Dr. Joko Ismuhadi’s Tax Accounting Equation: A Forensic Tool for Uncovering Indonesia’s Underground Economy

- Ekonomi

Monday, 31 March 2025 02:59 WIB

Jakarta, fiskusnews.com:

I. Executive Summary:

This report delves into the concept of Dr. Joko Ismuhadi’s Tax Accounting Equation, a methodology proposed as a forensic tool for analyzing and potentially quantifying the underground economy, particularly within the Indonesian context. Dr. Ismuhadi, with his background in both tax auditing and academic research in tax law and accounting, has seemingly developed this equation as a novel approach to address the persistent challenges of measuring and understanding hidden economic activities. While the specific details of the equation remain elusive within the provided materials, news reports from Indonesia suggest its consideration as a significant instrument for tax analysis and for its potential role in identifying and closing tax loopholes. This report explores Dr. Ismuhadi’s expertise, the theoretical underpinnings of his approach rooted in fundamental accounting principles, its potential mechanisms for uncovering concealed economic activities, and its positioning within the broader landscape of methodologies used to analyze the underground economy. The limitations of the current analysis, primarily due to the lack of specific details regarding the equation itself, are acknowledged, and areas for future research are highlighted to gain a more comprehensive understanding and validation of its effectiveness.

II. Introduction:

The underground economy, an intricate web of economic activities intentionally concealed from official reporting and taxation, presents a significant challenge for governments and policymakers worldwide . Variously termed the shadow economy, informal economy, or hidden economy, it encompasses a wide spectrum of activities, ranging from unreported legal transactions conducted to evade taxes or regulations, to entirely illicit operations such as the trade of stolen goods, drug dealing, and smuggling . The very nature of these concealed activities makes them exceptionally difficult to quantify accurately, posing substantial obstacles to the compilation of reliable macroeconomic indicators and the formulation of sound economic policies . The absence of a universally accepted definition and a standardized measurement methodology further underscores the complexity of this issue and highlights the potential value of innovative approaches that can shed light on these hidden economic realms . In response to these persistent challenges, Dr. Joko Ismuhadi, a researcher with a notable background in Indonesian tax law and accounting, has emerged with a proposed “Tax Accounting Equation” . This equation is positioned as a potentially groundbreaking method specifically designed to analyze and uncover the intricacies of the underground economy within Indonesia. Initial reports from Indonesian news sources suggest that Dr. Ismuhadi’s work is being considered as a valuable “forensic tool” for tax analysis, hinting at its potential to identify and address existing tax loopholes that facilitate the growth of the underground economy .

III. Dr. Joko Ismuhadi: Expertise and Context:

Dr. Joko Ismuhadi’s profile reveals a researcher deeply embedded in the study of Indonesian taxation and financial regulations. His current engagement as a PhD student in the Department of Accounting at Padjadjaran University in Bandung signifies his commitment to rigorous academic inquiry in this field. Complementing his academic pursuits is his prior experience as a Tax Auditor at the Directorate Generale Tax in Indonesia . This practical experience provides him with firsthand knowledge of the challenges inherent in tax administration and the complexities of identifying and addressing tax evasion. Further underscoring his multidisciplinary approach to taxation issues is his doctoral candidacy in both tax criminal law and tax accounting at Borobudur University . This dual focus suggests a comprehensive understanding of the legal ramifications and accounting mechanisms associated with tax avoidance and the underground economy. Dr. Ismuhadi’s background, therefore, uniquely positions him to bridge the gap between theoretical accounting principles and the practical realities of tax enforcement in Indonesia. Beyond his work on the Tax Accounting Equation, Dr. Ismuhadi’s research interests span a range of pertinent legal and financial issues within Indonesia. He has contributed to research on the legal protection of default debtors in online lending agreements and has explored the complexities of intellectual property rights concerning traditional knowledge . Notably, his research also extends to the critical area of legal actions against corporate tax manipulation and money laundering . This existing focus on illicit financial activities indicates a consistent research trajectory aimed at enhancing financial transparency and regulatory compliance within Indonesia. These diverse yet related research endeavors suggest that Dr. Ismuhadi’s Tax Accounting Equation is likely not an isolated concept but rather part of a broader intellectual framework aimed at improving financial transparency and tax administration within Indonesia. Understanding the specific challenges within the Indonesian economic and tax environment is crucial for appreciating the potential significance of Dr. Ismuhadi’s work. While the provided snippets do not offer specific details on the scale or characteristics of Indonesia’s underground economy, it is widely acknowledged that developing economies often face significant challenges related to informal economic activities and tax compliance. Dr. Ismuhadi’s research, particularly his Tax Accounting Equation, appears to be a direct response to these national issues, potentially offering a tailored solution to improve tax analysis and combat hidden economic activities within Indonesia.

