – Expenses = Assets – Liabilities, emphasizes the equilibrium that is expected between a company’s profitability (the difference between its revenues and expenses) and its net asset position (the difference between its assets and liabilities). The underlying principle here is that a company’s operational performance should ideally lead to a corresponding change in its overall financial standing, reflected in the relationship between its resources and obligations. The second form of the TAE, Revenue = Expenses + Assets – Liabilities, highlights a potentially inverse relationship between a company’s reported revenue and its liabilities. Dr. Ismuhadi posits that in cases of tax avoidance, companies might strategically misclassify actual revenue as liabilities to understate their taxable income.

The TAE, therefore, is not simply a reiteration of the basic accounting equation but a specific adaptation crafted with the express purpose of detecting potential tax manipulation. While the fundamental equation provides a broad overview of a company’s financial health, the TAE narrows the focus to specific relationships that are particularly susceptible to manipulation in the context of tax avoidance. By emphasizing the interplay between profitability and the net asset position, the TAE provides tax authorities with a targeted lens through which to examine financial data, potentially revealing discrepancies that might otherwise be overlooked in a standard financial statement analysis.

3. Proposed Application of the TAE in the Indonesian Tax System

Dr. Ismuhadi proposes that Indonesian tax authorities can utilize the TAE to identify potential tax avoidance by scrutinizing financial statements for unusual imbalances in the relationships defined by the equation. Certain scenarios, when viewed through the lens of the TAE, could serve as initial indicators, prompting further investigation. For instance, if a company reports consistently low profitability (where the difference between Revenue and Expenses is minimal) while simultaneously exhibiting a substantial net asset position (where Assets significantly outweigh Liabilities), this could be a red flag. This particular imbalance might suggest that the company is underreporting its revenue or artificially inflating its expenses to reduce its taxable income, while the accumulated wealth remains evident in its asset holdings. Similarly, if a company’s reported revenue appears unusually low when compared to its expenses and overall net asset base, this could also warrant closer examination. Such a scenario might indicate the presence of hidden income or a deliberate misclassification of revenue streams.

A key manipulation tactic that Dr. Ismuhadi highlights is the potential misclassification of income as liabilities by taxpayers. By recording revenue as a liability, companies can effectively defer or even avoid the immediate recognition and taxation of that income, as liabilities generally are not subject to income tax until they are settled or realized. This strategy can distort the expected equilibrium within the TAE, particularly in the form Revenue = Expenses + Assets – Liabilities, where an unusually high level of liabilities coupled with low reported revenue could suggest such a misclassification. Dr. Ismuhadi also points to the potential use of clearing accounts and sophisticated financial engineering techniques, such as back-to-back loans disguised as hedging activities, as mechanisms to facilitate the reclassification of income as non-taxable liabilities. These complex maneuvers can obscure the true nature of financial transactions, making it challenging for tax authorities using conventional methods to detect the underlying tax avoidance.

The TAE is intended to serve as a quantitative framework for the early detection of these potentially misleading accounting transactions. By providing a mathematical structure to analyze the relationships between key financial statement elements, the TAE can enhance the efficiency of tax audits. Instead of relying solely on traditional audit methods, tax officers can use the TAE to screen a large volume of financial data and identify companies that exhibit unusual patterns or imbalances, allowing them to focus their audit resources on entities with a higher likelihood of engaging in tax avoidance. Furthermore, Dr. Ismuhadi suggests that the TAE is particularly relevant in analyzing financial transactions within group companies, especially those with integrated operations from upstream to downstream. In such complex structures, financial engineering activities aimed at shifting profits or inflating costs to minimize overall tax liability are more likely to occur, and the application of the TAE to the consolidated or individual financial statements of these related entities can help uncover potentially tax-avoidant transactions.

4. Illustrative Examples and Case Scenarios

While the provided research material does not include specific real-world case studies demonstrating the application of the TAE in detecting discrepancies or potential tax manipulation within the Indonesian context , it is possible to construct hypothetical scenarios to illustrate its potential use based on the principles outlined by Dr. Ismuhadi.