IV. Deconstructing Dr. Joko Ismuhadi’s Tax Accounting Equation:

At the heart of all accounting practices lies the fundamental accounting equation: Assets = Liabilities + Equity . This equation embodies the core principle of duality, asserting that a company’s resources (assets) are financed by either what it owes to others (liabilities) or by the owners’ investments (equity). This foundational equation is the bedrock upon which financial statements are built and serves as a constant check on the accuracy of accounting records. The expanded version of this equation provides a more detailed view of the factors influencing equity over time: Assets = Liabilities + Owner’s Equity + Revenues – Expenses – Dividends . The repeated reference to Dr. Ismuhadi’s work as a “Tax Accounting Equation” strongly implies that his model is a significant adaptation or extension of this fundamental accounting principle, specifically designed to incorporate tax-related elements and potentially reveal hidden economic activities that would otherwise remain outside the purview of standard financial reporting. A significant limitation in this analysis is the absence of explicit details regarding the specific components and variables that constitute Dr. Ismuhadi’s Tax Accounting Equation. While numerous articles on the Indonesian news platform fiskusnews.com analyze this equation , the actual content of these articles, which likely contain the crucial specifics, is currently inaccessible . Despite this limitation, we can hypothesize potential key components and variables that Dr. Ismuhadi might have incorporated, drawing upon his expertise and the context of the underground economy. One potential element could involve a comparison between reported income and various indicators of economic activity that might suggest a higher level of income than officially declared. This could include analyzing consumption patterns, asset ownership, or other publicly available economic data. Another possible component might focus on the discrepancy between the amount of tax paid by an individual or entity and the expected tax liability based on their reported or estimated income. Significant deviations could flag potential participation in the underground economy. The equation might also attempt to differentiate between formal and informal cash flows, perhaps by analyzing patterns of transactions through formal financial institutions versus estimates of cash transactions that are more prevalent in the informal sector. Furthermore, it’s conceivable that the equation could involve a comparison between declared assets and liabilities and their estimated true value, aiming to identify potential underreporting that might conceal undeclared wealth or income. Given the mention of “closing tax loopholes,” the equation might also incorporate variables designed to flag the potential utilization of specific legal ambiguities or weaknesses in the tax code to reduce tax obligations. Considering its designation as a “forensic tool,” the intended structure of Dr. Ismuhadi’s Tax Accounting Equation is likely designed to identify anomalies, inconsistencies, or significant deviations in financial data that could serve as red flags, indicating the potential presence of undeclared economic activity. The purpose of “closing tax loopholes” further suggests that the equation might be structured to highlight specific areas within the tax system where income or transactions are not being adequately captured or taxed, thereby providing a basis for legislative or regulatory reform.

V. The Tax Accounting Equation as a Tool for Uncovering the Underground Economy:

The fundamental premise underlying Dr. Ismuhadi’s Tax Accounting Equation as a tool for uncovering the underground economy likely rests on the principle that all economic activity, regardless of its formal or informal nature, should ultimately leave some discernible trace in an entity’s financial position, affecting its assets, liabilities, and equity. Dr. Ismuhadi’s innovation appears to be in expanding upon this core accounting principle by strategically incorporating tax-relevant variables. The aim is to create a framework that can detect discrepancies and imbalances in financial data that are characteristic of undeclared economic activity. For instance, a significant disparity between an individual’s or business’s reported income and their observable consumption patterns or accumulation of assets could be flagged by the equation as a potential indicator of hidden income. The core idea, therefore, likely revolves around establishing expected correlations and relationships between various accounting and tax variables and then identifying significant deviations from these expected norms as potential signals of engagement in the underground economy. Dr. Ismuhadi’s Tax Accounting Equation could potentially be applied through several mechanisms to uncover hidden economic activities. One approach might involve analyzing unusual ratios and trends in tax-related data over time or across different entities. For example, a sudden or consistently low ratio of tax paid to reported income compared to industry averages might warrant further scrutiny. The equation could also be designed to cross-reference data from various sources, such as tax returns, financial statements, and broader economic indicators, to build a more holistic and potentially revealing picture of an entity’s financial activities. By integrating these diverse data points, inconsistencies that might otherwise go unnoticed could become apparent. Furthermore, it is conceivable that Dr. Ismuhadi’s model could be used to develop predictive models. By analyzing historical data and the relationships between the equation’s variables, it might be possible to identify entities or sectors with a higher statistical likelihood of participating in the underground economy. Finally, the equation could be applied as a forensic tool in specific cases where there is already a suspicion of undeclared income or tax evasion. By analyzing the available financial data through the lens of the equation, it might be possible to quantify the extent of the underground activity and gather evidence for potential enforcement actions. The effectiveness of these potential mechanisms will be intrinsically linked to the specific variables included in Dr. Ismuhadi’s equation, the quality and accessibility of the necessary data, and the sophistication of the analytical techniques employed in its application. The designation of Dr. Ismuhadi’s approach as a “forensic tool” strongly aligns it with the established principles and practices of forensic accounting . Forensic accounting is a specialized field that applies accounting, auditing, and investigative skills to examine financial records and uncover evidence of fraud, financial irregularities, and financial crimes, including tax evasion. Key responsibilities of forensic accountants include uncovering hidden assets, meticulously tracing suspicious financial transactions, and ensuring the accuracy and completeness of financial reporting . By framing his Tax Accounting Equation within this context, Dr. Ismuhadi positions it as a practical instrument for tax authorities and forensic accounting professionals to actively investigate and potentially quantify the scale of the underground economy within Indonesia.

VI. Research and Application of the Equation:

The available information indicates a significant level of research and attention surrounding Dr. Ismuhadi’s Tax Accounting Equation, particularly within Indonesia. The Indonesian news platform fiskusnews.com features numerous articles that directly address and analyze the equation in the context of uncovering the underground economy . Titles such as “Mengungkap Aktivitas Ekonomi Bawah Tanah: Analisis Persamaan Akuntansi Pajak Dr. Joko Ismuhadi” (Unveiling Underground Economy Activity: An Analysis of Dr. Joko Ismuhadi’s Tax Accounting Equation) appear repeatedly , clearly indicating a direct focus on the equation’s potential to reveal hidden economic activities. Furthermore, an article titled “Potensi Keberhasilan Pengelolaan Perpajakan Kegiatan Ekonomi Bawah Tanah dengan Menggunakan Persamaan Akuntansi Perpajakan Dr. Joko Ismuhadi Soewarsono” (Potential Success of Managing Taxation of Underground Economic Activities Using Dr. Joko Ismuhadi Soewarsono’s Tax Accounting Equation) suggests an optimistic outlook regarding the practical utility of this approach in improving tax administration related to the informal sector. However, a critical limitation in this analysis is the current inaccessibility of these specific articles on fiskusnews.com . This prevents a direct examination of the research methodologies employed, the specific findings reported, and the detailed discussions on the application of the equation as presented in these sources. Despite this limitation, the sheer volume of news coverage dedicated to this topic within Indonesian tax news outlets strongly implies that Dr. Ismuhadi’s Tax Accounting Equation represents a notable development within the Indonesian tax landscape. It suggests that his work is being actively considered and analyzed for its potential to address the persistent challenges posed by the underground economy in Indonesia. The available information overwhelmingly indicates that the development and analysis of Dr. Ismuhadi’s Tax Accounting Equation are primarily focused within the Indonesian context . This aligns with Dr. Ismuhadi’s academic and professional affiliations within Indonesia. This strong geographic focus suggests that the equation might be specifically tailored to address the unique characteristics of the Indonesian economy, its specific tax regulations, and the particular nature of its underground economic activities.