Consider a hypothetical Indonesian manufacturing company, PT Makmur Jaya, which has shown consistent revenue growth over the past five years. However, in the latest fiscal year, the company reports a significant drop in its profitability, with Revenue – Expenses being unusually low compared to previous years. Simultaneously, the company’s balance sheet reveals a substantial increase in its total assets, funded primarily by a relatively small increase in liabilities and no significant changes in equity. Applying the first form of the TAE (Revenue – Expenses = Assets – Liabilities) would reveal a notable imbalance: a low value on the left side of the equation and a high value on the right side. This discrepancy could prompt Indonesian tax authorities to investigate further, as it might suggest that PT Makmur Jaya has underreported its revenue, perhaps through off-book transactions or by delaying revenue recognition, while the proceeds have been used to acquire additional assets.

In another scenario, imagine a service-based company, PT Cemerlang, which reports unusually low revenue for the fiscal year, significantly lower than its operating expenses. At the same time, the company’s liabilities have decreased substantially, but there is no corresponding decrease in assets or increase in equity that would typically explain such a liability reduction. Using the second form of the TAE (Revenue = Expenses + Assets – Liabilities), the low revenue figure, coupled with the decrease in liabilities, would create an imbalance. This situation could indicate that PT Cemerlang has inflated its expenses to reduce its taxable income, and the reduction in liabilities might be linked to transactions that were not properly accounted for as revenue.

Furthermore, consider a multinational company operating in Indonesia that reclassifies a significant portion of its sales revenue as “advances from customers” in its financial statements. This reclassification shifts the amounts from a revenue account to a liability account. Applying the TAE, particularly the second form, would show an unusually low revenue figure and a corresponding increase in liabilities, without a clear business rationale for such a substantial increase in customer advances. This deviation from the expected equilibrium could alert tax authorities to the possibility that the company is attempting to avoid immediate tax on its revenue by mischaracterizing it as a liability, as suggested by Dr. Ismuhadi.

It is noteworthy that Dr. Ismuhadi presented his Tax Accounting Equation during a Focus Group Discussion at the Head Office of the Directorate General of Taxes. This indicates that the TAE is not merely a theoretical concept but has been proposed and discussed within the Indonesian tax administration as a potential tool for practical application in identifying tax avoidance maneuvers.

5. Discussion and Evaluation of the TAE

While a comprehensive evaluation of the TAE would ideally involve peer-reviewed academic publications and empirical testing, the available research material provides some insights into its discussion and potential reception. A paper titled “Tax Accounting Equations: Early Detection of Tax Avoidance” authored by Joko Ismuhadi suggests a formal documentation and proposal of the TAE within the Directorate General of Taxes. This indicates that the concept has been developed and presented within tax administration circles in Indonesia. Additionally, a reference to an analysis of the TAE in relation to Article 4 paragraph 1 of the Indonesian Income Tax Law implies a level of scrutiny regarding its legal and practical implications within the existing tax framework. The existence of a video titled “Tax Accounting Equation: Uncover Underground Economy Activity” suggests that the TAE has also garnered public attention and is being discussed in broader forums. Furthermore, the mention of the TAE in the context of financial engineering highlights its relevance in understanding sophisticated tax avoidance techniques that involve complex financial maneuvers. The description of Dr. Ismuhadi’s Novelty Tax Accounting Equation as a forensic tool for enhanced tax enforcement reinforces its intended purpose in the detection and investigation of potential tax irregularities.

The TAE offers several potential strengths as a forensic tool for tax enforcement. Its simple yet structured mathematical framework provides a basis for an initial risk assessment of financial statements. By focusing on the relationships between key financial statement elements that are particularly relevant to tax avoidance, such as profitability and net assets, the TAE can help tax authorities prioritize their audit efforts. It offers a method for the preliminary screening of a large number of financial statements to identify potential anomalies that might warrant further scrutiny. Moreover, the TAE specifically highlights manipulation tactics, such as the misclassification of income as liabilities, which are known methods of tax avoidance.