VII. Effectiveness, Limitations, and Criticisms:

Dr. Ismuhadi’s Tax Accounting Equation, as a novel approach, presents several potential advantages in the analysis of the underground economy. Its foundation in accounting principles offers a potentially innovative perspective compared to traditional macroeconomic estimation techniques that often rely on broader economic indicators. The potential for micro-level analysis, depending on the equation’s structure, could allow for a more targeted identification of undeclared economic activity at the individual or entity level, which might be missed by aggregate approaches. Furthermore, its designation as a forensic tool suggests a direct applicability to tax administration, potentially providing tax authorities with a more actionable framework for investigating potential tax evasion and undeclared income. The insights derived from the equation’s application could also inform the development of more effective and targeted tax policies and enforcement strategies aimed at reducing the size and impact of the underground economy. However, inherent limitations and challenges must also be considered. A fundamental obstacle in any analysis of the underground economy is the scarcity and unreliability of data on concealed activities. The effectiveness of Dr. Ismuhadi’s equation will heavily depend on the availability and accuracy of proxy data or indirect indicators that can be used as inputs. Additionally, a sophisticated tax accounting equation might be complex to implement in practice, requiring specialized expertise for its application, the analysis of the resulting data, and the interpretation of the findings. Another significant challenge is the potential for evasion and behavioral adaptation. Individuals and businesses operating within the underground economy are likely to evolve their methods to avoid detection by any known analytical tools, potentially limiting the long-term effectiveness of the equation. The current lack of publicly available details regarding the specific formulation and detailed research findings on Dr. Ismuhadi’s equation presents a significant hurdle in providing a comprehensive assessment of its limitations. Without this information, it is challenging to understand the specific assumptions underlying the model and the extent to which these assumptions might hold true in various contexts. Anticipating potential criticisms is also difficult without a clear understanding of the equation’s methodology. However, drawing from general critiques leveled against methods aimed at measuring the underground economy, several potential areas of concern can be identified. The equation might rely on certain assumptions about the relationship between accounting variables and underground economic activity that could be questioned or might not be universally applicable. Validating the accuracy of the equation’s findings against independent and reliable measures of the underground economy could prove challenging, given the inherent difficulty in directly observing these concealed activities. The scope and coverage of the equation might also be a point of discussion; it might be more effective at capturing certain types of underground economic activity while potentially overlooking others. Finally, there is always a risk of both false positives, where legitimate economic activity is incorrectly identified as being part of the underground economy, and false negatives, where actual underground activity goes undetected by the equation. A thorough and critical evaluation of Dr. Ismuhadi’s Tax Accounting Equation’s effectiveness and limitations necessitates access to the detailed methodology, the underlying assumptions, and empirical evidence from its application.

VIII. Comparison with Alternative Methodologies for Analyzing the Underground Economy:

Various methodologies have been developed to analyze and estimate the size of the underground economy, each with its own set of assumptions, strengths, and weaknesses. Macroeconomic approaches often rely on aggregate economic data to infer the scale of hidden economic activity. One prominent method is the Currency Demand Approach (CDA), which posits that an increase in the underground economy leads to a higher demand for cash due to the anonymity it offers for transactions aimed at evading taxation . While the traditional CDA has been influential, it has also faced criticisms regarding its underlying assumptions and the indirect nature of its measurement . For instance, one critique points out the difficulty in definitively attributing changes in currency demand solely to underground economic activity, as other factors can also influence cash holdings . A “modified CDA” attempts to address some of these criticisms by using more direct measures of cash transactions . Other macroeconomic methods include the monetary approach, which analyzes the overall money supply and its velocity, and the fiscal approach, which examines discrepancies between reported government revenue and expenditure. Microeconomic and direct measurement approaches involve gathering data directly from individuals or businesses. Surveys and interviews can be used to inquire about participation in unreported economic activities, although these methods often suffer from issues of underreporting and potential bias. Tax audits and compliance data can provide valuable insights into the extent of tax evasion and the types of undeclared income, but they only capture a portion of the overall underground economy. Model-based estimation techniques employ statistical and economic models to analyze the underground economy. Regression analysis can be used to identify macroeconomic variables that are correlated with the size of the hidden economy . For example, one study found a direct relationship between a country’s population size and the size of its underground economy . Theoretical tax evasion models attempt to understand the decision-making processes behind tax evasion, often incorporating factors such as the probability of being audited and the severity of penalties . These models can explore various scenarios and the impact of different policy interventions on tax compliance. Dr. Ismuhadi’s Tax Accounting Equation, being rooted in accounting principles and potentially focused on forensic analysis at a more granular level, offers a distinct approach compared to these existing methodologies. While macroeconomic methods provide aggregate estimates, Dr. Ismuhadi’s equation might offer the potential for more targeted analysis of individual or entity-level data. Compared to direct surveys, it relies on potentially more objective financial data, although the availability and reliability of this data for the underground economy remain a challenge. Unlike purely theoretical tax evasion models, Dr. Ismuhadi’s equation appears to be designed as a practical tool for application by tax authorities. The most effective method for analyzing the underground economy often depends on the specific context, the availability and quality of data, and the particular research or policy objectives. Dr. Ismuhadi’s Tax Accounting Equation, with its forensic accounting orientation, could potentially complement existing methods, offering a unique perspective and a potentially valuable tool for tax administrators in Indonesia.

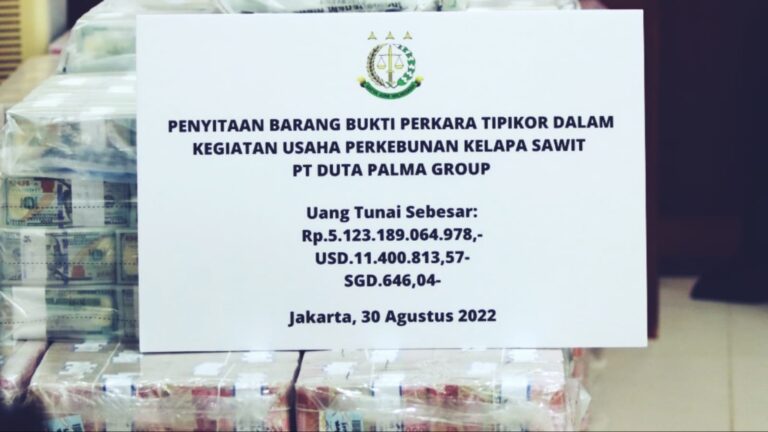

IX. Case Studies and Real-World Applications:

Given Dr. Ismuhadi’s affiliation and the strong Indonesian focus of the news articles discussing his Tax Accounting Equation, it is reasonable to expect that any case studies or real-world applications of this methodology would primarily be found within Indonesia. However, the provided research snippets do not contain specific case studies or detailed examples illustrating how Dr. Ismuhadi’s Tax Accounting Equation has been applied in practice. While the numerous articles on fiskusnews.com suggest active discussion and analysis of the equation, the inaccessibility of these sources prevents the identification of any concrete examples of its implementation. Future research should prioritize investigating whether there are any publicly available case studies or documented instances of the application of Dr. Ismuhadi’s Tax Accounting Equation by Indonesian tax authorities, researchers, or within specific sectors of the Indonesian economy. Understanding how this equation has been used in real-world scenarios is crucial for evaluating its practical utility and its impact on uncovering the underground economy. The current absence of such readily available case studies in the provided materials highlights a potential gap in understanding the practical implementation and demonstrated impact of Dr. Ismuhadi’s equation.

X. The Role of the Equation in Closing Tax Loopholes:

A significant aspect of Dr. Ismuhadi’s Tax Accounting Equation, as highlighted in the news articles, is its potential role in identifying and ultimately closing tax loopholes . Tax loopholes are legal ambiguities or oversights within tax laws and regulations that allow individuals or businesses to legally minimize their tax obligations, sometimes in ways that were not intended by the lawmakers . A forensic tax accounting equation, by offering a detailed and potentially novel way of analyzing financial data, could potentially reveal specific weaknesses or ambiguities in the tax code that facilitate tax avoidance and the concealment of income within the underground economy. For example, in the United States, policymakers have been engaged in efforts to close loopholes like the “carried interest loophole” which allows certain investment managers to pay a lower capital gains tax rate on their income . Similarly, loopholes related to exchange-traded funds and partnership basis shifting have also come under scrutiny . Within the context of Dr. Ismuhadi’s work, a particularly noteworthy article title is “Persamaan Akuntansi Pajak oleh Dr. Joko Ismuhadi Soewarsono Menutup Celah Pajak dengan Mengubah Pasal 4 Ayat (1) UU PPh” (Dr. Joko Ismuhadi Soewarsono’s Tax Accounting Equation Closes Tax Loopholes by Amending Article 4 Paragraph (1) of the Income Tax Law) . Article 4 Paragraph (1) of the Indonesian Income Tax Law likely defines the scope of taxable income. The inaccessibility of the linked article prevents a detailed understanding of the specific proposed amendment and the precise mechanism through which Dr. Ismuhadi’s equation facilitates this loophole closure. However, it can be reasonably inferred that Dr. Ismuhadi’s Tax Accounting Equation likely identifies specific types of income, transactions, or financial arrangements that are currently not adequately captured or taxed under the existing provisions of Article 4 Paragraph (1). This identification then provides the basis for proposing amendments to the law to address these identified loopholes and broaden the tax base, potentially capturing more of the economic activity occurring within the underground economy. This connection to a specific article of the Indonesian tax law suggests a direct and potentially significant policy implication of Dr. Ismuhadi’s research, indicating its potential to directly influence and strengthen the Indonesian tax code.