However, the TAE also has potential limitations. Like any analytical tool based on reported financial data, its effectiveness is contingent upon the accuracy and completeness of that data. Companies engaging in sophisticated tax avoidance schemes might employ manipulations that do not necessarily result in obvious imbalances within the TAE, requiring more nuanced forensic accounting techniques to uncover. Additionally, the application and interpretation of the TAE would necessitate skilled tax auditors with a strong understanding of accounting principles to differentiate between genuine business reasons for financial statement imbalances and those indicative of potential tax avoidance. Furthermore, the research material does not reveal any formal academic peer-reviewed publications or rigorous empirical testing of the TAE’s effectiveness in detecting tax avoidance. This absence might suggest that the TAE is either a relatively new concept or one that has primarily been focused on practical application within the Indonesian tax authority rather than extensive academic validation.

6. Alternative and Existing Methods Used by Indonesian Tax Authorities

Indonesian tax authorities employ a range of methods to detect and prevent tax avoidance and evasion. Traditional tax audits and law enforcement remain fundamental tools, with regular audits conducted to identify inconsistencies in financial reports and stricter legal enforcement, including penalties and criminal charges, serving as deterrents. The recent implementation of the Digital Tax System, known as Coretax, on January 1, 2025, represents a significant step towards modernizing tax administration by integrating taxpayer data with third-party sources and providing real-time access to financial transactions, thereby enhancing transparency and reducing opportunities for fraud. Alongside technological advancements, the government continues to focus on improving administrative procedures related to tax registration, reporting, and collection to ensure greater compliance.

Beyond these broad measures, Indonesia has implemented specific anti-avoidance rules (SAAR) to target particular tax avoidance strategies. Thin capitalization rules limit the amount of interest expense that companies can deduct based on their debt-to-equity ratio, preventing excessive leveraging to reduce taxable income. Transfer pricing regulations are in place to ensure that transactions between related companies, particularly multinational entities operating in Indonesia, are conducted at arm’s length, reflecting market values and preventing the artificial shifting of profits to lower-tax jurisdictions. Controlled Foreign Corporation (CFC) rules aim to prevent domestic taxpayers from avoiding Indonesian tax by accumulating profits in foreign companies located in low-tax jurisdictions. Anti-treaty shopping rules are designed to prevent businesses from improperly taking advantage of double taxation agreements (DTAs) to reduce their tax liabilities in Indonesia. Additionally, a general anti-avoidance rule (GAAR) exists to target transactions whose primary purpose is to avoid taxes, even if they technically comply with specific regulations.

Indonesia has also utilized voluntary disclosure programs (VDP) to encourage taxpayers to voluntarily report previously undeclared assets, potentially increasing tax revenue and improving long-term compliance. Participation in the Automatic Exchange of Information (AEoI) initiative facilitates the sharing of financial information between Indonesia and other countries, aiding in the detection of cross-border tax evasion. Indonesian tax authorities are also increasingly leveraging data analytics and technology, utilizing third-party data sources and implementing compliance risk management (CRM) systems and platforms like Smartweb to identify high-risk taxpayers and transactions. Membership in international bodies like the Financial Action Task Force (FATF) and the Joint International Tax Shelter Information and Collaboration (JITSIC) underscores Indonesia’s commitment to global cooperation in combating financial crimes, including tax evasion. Tax amnesty programs have also been employed periodically to provide opportunities for non-compliant taxpayers to become compliant. Furthermore, innovative research methods like double list experiments have been used to indirectly measure the prevalence of tax evasion among firms in Indonesia. Finally, forensic accounting techniques, which involve the application of specialized knowledge and investigative skills to identify and analyze financial discrepancies and fraud, are increasingly being utilized in Indonesia to combat financial misconduct, including tax evasion. The Tax Accounting Equation proposed by Dr. Ismuhadi could potentially serve as another valuable tool within this comprehensive framework for detecting and addressing tax avoidance in Indonesia.

Table 1: The Tax Accounting Equation (TAE) vs. Fundamental Accounting Equation

| Feature | Fundamental Accounting Equation | Tax Accounting Equation (TAE) |

|---|---|---|

| Purpose | Reflect overall financial balance | Detect potential tax avoidance and/or embezzlement |

| Focus | Company’s resources and obligations | Relationship between income statement and balance sheet |

| Formula (Basic) | Assets = Liabilities + Equity | Revenue – Expenses = Assets – Liabilities |

| Formula (Alternative) | Assets = Liabilities + Equity | Revenue = Expenses + Assets – Liabilities |

| Key Relationships Analyzed | Overall financial position | Profitability vs. Net Assets; Revenue vs. Liabilities |

Table 2: Potential Imbalances in the TAE and Their Implications for Tax Avoidance

| TAE Imbalance | Potential Indication | Further Investigation Required |

|---|---|---|

| Low Profitability, High Net Assets | Underreported revenue being parked as assets; Inflated expenses | Review revenue recognition policies, examine asset acquisitions, scrutinize expense documentation. |

| Low Revenue Relative to Expenses and Net Assets | Hidden income; Misclassification of revenue | Investigate potential unreported income sources, analyze the nature of expenses, verify asset valuations. |

| Significant Deviation from Expected Revenue-Liability Equilibrium | Income misclassified as liabilities to avoid immediate taxation | Examine liability accounts, particularly “advances from customers” or similar accounts, for unusual increases without corresponding service obligations; Scrutinize complex financial transactions that might be used to disguise revenue. |

7. Practical Tools and Guidelines Based on the TAE

An investigation into the availability of practical tools, software, or guidelines specifically developed based on Dr. Ismuhadi’s Tax Accounting Equation for tax analysis purposes in Indonesia reveals that the provided research snippets primarily focus on general tax preparation and compliance software. These include platforms designed for tax calculations, return filing, and compliance management, such as ATX, TaxAct, Lacerte, Avalara, Vertex, Bloomberg Tax, and Thomson Reuters ONESOURCE. While these tools are essential for tax professionals, none of the reviewed materials explicitly mention software or specific guidelines that are exclusively built upon the principles of the TAE.

This suggests that the Tax Accounting Equation, at its current stage, might primarily exist as a conceptual framework or a specific methodology proposed for use within the Directorate General of Taxes. It is plausible that the application of the TAE is currently integrated into the internal procedures and analytical techniques employed by tax auditors in Indonesia, without a dedicated external software solution being available. Further research or direct engagement with the Indonesian tax authorities would be necessary to definitively ascertain the existence of any specific practical tools or guidelines based on the TAE.

8. Academic and Professional Reception of the TAE

The work of Dr. Joko Ismuhadi on the Tax Accounting Equation has garnered notable attention within both academic and professional circles in Indonesia. His development and promotion of the TAE as an innovative model for enhancing tax detection and planning have sparked public discussions, particularly on platforms like YouTube, indicating a broader interest in his approach. Dr. Ismuhadi’s contributions are viewed as having the potential to modernize traditional accounting methodologies and provide new avenues for addressing the persistent issue of tax evasion in Indonesia. He has been recognized as a pioneer in the field of forensic tax accounting and for his contributions to tax law reform within Indonesia.

Dr. Ismuhadi has actively presented his work in various forums, including Focus Group Discussions held at the Directorate General of Taxes , suggesting a direct engagement with tax policymakers and practitioners. His research on tax avoidance and the Tax Accounting Equation is further evidenced by his authorship of papers and presentations focused on its development and practical application. His affiliation as an academic member of prominent tax professional associations in Indonesia, such as the Association of Tax Centers and Tax Academics of All Indonesia (Pertapsi), also underscores his standing within the professional community.