XI. Conclusion and Future Directions:

Dr. Joko Ismuhadi’s Tax Accounting Equation represents a potentially significant and innovative approach to the complex challenge of analyzing and understanding the underground economy, particularly within the Indonesian context. His strong background in both tax auditing and academic research in tax law and accounting provides a solid foundation for the development of such a tool. The numerous news articles in Indonesia discussing his equation as a “forensic tool” and its potential to uncover hidden economic activities and close tax loopholes highlight its relevance and the attention it has garnered within the Indonesian tax landscape. While the specific details of the equation and comprehensive research findings remain inaccessible through the provided materials, the available information strongly suggests that Dr. Ismuhadi’s work is a noteworthy contribution to the field. The potential of a tax accounting equation to offer a more granular, micro-level analysis compared to traditional macroeconomic methods, and its direct applicability as a forensic tool for tax administration, are compelling advantages. Furthermore, its potential role in identifying weaknesses within the Indonesian tax code, specifically related to Article 4 Paragraph (1) of the Income Tax Law, indicates a direct pathway to policy impact. However, the inherent limitations in analyzing the underground economy, such as data scarcity and the potential for evasion, must be considered. A thorough evaluation of the equation’s effectiveness and limitations requires access to its detailed methodology and empirical evidence of its application. Future research should prioritize obtaining the specific details of Dr. Joko Ismuhadi’s Tax Accounting Equation and analyzing the content of the articles on fiskusnews.com that discuss its application and findings. Investigating any potential case studies or real-world applications of the equation in Indonesia is also crucial. Furthermore, a comparative analysis of Dr. Ismuhadi’s approach with other established methodologies for estimating the underground economy would provide valuable insights into its unique contributions and potential advantages. Finally, exploring the specific proposed amendments to Article 4 Paragraph (1) of the Income Tax Law and the role of the equation in supporting these changes would further illuminate the potential policy impact of Dr. Ismuhadi’s work. In conclusion, Dr. Joko Ismuhadi’s Tax Accounting Equation holds considerable promise as a forensic tool for enhancing tax analysis, uncovering the intricacies of the underground economy, and potentially strengthening tax policies in Indonesia. Further research into its specific methodology and practical applications is warranted to fully realize its potential.

Reporter: Marshanda Gita – Pertapsi Muda

Share

Berita Lainnya

Bridgestone Pamer Teknologi dan Seni Ban Mobil di IIMS 2024

The Integration of STEM in Law Enforcement: Unpacking the “Ismuhadi Equation” and Charting a Responsible Future

The Accounting Equation and its Implications for Tax Analysis

STIE IGI mempersembahkan seminar OFFLINE yang wajib kamu ikuti:”FROM CAMPUS TO CAREER: PUBLIC SPEAKING FOR SUCCESS”

Urgensi Amnesti Pajak dalam Konteks Pasal 4 Ayat (1) Huruf p Undang-Undang Pajak Penghasilan

Rekomendasi untuk Anda

Berita Terbaru

Eksplor lebih dalam berita dan program khas fiskusnews.com

Tag Terpopuler

# #TAE

# #TAX ACCOUNTING EQUATION

# #TAX FRAUD

# #TAX EVASION