While the initial reception of Dr. Ismuhadi’s work appears positive, characterized by interest and discussions in various forums, the extent of formal academic scrutiny through peer-reviewed publications is not explicitly evident from the provided snippets. Although Dr. Ismuhadi’s profile on ResearchGate lists some conference papers , none of the titles directly refer to the Tax Accounting Equation. Similarly, while other researchers in Indonesia are exploring forensic accounting and tax knowledge , their work does not specifically evaluate Dr. Ismuhadi’s TAE. This might suggest that the TAE is a relatively recent development or that its primary focus has been on practical application within the Indonesian tax administration, with academic validation potentially being a subsequent step.

9. Conclusion and Recommendations

Dr. Joko Ismuhadi’s Tax Accounting Equation (TAE) represents a novel approach to analyzing financial statements with a specific focus on detecting potential tax avoidance within the Indonesian context. Rooted in the fundamental accounting equation, the TAE offers a targeted mathematical framework that emphasizes the relationships between a company’s profitability, net asset position, revenue, and liabilities. Its proposed application involves identifying unusual imbalances in these relationships as red flags that could indicate tax manipulation, such as underreporting revenue, inflating expenses, or misclassifying income as liabilities. While the provided material does not include real-world case studies or formal academic evaluations of the TAE’s effectiveness, its presentation to the Directorate General of Taxes and the public discussions it has generated suggest a positive initial reception and recognition of its potential.

The TAE holds promise as a forensic tool for enhancing tax enforcement in Indonesia. Its strength lies in providing a structured and relatively simple method for the initial screening of financial statements to pinpoint potential areas of concern. By focusing on key relationships susceptible to manipulation, the TAE can help tax authorities prioritize audits and potentially uncover sophisticated tax avoidance strategies. However, it is important to acknowledge the limitations. The TAE’s effectiveness depends on the quality of reported financial data and might not detect all forms of tax avoidance. Furthermore, skilled auditors are needed to interpret the results and avoid false positives.

To further develop and effectively implement the TAE, the following recommendations are offered:

- Dr. Ismuhadi is encouraged to pursue publication of his work on the TAE in peer-reviewed academic journals. This would facilitate broader scholarly discussion, critique, and validation of the model within the accounting and taxation fields.

- Pilot programs should be conducted within the Directorate General of Taxes to test the practical effectiveness of the TAE in real-world scenarios. These pilot programs could involve applying the TAE to historical financial data of companies known to have engaged in tax avoidance to assess its detection capabilities.

- Comprehensive training materials and guidelines should be developed for tax auditors on how to apply the TAE, interpret its results, and integrate it into their existing audit procedures. This would ensure consistent and effective utilization of the tool.

- The potential for integrating the TAE into existing tax analysis software and digital systems used by the Indonesian tax authorities should be explored. Automation could significantly enhance the efficiency of applying the TAE to large datasets.

- Further research is needed to refine the TAE and address its potential limitations, such as developing thresholds for imbalances that are more indicative of tax avoidance and minimizing the risk of false positives.

- Collaboration between Dr. Ismuhadi and other researchers in forensic accounting and tax in Indonesia could lead to further advancements and empirical validation of the TAE.

In conclusion, Dr. Joko Ismuhadi’s Tax Accounting Equation presents a potentially valuable addition to the toolkit for combating tax avoidance in Indonesia. While its initial reception is encouraging, further rigorous evaluation and strategic implementation are crucial to fully realize its potential in enhancing tax enforcement and safeguarding national revenue.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

MAKSI FEB UNPAD di Acara KOMISI (Kelas Online akadeMISI) Seri Pemeriksaan Pajak Episode 4 bertajuk Metode & Teknik Pemeriksaan

SF CONSULTING CUSTOMS & EXCISE FREE MORNING BRIEFING

Delik Berangkai Tipijak dan TPPU Dilakukan Simultan, Mungkinkah?

Back 2 Back: Tipijak and TPPU mode

UNBOXINGKEWAJIBAN & FASILITAS PAJAK UMKM

WEBINAR “TRANSISI SAK-EP & PERBEDAANNYA DENGAN SAK-ETAP”

Woro-woro… Woro-woro… Rek!

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# Prabowo

# Presiden RI